Stock Market Today: Tech Throttled as Treasury Yields Continue Climb

Nosebleed valuations in the technology sector cooled off Monday amid a brutal day for Nasdaq longs. The Dow, meanwhile, clawed out modest gains.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

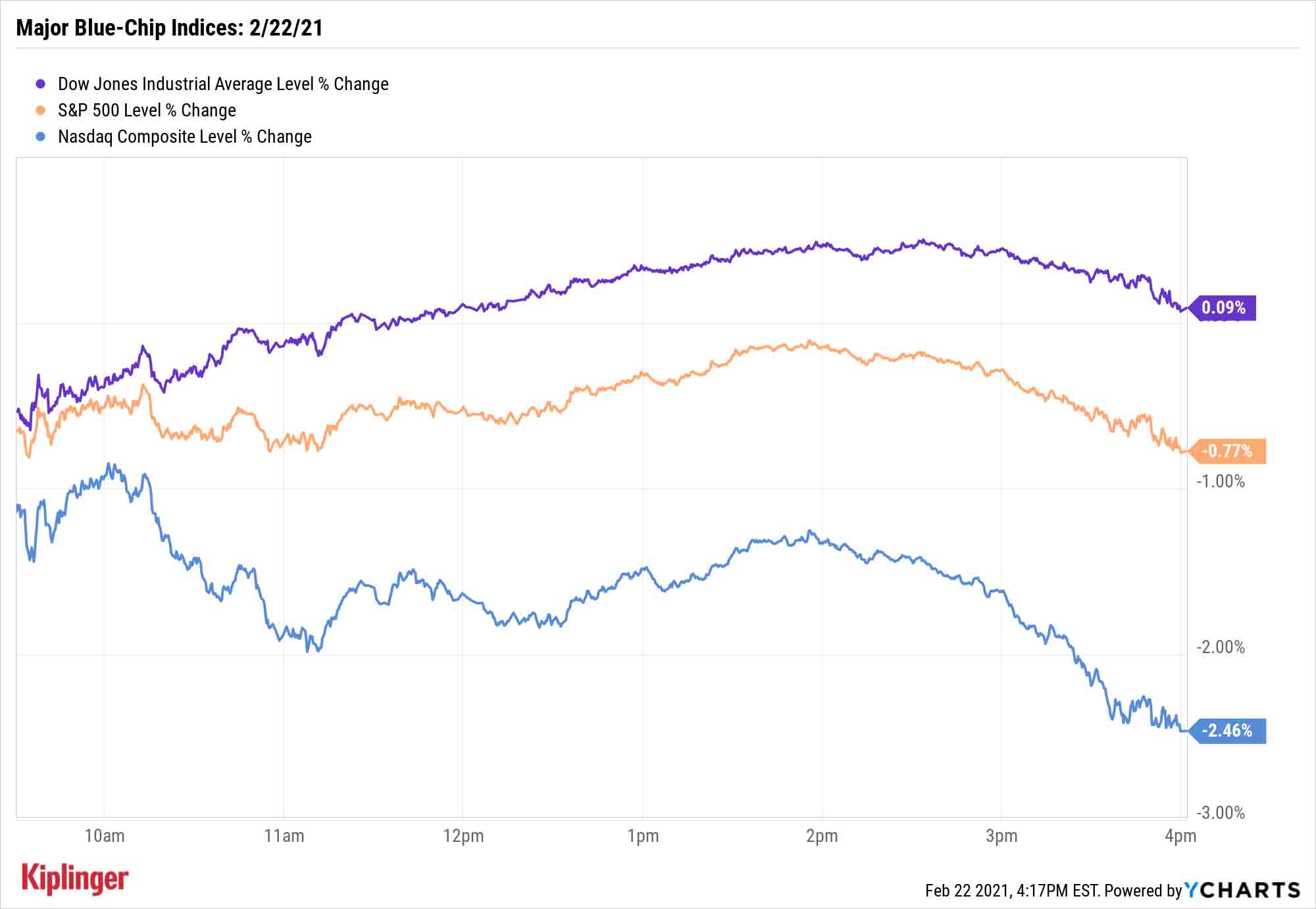

How'd the stock market do today? The answer's a little complicated, and heavily depends on which major blue-chip index you hitch your wagon to.

The S&P 500 closed with a 0.8% loss to 3,876, while the tech-heavy Nasdaq Composite slumped for a fifth consecutive day, by 2.5% to 13,533 … but the Dow Jones Industrial Average managed to claw out a 0.1% gain, to 31,521.

It's a continuation of a trend that has emerged over the past couple of weeks amid a sharp rise in interest rates; higher rates on bonds can weigh on the appeal of stocks broadly, but specifically on the growthy but extremely expensive tech sector, where costlier borrowing will trim margins. Apple (AAPL) declined 3.0%. Tesla (TSLA) plunged 8.6%.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

On the flip side, financial stocks continued to jump, as higher rates help banks and insurers pad their bottom line. Monday's best performances came from the energy sector, however, as Texas's recent weather woes are expected to hinder oil and gas supplies for weeks. U.S. crude oil futures jumped 3.8% to $61.49 per barrel, lifting stocks such as Exxon Mobil (XOM, +3.7%) and Chevron (CVX, +2.7%).

Other action in the stock market today:

- The small-cap Russell 2000 finished 0.7% lower, to 2,251.

- Gold futures rallied 1.7% to finish the day at $1,808.40 per ounce.

- Bitcoin prices swung quite a bit. After finishing at $55,371 on Friday afternoon, they briefly eclipsed $58,000 this weekend before peeling back. Prices then dipped to as low as $50,623 in Monday trading before finishing at $54,009. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

More New Stocks Are on the Way

While investors may have lost some appetite for expensive tech stocks, they're clearly still hungry for the novel and new. 2021 has seen voracious demand for initial public offerings (IPOs), including Bumble (BMBL), Affirm (AFRM) and Petco (WOOF) – and more are on the way.

In the past few days, several high-profile companies have thrown their hats into the ring by filing S-1s with the SEC, including Coupang (South Korea's second-largest online retailer) and crafts retailer Jo-Ann Stores.

If you're curious about these and other potential offerings on the 2021 horizon, check out our frequently updated list of the year's hottest upcoming IPOs. Several of the companies on our original watch list have already gone public; currently, we're looking at a dozen companies that should pull off IPOs by year's end. We break down each company: what they do, when they're expected to offer up shares, and how much each company will be valued at.

Kyle Woodley was long Bitcoin as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

The Bear Market Protocol: 3 Strategies to Consider in a Down Market

The Bear Market Protocol: 3 Strategies to Consider in a Down MarketThe Bear Market Protocol: 3 Strategies for a Down Market From buying the dip to strategic Roth conversions, there are several ways to use a bear market to your advantage — once you get over the fear factor.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.