Stock Market Today: Jobs Data Give Investors Cause for Pause

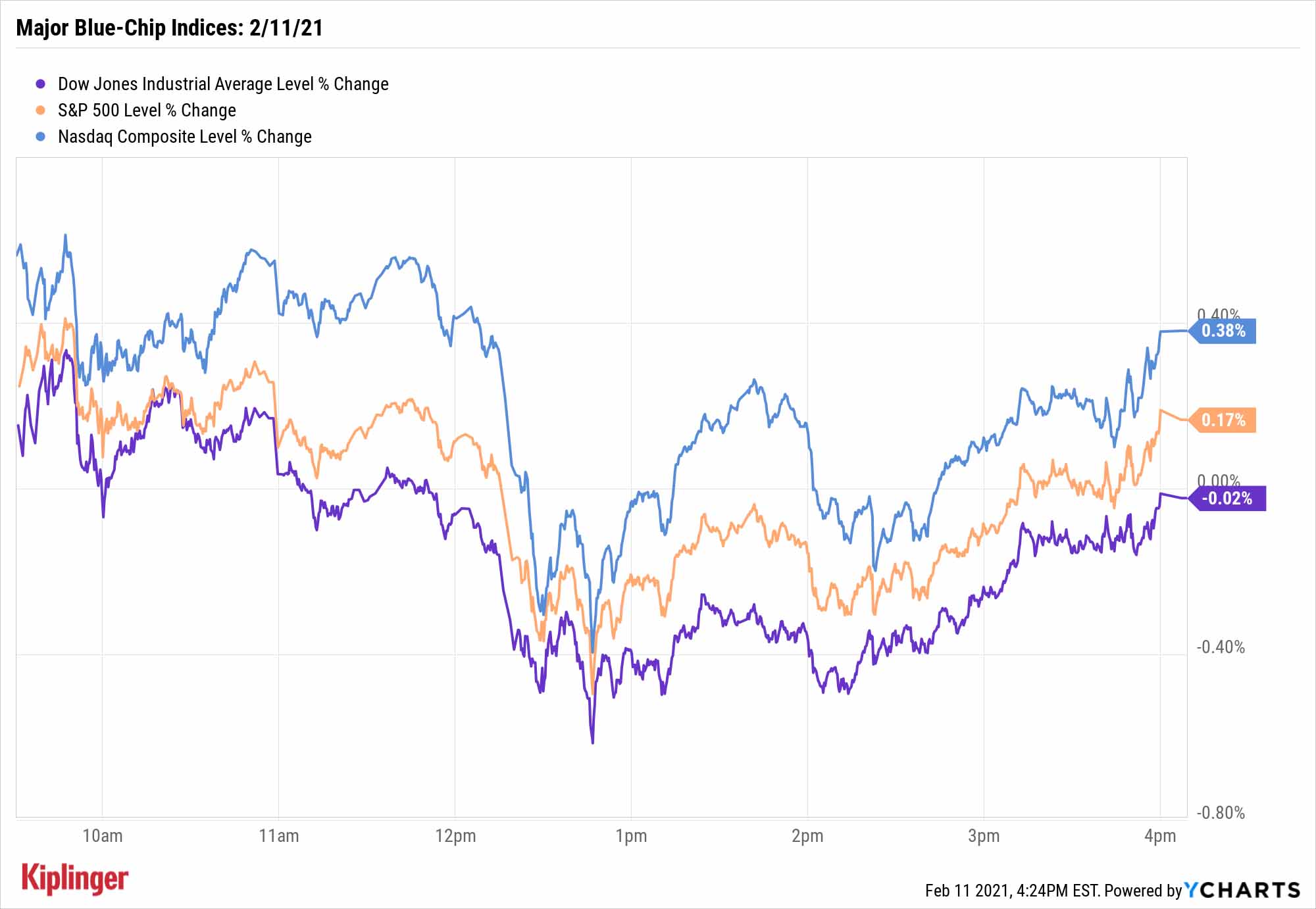

Higher-than-expected initial unemployment claims left the major indices with middling results Thursday; chip stocks and marijuana plays had much more clear direction.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

A day after Federal Reserve Chair Jerome Powell painted a less-than-rosy picture of the U.S. employment situation, economic data provided some support for that idea.

The Labor Department on Thursday reported 793,000 initial unemployment-benefits claims for the week ended Feb. 6. That was better than the prior week's revised 812,000 filings, but more than the 760,000 expected by economists surveyed by Bloomberg.

Stocks broadly searched for direction for another day, though a couple pockets of the market had a very clear bent. Semiconductor stocks including Nvidia (NVDA, +3.3%) and Intel (INTC, +3.1%) shot higher on increasingly higher chip demand. Marijuana stocks, which had recently sprinted to downright giddy valuations, lost quite a bit of froth – Tilray (TLRY, -49.7%) and merger partner Aphria (APHA, -35.8%) were among the biggest decliners.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

All of the major indices were in the red at some point Thursday, though several managed to reclaim positive territory. The Dow Jones Industrial Average declined marginally to 31,430, but the S&P 500 (+0.2% to 3,916) and Nasdaq Composite (+0.4% to 14,025) recovered and climbed just enough to set new all-time highs.

Other action in the stock market today:

- The small-cap Russell 2000 gained 0.1% to 2,285.

- U.S. crude oil futures finally ran out of gas, declining 0.8% to $58.24 per barrel, ending its win streak at eight consecutive sessions.

- Gold futures settled 0.9% lower to $1,826.80 per ounce.

- Bitcoin prices, at $44,775 on Wednesday, rebounded 8.0% to $48,379 on Thursday. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

It's Not Too Late for Economic Recovery Plays

For the past few months, you've heard about several "reflation trade" sectors (think bank stocks or oil plays) expected to bounce back as the economy does. While share prices in these sectors have been rising, as has the overall market, they still have ample fuel in the tank.

So says Canaccord Genuity equity strategist Tony Dwyer, who adds that we've seen similar market action before.

"We adopted the economic recovery theme last summer and suggested it was likely to be a multi-year thesis," he says. "There has been nothing to alter our view despite the lackluster relative performance since last November. … The macro backdrop and market action coming off the March 2020 low continues to track the gains coming out of the Great Financial Crisis, which means corrections may be coming followed by even more gains."

Those considering trying to make the most of this multiyear thesis can certainly do so via sector funds. However, those looking to generate a bit more alpha with more focused picks, should take note of who the pros like across (at a minimum) the rest of 2021. That includes financials and energy, as well as two areas that have some more catching up to do: materials and industrials.

Kyle Woodley was long NVDA and Bitcoin as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

Dow Soars 588 Points as Trump Retreats: Stock Market Today

Dow Soars 588 Points as Trump Retreats: Stock Market TodayAnother up and down day ends on high notes for investors, traders, speculators and Greenland.