Stock Market Today: Economy Flashes Good Signs, But Stocks Fizzle

Strong housing and consumer confidence data, as well as a few positive blue-chip earnings reports, weren't enough to lift the major indices Tuesday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The stock market was turned back Tuesday despite a good amount of positive news and data dumps.

Home prices continued to rocket higher in November, improving 1.4% month-over-month, according to a 20-city composite index from S&P/CS CoreLogic, and 9.1% year-over-year.

"The strength in home prices in the S&P CoreLogic CS survey is similar to that reported by the FHFA for the same period, which showed home prices up 1.0% m/m and 11.0% y/y," says Blerina Uruçi, U.S. economist, director at Barclays. "Both surveys outperformed consensus expectations for November and have been on a very steady upward trajectory since the end of the lockdown last year.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Meanwhile, the Conference Board's consumer confidence index rebounded in January, to 89.3 from a five-month low of 87.1 in December.

It was a busy day for corporate earnings, too. Dow Jones Industrial Average components Johnson & Johnson (JNJ, +2.7%) and 3M (MMM, +3.3%) both got a lift from better-than-expected Q4 results. Verizon (VZ, -3.2%) beat estimates too, but its stock slipped on disappointing subscriber additions, while American Express's (AXP, -4.1%) characterization of 2021 as a "transition year" spooked investors.

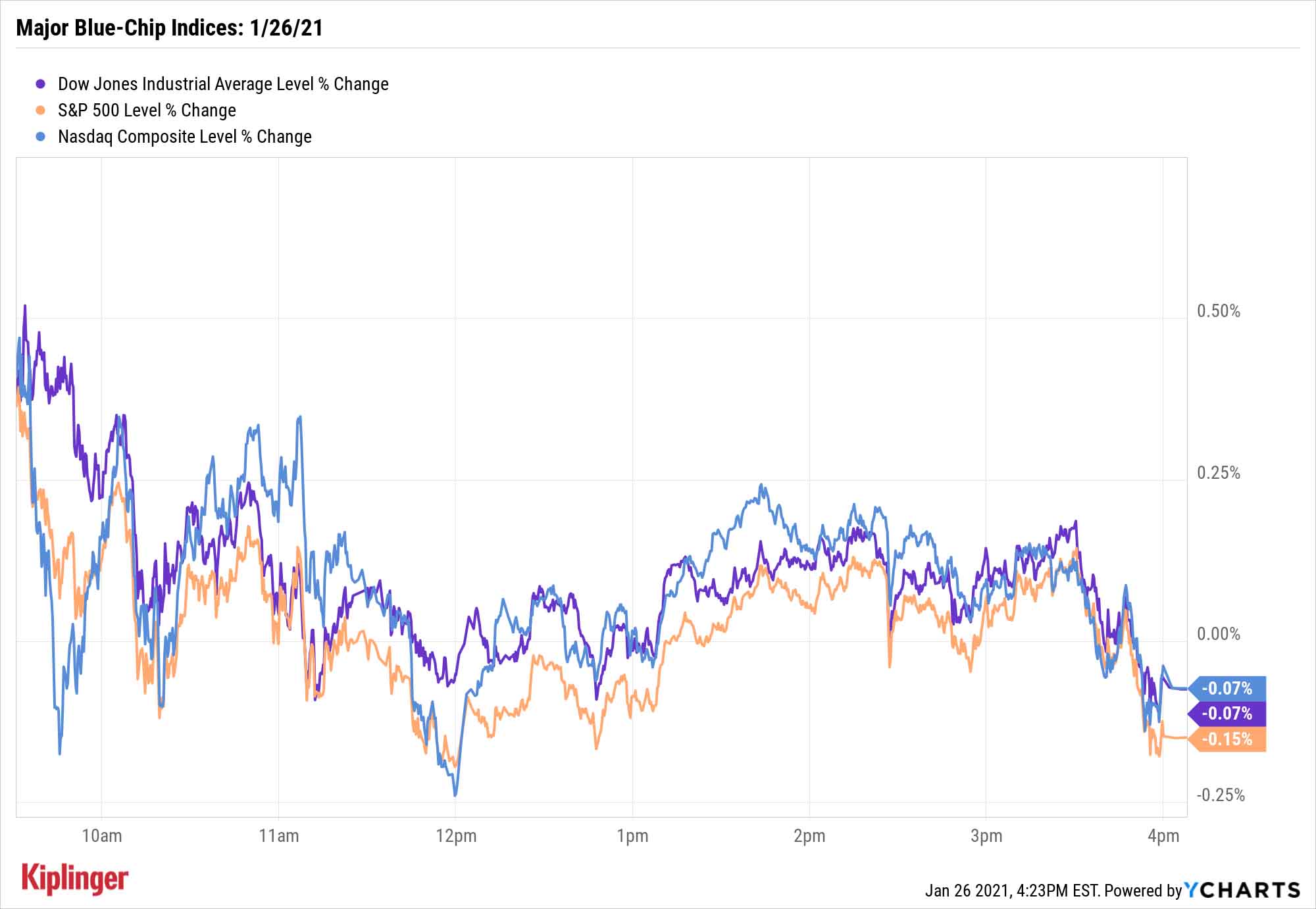

The Dow finished with a slight 0.1% decline to 30,937. The Nasdaq Composite (-0.1% to 13,626) had its five-session win streak snapped, and the S&P 500 (-0.2% to 3,849) also slipped from record highs.

Other action in the stock market today.

- The Russell 2000 declined by 0.6% to 2,149.

- Gold futures were down again, off 0.2% to 1,850.90 per ounce.

- U.S. crude oil futures settled similarly lower, losing 0.2% to $52.66 per barrel.

- Bitcoin prices, at $33,430 on Monday, continued their decline with a 4.3% loss to $31,981. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

WallStreetBets Is At It Again

The latest craze to hit Wall Street also continued with vigor Tuesday. That is, a group of traders from the "WallStreetBets" community on the Reddit app kept going after heavily shorted stocks in an attempt to trigger short squeezes that pop those shares higher.

It's a phenomenon that has captured the attention of not just traders, but market observers and even legal minds, and has even forced a well-known short-selling hedge fund to seek out financial help.

The community was met with varying levels of success today. Their prime target, GameStop (GME), exploded for another 92.7%. BlackBerry (BB) enjoyed a more modest 4.9% gain, while Nokia (NOK, -2.5%) finished in the red.

It's a fascinating trend, albeit one that's only suitable for those with extreme risk tolerance and the time to remain glued to their accounts all day. Most investors are better off in traditional growth plays, whether you're talking about larger growth stocks or small-cap dynamos.

If you are curious about what younger investors are looking at, however, one way is to look at the most widely owned stocks on the Robinhood app -- a no-fee trading pioneer that's popular among millennials. You'll see a perhaps surprising number of "mainstream" stocks among them, and more encouraging still: Wall Street's pros seem to give most their thumbs-up, too.

Kyle Woodley was long AXP, BB, JNJ and NOK as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Adds 211 Points as Greenland Tensions Ease: Stock Market Today

Nasdaq Adds 211 Points as Greenland Tensions Ease: Stock Market TodayWall Street continues to cheer easing geopolitical tensions and President Trump's assurances that there will be no new tariffs on Europe.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Dow Dives 870 Points on Overseas Affairs: Stock Market Today

Dow Dives 870 Points on Overseas Affairs: Stock Market TodayFiscal policy in the Far East and foreign policy in the near west send markets all over the world into a selling frenzy.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

Dow Rises 497 Points on December Rate Cut: Stock Market Today

Dow Rises 497 Points on December Rate Cut: Stock Market TodayThe basic questions for market participants and policymakers remain the same after a widely expected Fed rate cut.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.