Tread Carefully in a Hot IPO Market

Be wary of high-priced initial public offerings (IPOs) in a stock market that’s stacked against you.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

It’s 2021, but on Wall Street it feels like the exuberant days at the turn of the century. Initial public offerings (IPOs) are hot again. A new wave of young companies, many that have yet to post a profit, are selling stock to the public for the first time. And the reception from investors has been bullish.

Maybe too bullish, IPO watchers warn. “There’s definitely froth” in the market, says Lindsey Bell, chief investment strategist at Ally Invest. The market’s powerful rebound from last year’s pandemic-related plunge put investors in a buying mood. Eye-popping IPO gains are fueling the hype.

Big first-day pops have caught investors’ attention. Shares of Airbnb (ABNB) jumped 113% and food-delivery service DoorDash (DASH) rose 86% in their trading debuts late last year. The average first-day return for IPOs in 2020 was nearly 42%, the best day-one showing since 2000, according to Jay Ritter, finance professor at the University of Florida.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

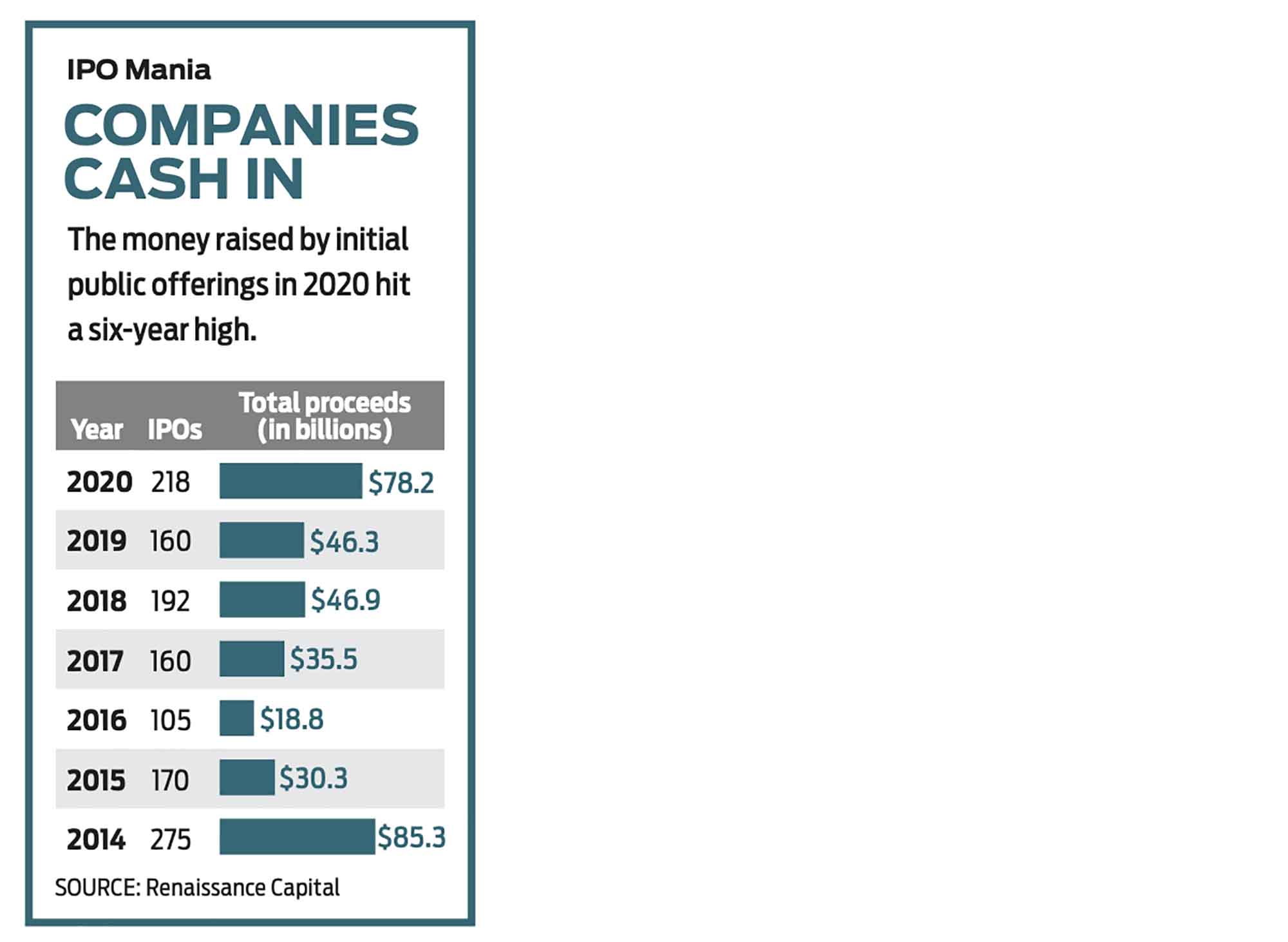

Last year’s average annual IPO gain of 75% was the highest in 20 years, according to IPO experts at Renaissance Capital. The 218 IPOs in 2020 were the most since 2014, and IPO momentum will likely continue in 2021 amid expectations for an improving economy and strong market as the COVID-19 vaccine rolls out.

Don’t Buy Into the Hype

For every high-profile IPO that doubles on its first day, there are many newbie stocks that disappoint investors. In fact, the long-term performance of IPOs is underwhelming. About half of IPOs “will produce negative returns” in their first five years as public companies, Ritter says. “My advice now is to stay away from IPOs,” he says.

His caution stems from expensive valuations that tend to limit future gains. Investors are again paying top dollar for tech IPOs. The median tech IPO in 2020 at its first-day closing price traded at 23.3 times sales – more than three times higher than average, Ritter says.

There’s another reason to eye freshly minted stocks with skepticism: The IPO game puts individual investors at a disadvantage. Banks that underwrite IPOs set the offering price and dole out most shares at that price to their best customers, such as hedge funds and mutual funds. “Very few shares go to mom-and-pop investors,” Ritter says. Most people can’t buy shares of an IPO until it starts trading. And that means they can’t benefit fully – if at all – from big first-day gains.

Consider Airbnb’s December 10 debut. The first trade was at $146 per share, or 115% above its $68 offering price; the stock closed that day at $145. Although headlines touted an eye-popping 113% gain, investors who bought at the opening price suffered a loss of 1%. (The shares recently traded at $150.)

Looking at IPO returns for the first year of trading and excluding first-day performance provides a more accurate snapshot of how IPO investors will fare, says Wes Crill, senior researcher at Dimensional Fund Advisors. Investors will earn better returns by investing in a broad stock index than by owning a portfolio of recent IPOs, a DFA study found.

In the period from the start of 1992 through 2018, a hypothetical portfolio of IPOs issued over the previous 12 months, weighted by market value and rebalanced monthly, posted annualized returns of nearly 7%. That lagged the 9% return of the Russell 3000 stock index, a broad U.S. stock index that tracks both large-company and small-cap stocks.

First-year IPO returns can also be hurt by “lock-up” periods. Rules prevent insiders and early investors from selling shares until 90 to 180 days after the IPO. So in the first three to six months, fewer shares are available to trade, which can result in inflated stock prices. Once the lock-up period ends, the supply of shares for sale in the open market increases, which can depress prices.

Long-term IPO returns are nothing to brag about, either. IPOs that were bought at the first day’s closing price and held for 48 months posted a median decline of 17.4%, according to research firm IPOX Schuster, citing data from 1985 through 2019. Nearly 57% of IPOs in that four-year holding period had negative returns. “Most IPOs will underperform,” says firm founder Josef Schuster.

Yet high-profile IPOs that make it big lure investors into mistakenly thinking IPOs are get-rich-quick investments. Even the most-hyped IPOs sometimes fail to deliver. Shares of Fitbit (FIT), which makes wearable devices, and meal-delivery company Blue Apron (APRN) still trade below their respective IPO prices from 2015 and 2017. The stock of ride-sharing leader Uber (UBER), which fell 7.6% on its first trading day in May 2019, only recently climbed above its $45 IPO price, to $53 in mid January.

Some of today’s most successful stocks weren’t instant hits, Bell says. Social media giant Facebook (FB) “flopped out of the gate,” she notes. Investors had to hold the stock for 15 months before it climbed back above its $38 offering price.

Identifying which IPOs will succeed is tough; clarity usually comes only in hindsight. Because IPOs tend to be younger companies with short track records and unproven management teams, it’s harder to predict whether they’ll thrive or dive. The more uncertain the outlook for a company’s sales and profits, the riskier and more volatile its stock tends to be.

Smart Ways to Play IPOs

This year’s IPO pipeline is expected to be robust and could include spacecraft maker SpaceX; Alphabet’s (GOOGL) autonomous vehicle unit, Waymo; cloud-computing company Databricks; grocery delivery service Instacart; and dating app Bumble – well-known firms sure to drum up plenty of investor interest.

If you still want to get in on the IPO action, there are strategies you can employ to boost your chances of generating positive returns. Most important, if you can’t get shares at the offering price, avoid buying an IPO on its first day of trading.

Instead, consider a wait-and-watch strategy. If you are confident that a new public company has a bright future, consider buying on a dip, or even after a big drop. In 2012, Facebook shares lost more than half of their value in the four months after going public before rebounding. As of mid January, the social media giant is up nearly 1,400% since that initial swoon.

“If the price drops enough, [IPOs] can be good investments,” Ritter says. You might also wait until after a firm proves its sales and earnings growth is sizable and sustainable.

Another way to gain exposure to IPOs and reduce individual-stock risk is by investing in broadly diversified and low-cost exchange-traded funds that own IPOs – as a tactical addition to your core holdings. The First Trust U.S. Equity Opportunities ETF (FPX), which tracks IPOs in the IPOX-100 U.S. index, gained more than 47% in 2020, trouncing the S&P 500. The ETF has posted better returns than the S&P 500 in six of the past 10 calendar years.

The IPO ETF (IPO), which tracks Renaissance Capital’s IPO index, gained 107% in 2020, compared with an 18% gain for the broad stock market. But performance for the ETF has been spotty, with this portfolio posting lower returns than the S&P 500 in four of the past seven years.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Adam Shell is a veteran financial journalist who covers retirement, personal finance, financial markets, and Wall Street. He has written for USA Today, Investor's Business Daily and other publications.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)State Taxes Living in one of these places could lower your 2025 investment taxes — especially if you invest in real estate.

-

The Final Countdown for Retirees with Investment Income

The Final Countdown for Retirees with Investment IncomeRetirement Tax Don’t assume Social Security withholding is enough. Some retirement income may require a quarterly estimated tax payment by the September 15 deadline.

-

Why Wells Fargo's Revenue Miss Isn't Worrying Wall Street

Why Wells Fargo's Revenue Miss Isn't Worrying Wall StreetWells Fargo is one of the best S&P 500 stocks Wednesday even after the big bank's top-line miss. Here's what you need to know.

-

Constellation Energy Stock Soars on Its $26 Billion Buy. Here's Why Wall Street Likes the Deal

Constellation Energy Stock Soars on Its $26 Billion Buy. Here's Why Wall Street Likes the DealConstellation Energy is one of the best S&P 500 stocks Friday after the utility said it will buy Calpine in a cash-and-stock deal valued at $26 billion.

-

What Scott Bessent's Treasury Secretary Nomination Means for Investors

What Scott Bessent's Treasury Secretary Nomination Means for InvestorsMarkets are reacting positively to Trump's nomination of Scott Bessent for Treasury secretary. Here's why.

-

TJX Stock: Wall Street Stays Bullish After Earnings

TJX Stock: Wall Street Stays Bullish After EarningsTJX stock is trading lower Wednesday despite the TJ Maxx owner's beat-and-raise quarter, but analysts aren't worried. Here's why.

-

Cisco Stock: Why Wall Street Is Bullish After Earnings

Cisco Stock: Why Wall Street Is Bullish After EarningsCisco stock is lower Thursday despite the tech giant's beat-and-raise quarter, but analysts aren't concerned. Here's what you need to know.

-

Apple Stock Slips After Earnings. Wall Street Isn't Worried

Apple Stock Slips After Earnings. Wall Street Isn't WorriedApple stock is trading lower Friday despite the iPhone maker beating expectations for its fiscal fourth quarter, but analysts are still bullish.