Stock Market Today: Stocks, Bitcoin Keep Scrambling Over the Wall of Worry

The major indices pressed on despite a new low point in the COVID fight and a disappointing jobs report. Digital currency Bitcoin hit new breathtaking heights as well.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

U.S. stock markets finished the first week of 2021 with yet more gains as investors, still high on hopes of even more federal stimulus and a less tumultuous political landscape, managed to slog through several disquieting developments.

Daily COVID deaths on Thursday eclipsed the 4,000 mark for the first time, and the White House coronavirus task force warned of a "USA variant" that might be more contagious.

That comes as the Labor Department announced a decline of 140,000 jobs in December – the first drop since April and far worse than the 50,000 nonfarm payroll gains expected.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"Most of this drop was concentrated in leisure and hospitality, as new lockdown restrictions were introduced or expanded in different states," says Gene Goldman, chief investment officer at Cetera Investment Management. And because the report only reflects payrolls through mid-December, before many restrictions were introduced, "the February report will likely reflect more of those job losses."

"It appears the ongoing battle against the pandemic is putting pressure on the real economy once again and despite what financial markets are signaling, the labor market is indicating there is still a ways to go on the economic road to recovery," says Charlie Ripley, senior investment strategist for Allianz Investment Management. "Overall, the ability for Congress to provide additional fiscal support has increased and today's employment report simply beckons them to do so."

But additional relief might not necessarily be on the way. Sen. Joe Manchin (D-W.Va.) bruised hopes for further stimulus Friday, telling The Washington Post he is "absolutely" opposed to a round of new checks, though he later clarified he would support stimulus targeting people in greater need.

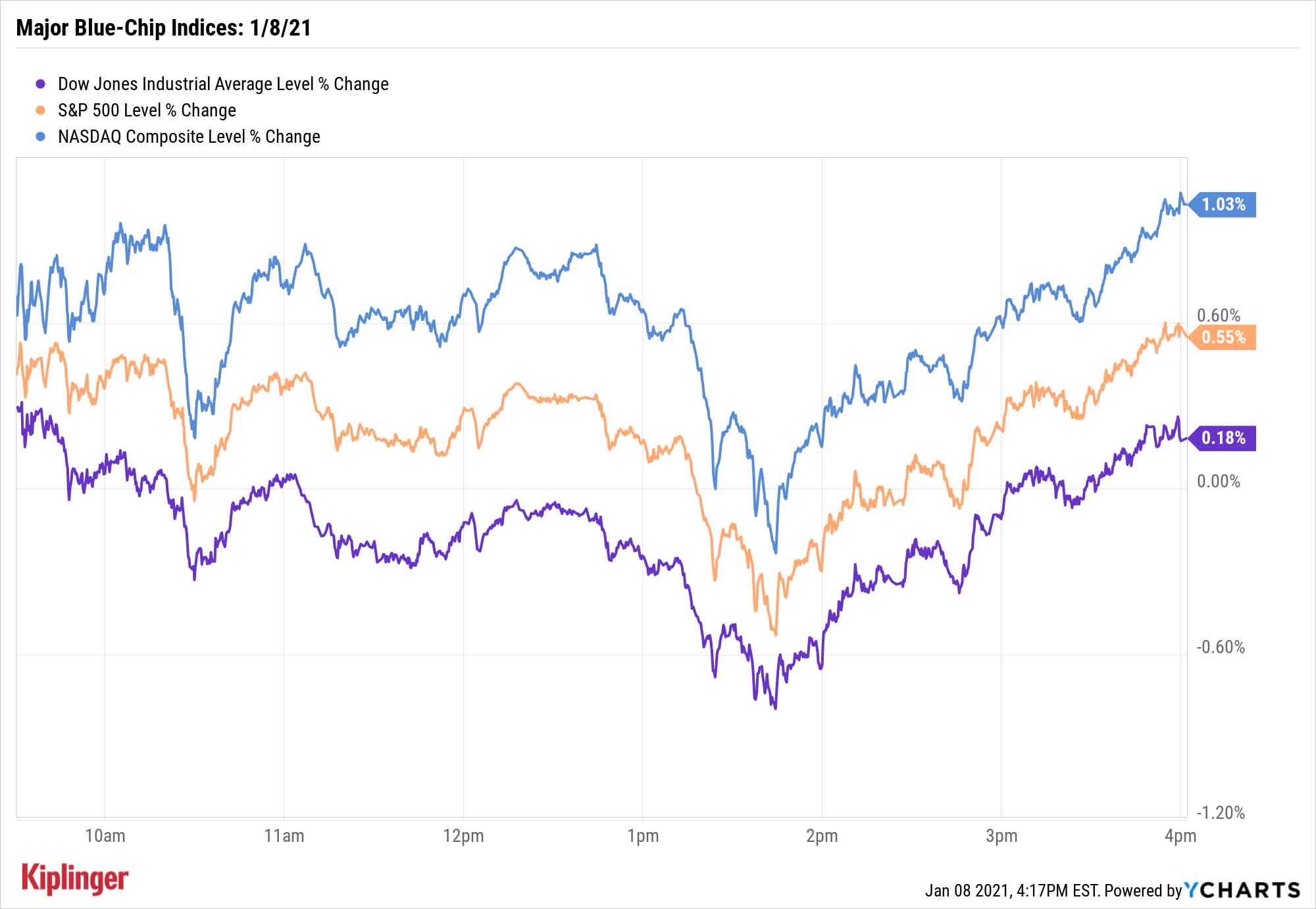

The Dow Jones Industrial Average still managed to top yesterday's record close, gaining 0.2% to 31,097. The S&P 500 (+0.6% to 3,824) and Nasdaq Composite (+1.0% to 13,201) also reached new highs.

Other action in the stock market today:

- The small-cap Russell 2000 took a step down from yesterday's record heights, declining 0.3% to 2,091.

- U.S. crude oil futures notched their fourth gain in a row, jumping 2.4% to settle at $52.03 per barrel.

- Gold futures went in the opposite direction, declining 3.7% to $1,843.20 per ounce.

A Banner Day for Bitcoin

Also setting records Friday (and for the past month, for that matter) was Bitcoin, the digital currency that has once again captured Wall Street's attention.

Bitcoin prices, which nearly reached $20,000 in 2017 before crashing into the $3,000s in 2018, reclaimed their old highs and plenty more near the end of 2020. The asset has more than doubled in less than a month, hitting a peak of $41,962 today before settling in at prices around $39,000. (Bitcoin markets don't close; price taken at 4 p.m. ET.)

Bitcoin, as well as other digital currencies, remain highly speculative assets that only those with strong risk appetites should entertain; risk-averse investors may find themselves more comfortable with large companies profiting from these technologies instead.

However, institutional money and investment analysts alike are coming around to the idea that cryptocurrencies are here to stay.

Our 2021 outlook for Bitcoin can help acquaint you with the space. Learn more about what Bitcoin is, understand why more investors are piling in, and discover where the experts think its price will finish in 2021.

Kyle Woodley was long Bitcoin as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

How to Turn Your 401(k) Into A Real Estate Empire

How to Turn Your 401(k) Into A Real Estate EmpireTapping your 401(k) to purchase investment properties is risky, but it could deliver valuable rental income in your golden years.

-

My First $1 Million: Retired Nuclear Plant Supervisor, 68

My First $1 Million: Retired Nuclear Plant Supervisor, 68Ever wonder how someone who's made a million dollars or more did it? Kiplinger's My First $1 Million series uncovers the answers.

-

How to Position Investments to Minimize Taxes for Your Heirs

How to Position Investments to Minimize Taxes for Your HeirsTo minimize your heirs' tax burden, focus on aligning your investment account types and assets with your estate plan, and pay attention to the impact of RMDs.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.

-

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have TodayBank of America stock has been a massive buy-and-hold bust.