Stock Market Today: Big Tech Stocks Thumped After Banning Trump

Shares of several major tech firms slumped Monday after 'deplatforming' President Trump and others in response to last week's attack on the Capitol.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stocks dipped from record heights Monday amid fresh fallout over last week's assault on the U.S. Capitol.

Democrats have quickly stepped up pressure to remove President Donald Trump from office, seeking first to call upon Vice President Mike Pence and the Cabinet to invoke the 25th Amendment; should that fail, House Dems appear ready to move on an article of impeachment charging the president with "incitement of insurrection."

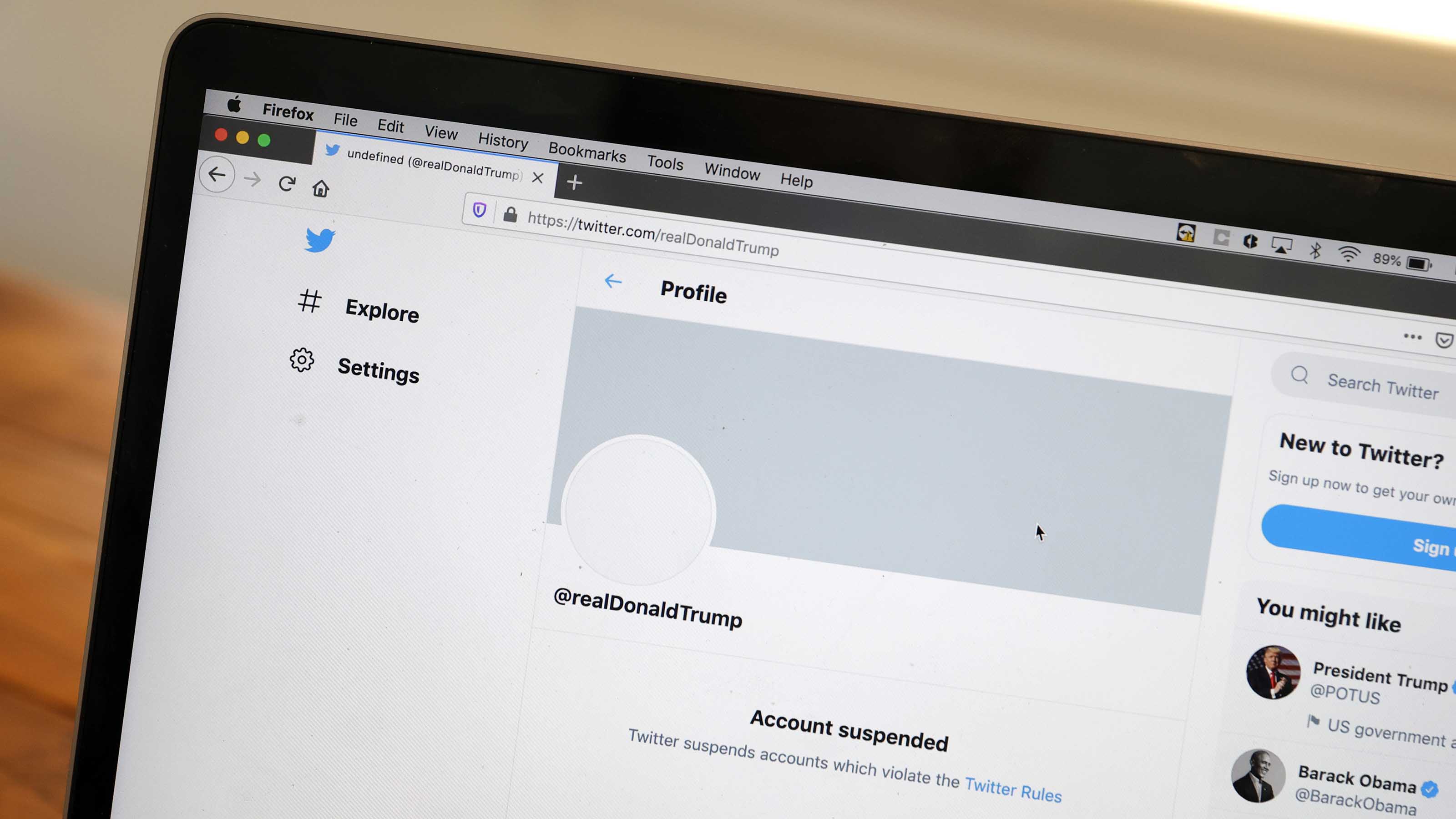

But also moving against the president were several big tech companies. Over the weekend, in one way or another, they "deplatformed" Trump and the social site Parler, which they claimed didn't do enough to moderate incitements of violence. Those stocks – including Apple (AAPL, -2.3%), Facebook (FB, -4.0%), Amazon.com (AMZN, -2.2%), Google parent Alphabet (GOOGL, -2.3%) and Twitter (TWTR, -6.4%) – sold off heavily on Monday.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"News over the weekend reminded investors that the FAANG stocks could certainly see increasing regulatory pressure over the coming months," says David Keller, chief market strategist at StockCharts.com. "The stock market is all about pricing in expectations for the future, and perceived threats to their business models could mean limited upside for this group."

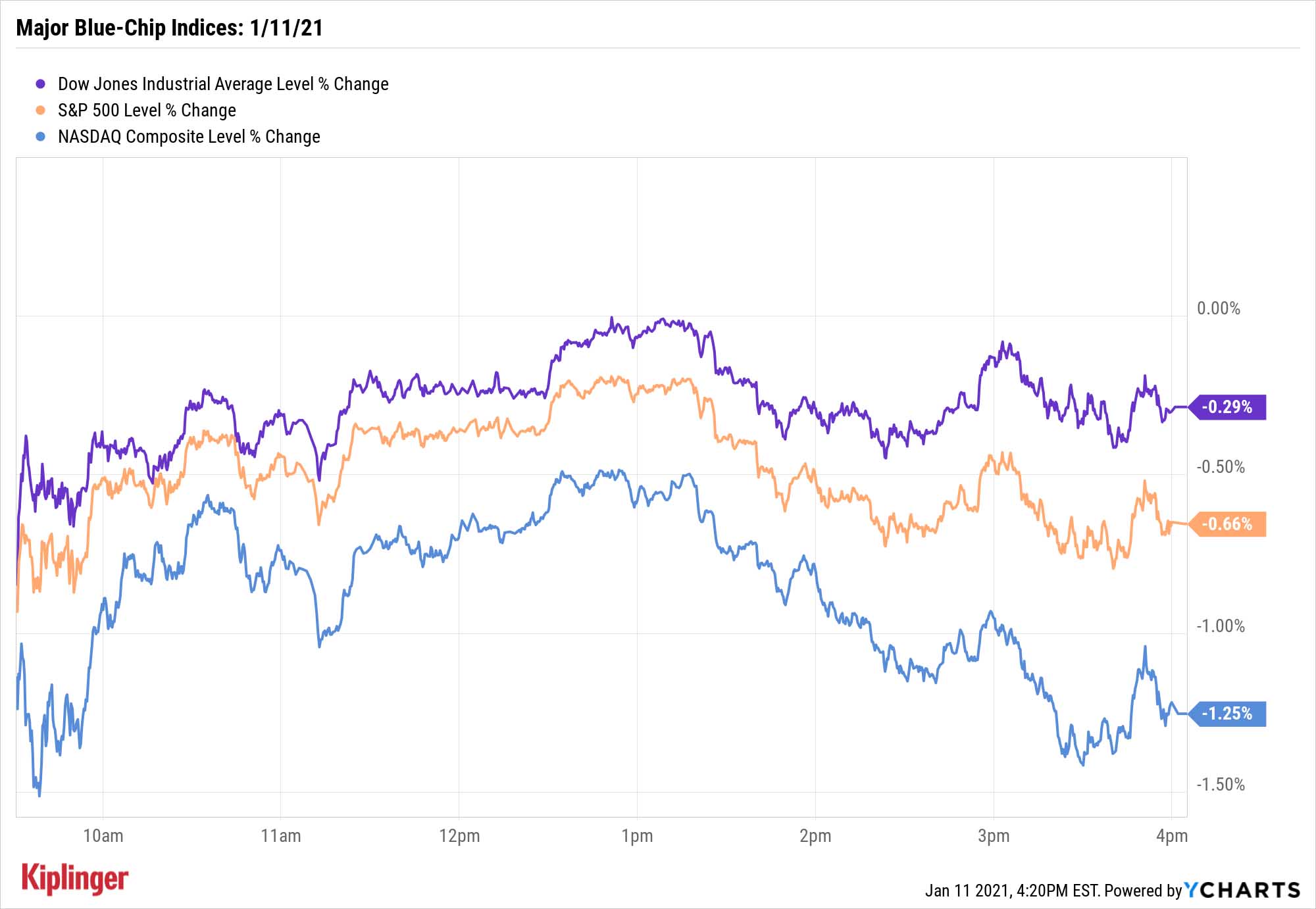

Today's weakness in Big Tech weighed on all the blue-chip indices to varying extents. The Dow Jones Industrial Average declined 0.3% to 31,008, while the Nasdaq Composite took a bigger 1.3% hit to 13,036.

Other action in the stock market today:

- The S&P 500 declined 0.7% to 3,799.

- The small-cap Russell 2000 inched marginally lower to 2,090.

- U.S. crude oil futures continued to rise, finishing up 0.2% to $52.32 per barrel.

- Gold futures improved, too, settling up 0.8% to $1,850.80 per ounce.

- Bitcoin prices, at roughly $39,000 on Friday, crashed to as low as $30,305 on Monday, technically putting it in a bear market. Prices were at $33,300 as of the Monday market close. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Keep Your Portfolio Balanced With Income

Whether Big Tech's losses will stick remains to be seen, but Monday did serve as a quick reminder of growth's double-edged sword. Many growth stocks, even the market's largest, can have momentum turn against them in a flash, whether it's on regulatory worries, a disruptive rival or some other outside shock.

That's why, when you're constructing a strategy to build wealth over time, it pays to also invest in companies that pay … dividends, that is.

While it can be difficult to find stocks that can deliver huge chunks of returns via those cash distributions, especially at the market's current lofty levels, they do exist. You'll see many of them among the ranks of Wall Street's monthly dividend payers, whose distributions are much more frequent than the quarterly norm.

Among that group are real estate investment trusts (REITs) – a familiar sector, and one whose components are required to pay 90% of their taxable profits as dividends to shareholders.

You might be less familiar with another business structure with the same mandate: business development companies (BDCs), which provide financing to smaller businesses. These private equity-esque firms can struggle when economic conditions hamper Main Street, but they stand poised to reap the rewards of an American recovery while offering some of the best yields on Wall Street. Read on as we look at some of the best BDCs for the year ahead: a set of five stocks yielding between 7.7% and 10.6%.

Kyle Woodley was long AMZN and Bitcoin as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

4 Estate Planning Documents Every High-Net-Worth Family Needs

4 Estate Planning Documents Every High-Net-Worth Family NeedsThe key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.