Stock Market Today: Stocks Tread Water, Bitcoin Joins the Trillion-Dollar Club

The Dow finished flat as a pancake as the stock market continues to stall against all-time highs, but Bitcoin continued building a head of steam.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

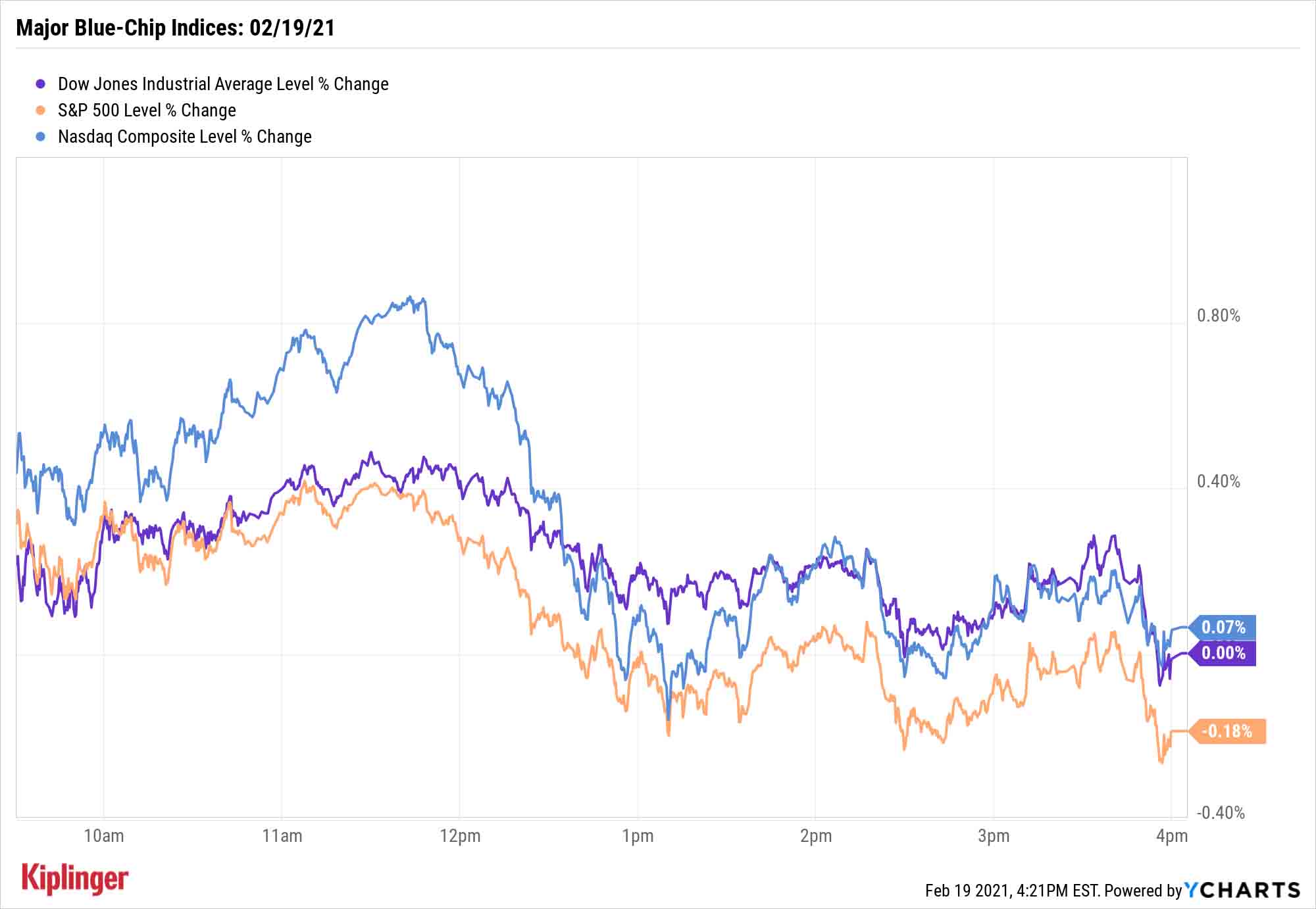

We've discussed this week the idea that the stock market might be running out of gas, and that certainly appeared to be the case Friday, as stocks finished mixed after giving up most of their morning gains.

That wasn't a problem for the digital currency Bitcoin, however.

Traders found several positive economic indicators to consider. U.S. businesses are expanding at their strongest rate in six years, according to IHS Markit's flash reading of the purchasing managers index, which rose to 58.8 in February from 58.7 in the month prior. And Deere (DE, +9.6%) provided some optimism after raising its 2021 profit forecast amid expectations for better equipment sales.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

However, a pop at the market open lost steam as the day progressed, fitting right in with a week that saw equities struggle up against all-time highs. The Dow Jones Industrial Average, up 154 points at its zenith, finished less than 1 point higher instead, closing at 31,494.

One potential problem remains just how optimistically priced stocks are already.

"Most of our indicators suggest stocks are pricing in a lot of good news," says Savita Subramanian, equity and quant strategist for BofA Securities. "In fact, over $3T in stimulus may already be priced in on one measure: the ratio of S&P 500 market cap to the M2 money supply. The ratio currently stands at 1.7x, the highest level since Feb 2020, and to get to the post-crisis average of 1.4x, we estimate additional $3.1T of M2 would be needed."

Other action in the stock market today:

- The S&P 500 declined 0.2% to 3,906.

- The Nasdaq Composite finished with a marginal gain to 13,874.

- The small-cap Russell 2000 rebounded after a dreary Thursday, rising 2.2% to 2,266.

- U.S. crude oil futures declined 0.8% to settle at $60.05 per barrel.

- Gold futures gained 0.1% to $1,777.40 per ounce.

Bitcoin: The Trillion-Dollar Cryptocurrency

If the stock market has lost its momentum this week, Bitcoin has surely found it. The digital currency, which has exploded by more than 1,300% since its 2020 bear-market lows, continues to grab Wall Street's attention as it reaches new milestones.

On Friday, Bitcoin prices eclipsed the $55,000 mark and finished regular trading hours at $55,397. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.) That marks a 6.3% daily climb, and an 18.8% jump higher since Monday morning.

Assets invested in Bitcoin have now surpassed $1 trillion; for perspective, if Bitcoin were a publicly traded company, it would now be worth more than Tesla (TSLA, $749 billion) or Facebook (FB, $745 billion).

Fueling that gain is one of the drivers we cited in our 2021 outlook for Bitcoin: institutional investors, who are quickly pouring huge sums of money into Bitcoin and other digital currencies.

Should you join them?

Bitcoin remains a high-risk investment, and also a difficult-to-access one if you only have a traditional brokerage account – you can't buy the digital currency without accessing a cryptocurrency exchange. But you can purchase crypto-connected companies such as these eight stocks. And you can also access crypto via a small but growing number of funds, similar to how you'd buy SPDR Gold Shares (GLD) to gain exposure to gold.

Read on as we introduce you to the newest option for crypto investors – a Bitcoin fund that charges less than half the fees of the current market leader – and explain its perks, as well as potential future threats.

Kyle Woodley was long Bitcoin as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

Nasdaq Adds 211 Points as Greenland Tensions Ease: Stock Market Today

Nasdaq Adds 211 Points as Greenland Tensions Ease: Stock Market TodayWall Street continues to cheer easing geopolitical tensions and President Trump's assurances that there will be no new tariffs on Europe.