Stock Market Today: Stocks Grind Ahead, Tesla Keeps Sprinting

Tesla (TSLA) and energy stocks were high points of an otherwise subdued Tuesday of trading for the major indices.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

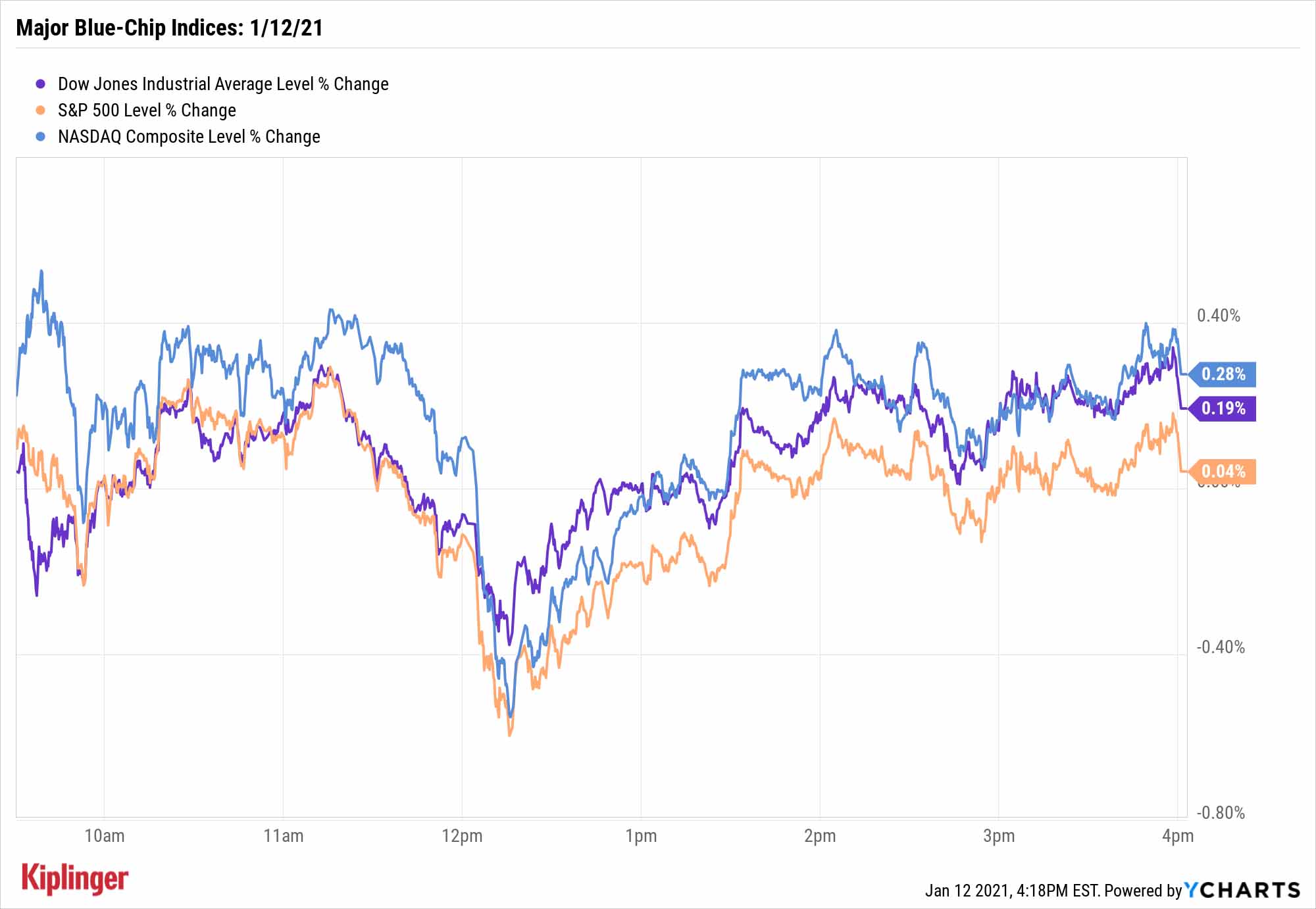

The market finished an up-and-down session with modest gains Tuesday as Wall Street weighed two good news/bad news situations.

In Washington, the incoming Biden administration is signaling a third stimulus check, but tensions are high as at least 10,000 National Guard troops are being deployed to protect the capital city from additional threats of violence in the wake of last week's attack on the Capitol.

Meanwhile, the federal government is expected to announce steps to speed up national COVID-19 vaccination after a turbulent rollout, but that comes as a more-contagious mutant strain continues to make inroads.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Tesla (TSLA, +4.7%) was a bright spot – the best S&P 500 stock of 2020 brought its 2021 gains to 20.4% after Citi analyst Jeff Chung said a new sedan from China's Nio (NIO, -1.2%) was "good but not enough to make any critical changes from Tesla's challenge."

Also on the rise were energy stocks (XLE, +3.6%) after U.S. crude oil futures jumped 1.8% to hit an 11-month high of $53.21 per barrel.

The Dow Jones Industrial Average finished up 0.2% to 31,068, and the small-cap Russell 2000 climbed 1.7% to hit a new high of 2,127.

Other action in the stock market today:

- The S&P 500 produced a marginal gain to 3,801.

- The Nasdaq Composite improved by 0.3% to 13,072.

- Gold futures improved, too, settling up 0.4% to $1,844.20 per ounce.

- Bitcoin prices, at $33,300 on Monday, improved to $34,300. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

What Do the Machines Have to Say About Stocks?

We look at all the mental muscle Wall Street has to offer in our stock coverage. Any single investor is limited to their own biases, their own ideas about risk and their own goals, and so it serves readers better to present a wider array of viewpoints.

Consider our best stocks for 2021, which does include some staff picks, but also several stocks recommended by some of the industry's best fund managers. Wall Street's analyst community is useful to gauge, too, given how much more closely they're able to study firms compared to the average investor. And from time to time, we even tap the billionaire brain trust, as their sizable resources and valuable connections can provide insights that most of us simply don't have.

Today, however, we've switched things up by handing it over to the machines.

Danel Capital, a financial advice company, boasts an interesting artificial intelligence (AI) algorithm – one that analyzes fundamental data, stock charts and even sentiment from investors like us – that has consistently "hand-picked" winners that have trounced the broader market over the past few years.

We're curious about how this system will fare in what's already proving to be another bizarre year, so we've highlighted the algo's top picks … and checked in with other experts to see what they think. Check it out.

Kyle Woodley was long Bitcoin and NIO as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

Stocks Extend Losing Streak After Fed Minutes: Stock Market Today

Stocks Extend Losing Streak After Fed Minutes: Stock Market TodayThe Santa Claus Rally is officially at risk after the S&P 500's third straight loss.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.