Stock Market Today: Nasdaq Scratches Out Another Record Finish

The Nasdaq came out of a mixed day with yet another fresh high. More interesting were Friday's moves by IBM, Intel and GameStop.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

A muted Friday for the broader stock market was much more interesting under the microscope.

The market received some good news in the form of readings from IHS Markit showing a decade-high level of manufacturing activity and expansion of services activity. That news was blunted by the nation's top infectious diseases expert, Dr. Anthony Fauci, who highlighted data showing that current COVID vaccines might not be as effective in curbing some mutated strains.

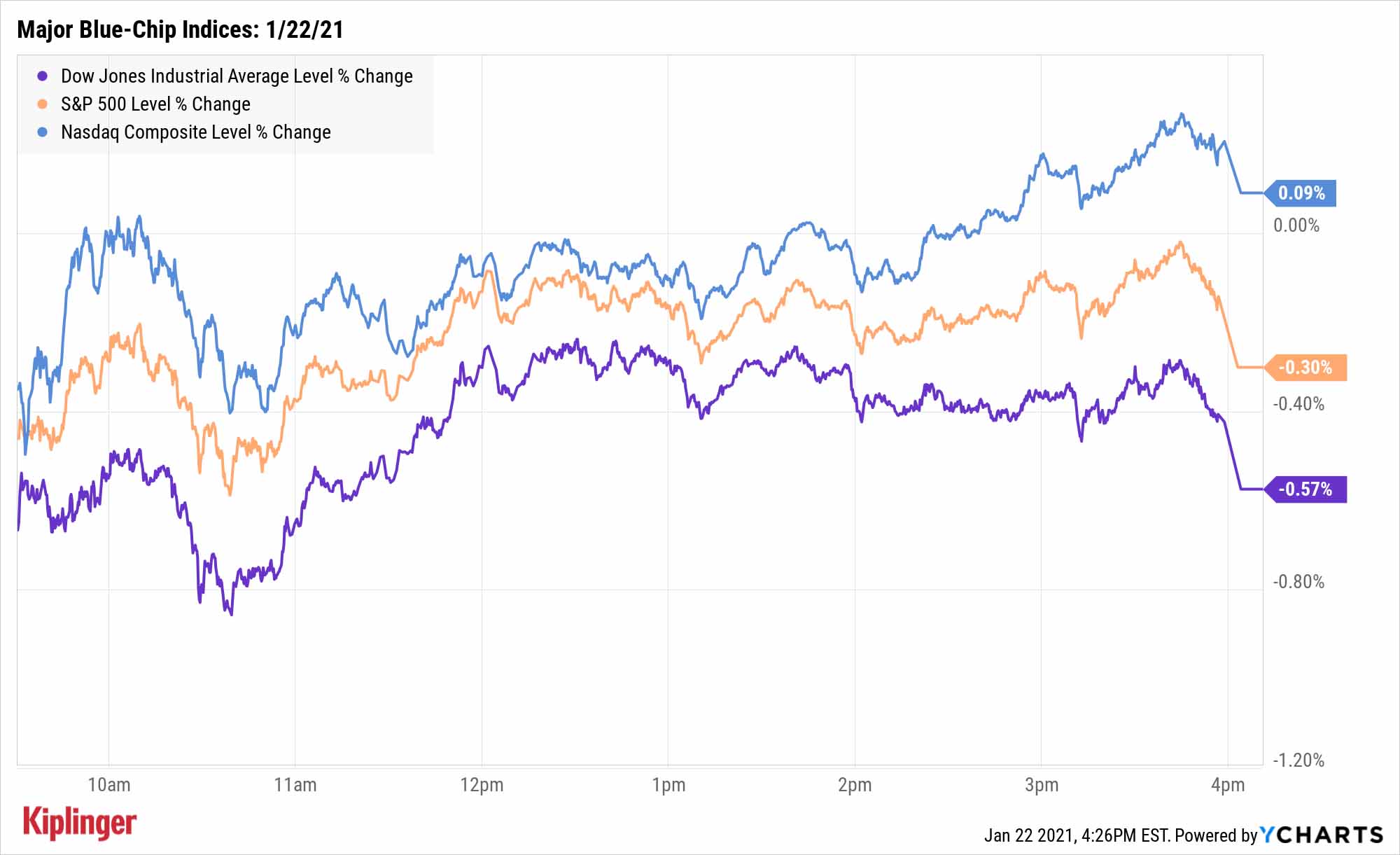

The Nasdaq Composite finished a modest 0.1% higher, good enough for a record close at 13,543. The Dow was clipped by 0.6% to 30,996, driven lower by International Business Machines (IBM, -9.9%), which reported disappointing quarterly revenues, and Intel (INTC, -9.3%), which popped yesterday after accidentally releasing its earnings before the closing bell, but yielded ground today.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Capturing much of Wall Street's attention, however, was GameStop (GME, +50.5%), which has rallied a wild 2,419% since April thanks to a mix of strong earnings, a transformative investor stake and the unraveling of bets against the stock. That helped the small-cap Russell 2000 violently rebound, with a 1.3% gain to a record 2,168.

Other action in the stock market today:

- The S&P 500 slipped 0.3% to 3,841.

- Gold futures dropped 0.6% to $1,855.70 per ounce.

- U.S. crude oil futures settled at $52.42 per barrel, a 1.3% decline.

- Bitcoin prices, at $31,902 on Thursday, rebounded 5.3% to $33,606. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

The Pros' Picks for 2021

The view from 10,000 feet is awfully different from the view on the ground.

The analyst community's broad-stroke convictions about what will work in 2021 are fairly uniform. Value stocks will finally have their day in the sun, they say, even if COVID lingers longer than hoped. Value-priced sectors, then, are also the rage: Financial stocks should win out, goes the logic. So too should oil and gas names.

But when you zoom in to the single-stock level, you'll find that many of the pros' favorite stocks for the year aren't all found in those favored niches.

We've highlighted 21 stock picks that stand out because of their high concentration of recent bullish 12-month calls, and our list is a mishmash of just about everything the market has to offer – large-cap health insurers, mid-cap tech plays, tiny health innovators and everything in between. Check them out!

Kyle Woodley was long Bitcoin as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

The Cost of Leaving Your Money in a Low-Rate Account

The Cost of Leaving Your Money in a Low-Rate AccountWhy parking your cash in low-yield accounts could be costing you, and smarter alternatives that preserve liquidity while boosting returns.

-

I want to sell our beach house to retire now, but my wife wants to keep it.

I want to sell our beach house to retire now, but my wife wants to keep it.I want to sell the $610K vacation home and retire now, but my wife envisions a beach retirement in 8 years. We asked financial advisers to weigh in.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Soars 588 Points as Trump Retreats: Stock Market Today

Dow Soars 588 Points as Trump Retreats: Stock Market TodayAnother up and down day ends on high notes for investors, traders, speculators and Greenland.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Visa Stamps the Dow's 398-Point Slide: Stock Market Today

Visa Stamps the Dow's 398-Point Slide: Stock Market TodayIt's as clear as ever that President Donald Trump and his administration can't (or won't) keep their hands off financial markets.

-

Dow Hits a Record High After December Jobs Report: Stock Market Today

Dow Hits a Record High After December Jobs Report: Stock Market TodayThe S&P 500 also closed the week at its highest level on record, thanks to strong gains for Intel and Vistra.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

These Were the Hottest S&P 500 Stocks of the Year

These Were the Hottest S&P 500 Stocks of the YearAI winners lead the list of the S&P 500's top 25 stocks of 2025, but some of the names might surprise you.