Stock Market Today: Earnings, Stimulus Drive Another Big Push for Stocks

Major indices enjoy a second day of strong gains Tuesday; after the bell, Amazon.com announces Jeff Bezos will transition out of CEO role.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Wall Street finally stuck to the same tune for more than one session at a time, in this case posting a second consecutive day of rip-roaring gains on Tuesday. That action was followed up by the sudden news that one of corporate America's most successful CEOs would be stepping down.

Despite the growing prevalence of more-contagious COVID-19 strains, hospitalizations and deaths are, for the moment, heading lower. Financial relief for the coronavirus-battered economy looks a little likelier too, as Sen. Joe Manchin (D-W.Va.) signaled support for an important step forward in approving a new relief package.

Strong earnings reports from United Parcel Service (UPS, +2.6%) and Exxon Mobil (XOM, +1.6%) also whipped up some optimism.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"Since multiple expansion – higher equity prices due to falling interest rates or rising liquidity – is unlikely to be an equity market driver this year, the 2021 bull thesis depends on earnings improvement to remain intact," says Lauren Goodwin, economist and portfolio strategist at New York Life Investments.

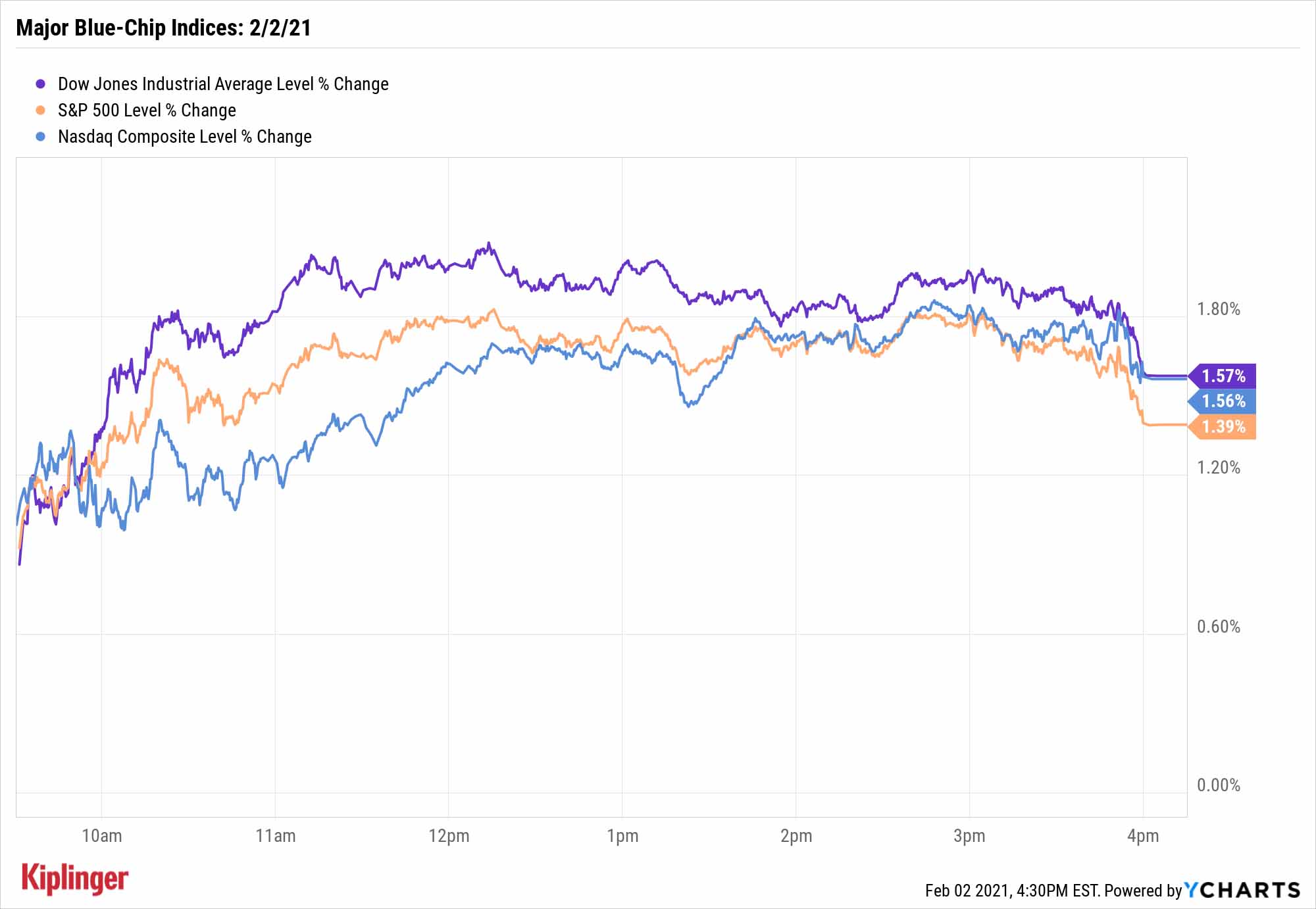

The Dow Jones Industrial Average (30,687) and Nasdaq Composite (13,612) each jumped 1.6%, while the S&P 500 enjoyed a robust gain of 1.4% to 3,826.

Investors in some of the "short squeeze" stocks espoused by the WallStreetBets Reddit community weren't so lucky. GameStop (GME) plunged a flat 60% after an 31% decline on Monday, AMC Entertainment (AMC) dropped 41.2% and BlackBerry (BB) lost 21.1%.

- The Russell 2000 jumped 1.2% to 2,151.

- Gold futures slid 1.9% to 1,833.40 per ounce.

- U.S. crude oil futures had another great day, improving by 2.3% to settle at $54.76 per barrel.

- Bitcoin prices, at $33,849 on Monday, popped by 5.9% to $35,842. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

- After the closing bell, Amazon.com (AMZN) announced that Jeff Bezos would step down as CEO, to be replaced by Amazon Web Services (AWS) chief Andy Jassy. Bezos will shift to the role of Executive Chair in the third quarter of 2021.

History Says 2021 Could Be a Slog

Third stimulus or not, earnings rebound or not, 2021 could still be tough. Vaccines might be on the way, but COVID is largely unchecked, unemployment remains high, and – despite all that – stocks as a whole are sitting at sky-high valuations.

History isn't on our side either.

Remember the old adage, "As goes January, so goes the year"? Ryan Detrick, chief market strategist for LPL Financial, points out there's some statistical validity to that.

"When the S&P 500 has been green in January, the index has been up 11.9% on average over the rest of the year (final 11 months) and higher 86% of the time," he says. "However, when that first month was red, stocks rose only 1.7% on average over the final 11 months and were higher barely 60% of the time."

In other words, investors might need more than just stocks that ebb and flow with the market's tide – they'll need companies postured for standout results. If you ask the pros, many will point you to these 25 stocks that they've endorsed with high confidence. That's admittedly a growth-centric group, and some of us prefer value and dividends.

Fortunately, the analyst community has no shortage of love for a number of high-yield names, too, including these 25 stocks that yield at least 3%.

Kyle Woodley was long AMZN and Bitcoin as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.