Stock Market Today: New Stimulus Plan Fails to Stimulate Stocks

Did Wall Street just "sell the news"? Stocks decline a day after Biden unveils $1.9 trillion "American Rescue Plan."

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

A week of drowsy trading got no lift from the latest prospect of more government spending.

President-Elect Joe Biden on Thursday evening unveiled a $1.9 trillion "American Rescue Plan" that includes a number of provisions, including $1,400 stimulus checks, supplemental unemployment benefits and a $15-per-hour federal minimum wage.

And yet, stocks went red on Friday.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Perhaps Wall Street had already baked in all of its expectations for the much-anticipated plan. Or perhaps the market remained distracted by COVID itself, which is still taking a hefty toll here in the U.S. as the vaccine rollout seems to crawl forward. Also of some concern was the start of the Q4 earnings season – mixed results from Citigroup (C, -6.9%) and Wells Fargo (WFC, -7.8%) weighed on those stocks and the rest of the financial sector.

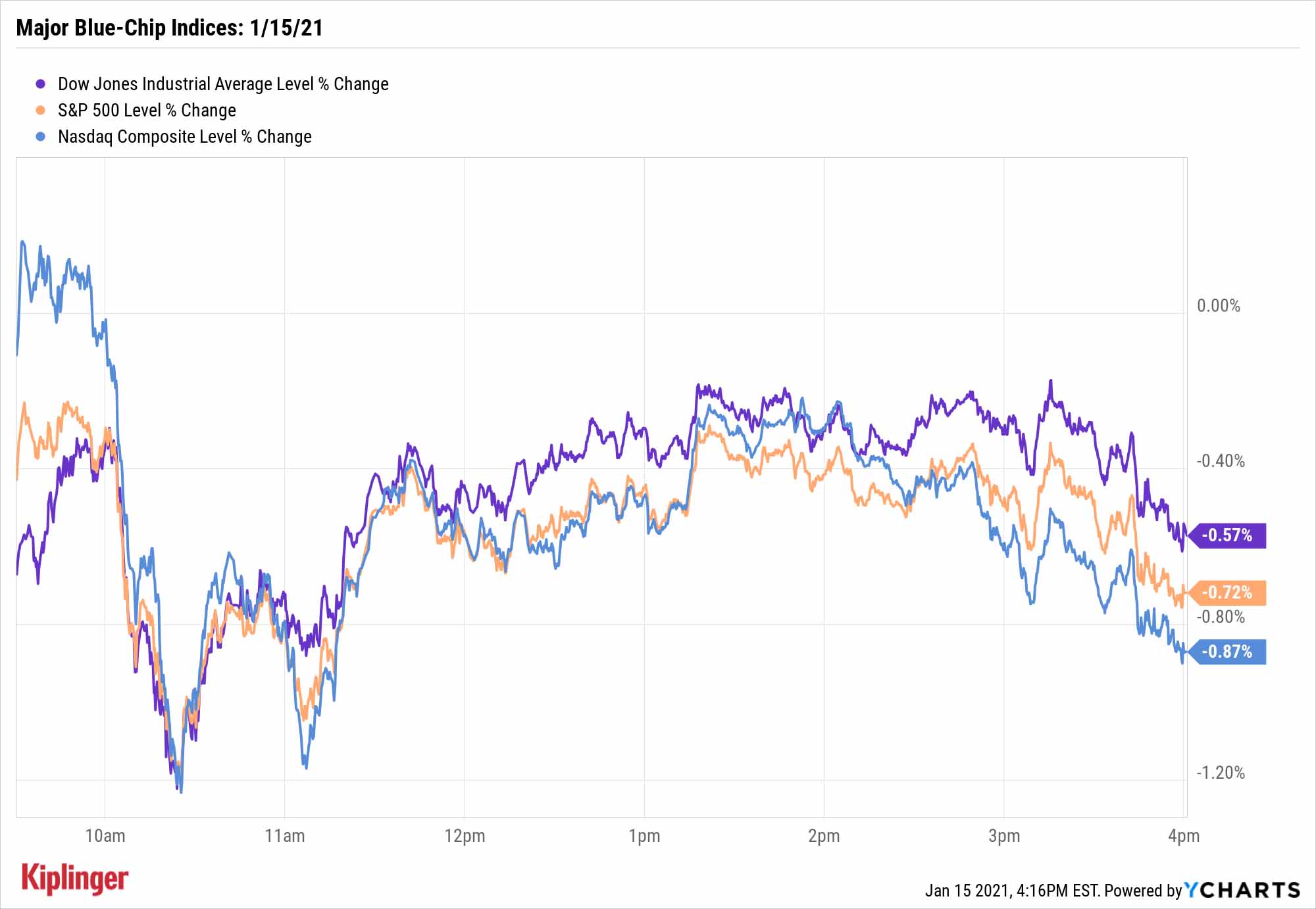

The Dow Jones Industrial Average closed 0.6% lower to 30,814, and the rest of the major indices followed suit.

Other action in the stock market today:

- The S&P 500 took a 0.7% spill to 3,768.

- The Nasdaq Composite broke back below 13,000, dropping by 0.9% to 12,998.

- The Russell 2000 dropped hard off its all-time high, losing 1.5% to 2,123.

- Gold futures weren't exempt, dipping 1.3% to settle at $1,827.80 per ounce.

- U.S. crude oil futures finally cooled off, losing 2.4% to $52.31 per barrel.

- Bitcoin prices, at $39,633 on Thursday, plunged more than 10% to $35,579. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

- Tesla (TSLA, -2.2%) shares declined after receiving a Street-high $950 price target from Wedbush analyst Daniel Ives, but not a Buy recommendation.

Turbulence Ahead?

While optimistic about 2021 overall, many analysts predicted some bumpiness, especially in Q1, and we might be at the onset of one such rough patch.

"We have fairly high conviction in two things," says Canaccord Genuity equity strategist Tony Dwyer. "Conditions remain ripe for a temporary correction that should give back much of what has been gained since late last year, and when it comes, investors are likely to believe it is something more sinister than an overbought correction."

One thing that stood out clearly Friday was a flight to income-producing equities. Within the Dow itself, three of the five best performers were so-called "Dogs" – the industrial average's highest-yielding stocks as of the start of the year.

Business development companies (BDCs), a high-yielding but low-traffic area of the market, also outperformed.

And real estate, much maligned in 2020, earned some attention Friday. Real estate investment trusts (REITs) are well-known among income investors given their mandate to turn over at least 90% of their taxable profits via cash distributions to their shareholders. Many of them currently sport higher-than-normal yields after a difficult 2020, making them a one-two punch of income and rebound potential once the American economy settles back onto its track. Check them out.

Kyle Woodley was long Bitcoin as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Stocks See First Back-to-Back Losses of 2026: Stock Market Today

Stocks See First Back-to-Back Losses of 2026: Stock Market TodayRising geopolitical worries and a continued sell off in financial stocks kept pressure on the main indexes on Wednesday.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

Stocks Extend Losing Streak After Fed Minutes: Stock Market Today

Stocks Extend Losing Streak After Fed Minutes: Stock Market TodayThe Santa Claus Rally is officially at risk after the S&P 500's third straight loss.