Stock Market Today: Investors Look Past Weak Jobs Report

The U.S. gained very few jobs in January, but persistent positive signs of eventual COVID relief kept Wall Street bidding up the major indices Friday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

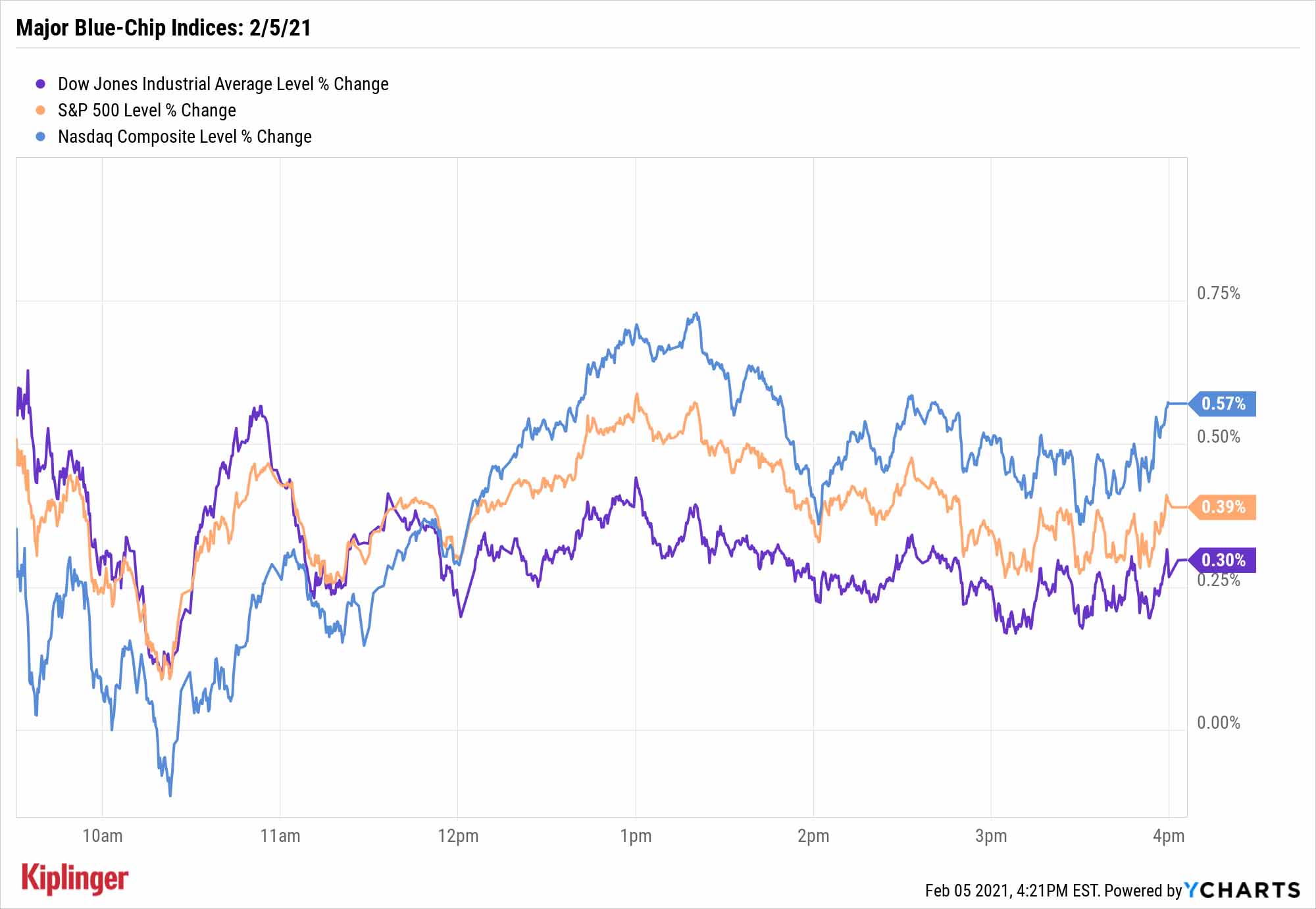

Stocks closed the week with a timid move higher as investors digested more positive breadcrumbs on COVID relief as well as a sign that the economic recovery is perhaps not as robust as hoped.

The Labor Department on Friday reported a slim 49,000 jobs were added in January, and a drop in the unemployment rate, from 6.7% to 6.3%, isn't as favorable as it seems.

"The headline unemployment number keeps moving down, which is normally a good thing," says Chris Zaccarelli, chief investment officer for Independent Advisor Alliance, "but the labor force participation rate has been coming down as well, indicating that more people are dropping out of the headline unemployment number."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Rick Rieder, BlackRock’s chief investment officer of Global Fixed Income, was more sanguine.

"With rolling lockdowns, regional divergences, government hiring dynamics, etc., the information at the aggregate level (+49,000 in payroll gains) was not terribly revealing, though we’re heartened by the improvement in temporary hiring (a leading sector, with 81,000 jobs gained)," he says. "Overall, we continue to think that U.S. economic growth will surprise to the upside and have been heartened by a number of recent economic and corporate earnings indicators."

Also Friday, President Joe Biden sought to assure Americans waiting for financial relief, saying, "I'm not cutting the size of the checks. They're going to be $1,400 – period." That was enough to lift most of the major indices to new highs for the second consecutive day.

The S&P 500 (+0.4% to 3,886), Nasdaq Composite (+0.6% to 13,856) and Russell 2000 (+1.4% to 2,233) all closed with new records Friday, while the Dow Jones Industrial Average (+0.3% to 31,148) is just 40 points, or a 0.1% gain, from its all-time high of 31,188 set on Jan. 20.

Other action in the stock market today:

- U.S. crude oil futures climbed yet again, up 1.0% to settle at $56.78 per barrel.

- Gold futures rebounded by 1.2% to close out Friday at $1,813.00 per ounce.

- Bitcoin prices, at $37,528 on Thursday, edged its way 0.6% higher to $37,754. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Safety First!

The more the market keeps scratching at new highs, the more market observers are preaching caution.

Stocks appear to be pricing in an awfully-great-case scenario – one that seems to ignore the risk of "the spread of stronger and more contagious COVID-19 mutations that are already seen in some countries," says James McDonald, CEO and chief investment officer of alternative investment manager Hercules Investments, adding that "the stock market is as stretched as ever."

And Zaccarelli chimes in on Biden's looming stimulus package: "Our concern would be in the short term, the stimulus bill is a buy the rumor, sell the fact type of situation and the stock market will actually head lower because the good news was already priced in."

That doesn't mean you should flee for the exits, but some investors might consider battening down the hatches. For instance, some coronavirus stocks are enjoying renewed interest of late and could climb in value if new COVID variants complicate America's fight against the coronavirus. So too could a number of other tech stocks.

Also worth considering are good old-fashioned defensive plays. We've recently analyzed 11 defensive stocks, mostly scattered across telecom, healthcare and consumer staples, that boast a number of qualities that investors will want in their corner should a market correction be just around the corner. Check them out!

Kyle Woodley was long Bitcoin as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.

-

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have TodayBank of America stock has been a massive buy-and-hold bust.