Stock Market Today: Selloff? What Selloff? Morning Plunge Quickly Evaporates

The Nasdaq spewed red ink to kick off Tuesday morning but recovered most of its ground, with Fed comments helping to soothe investor concerns.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

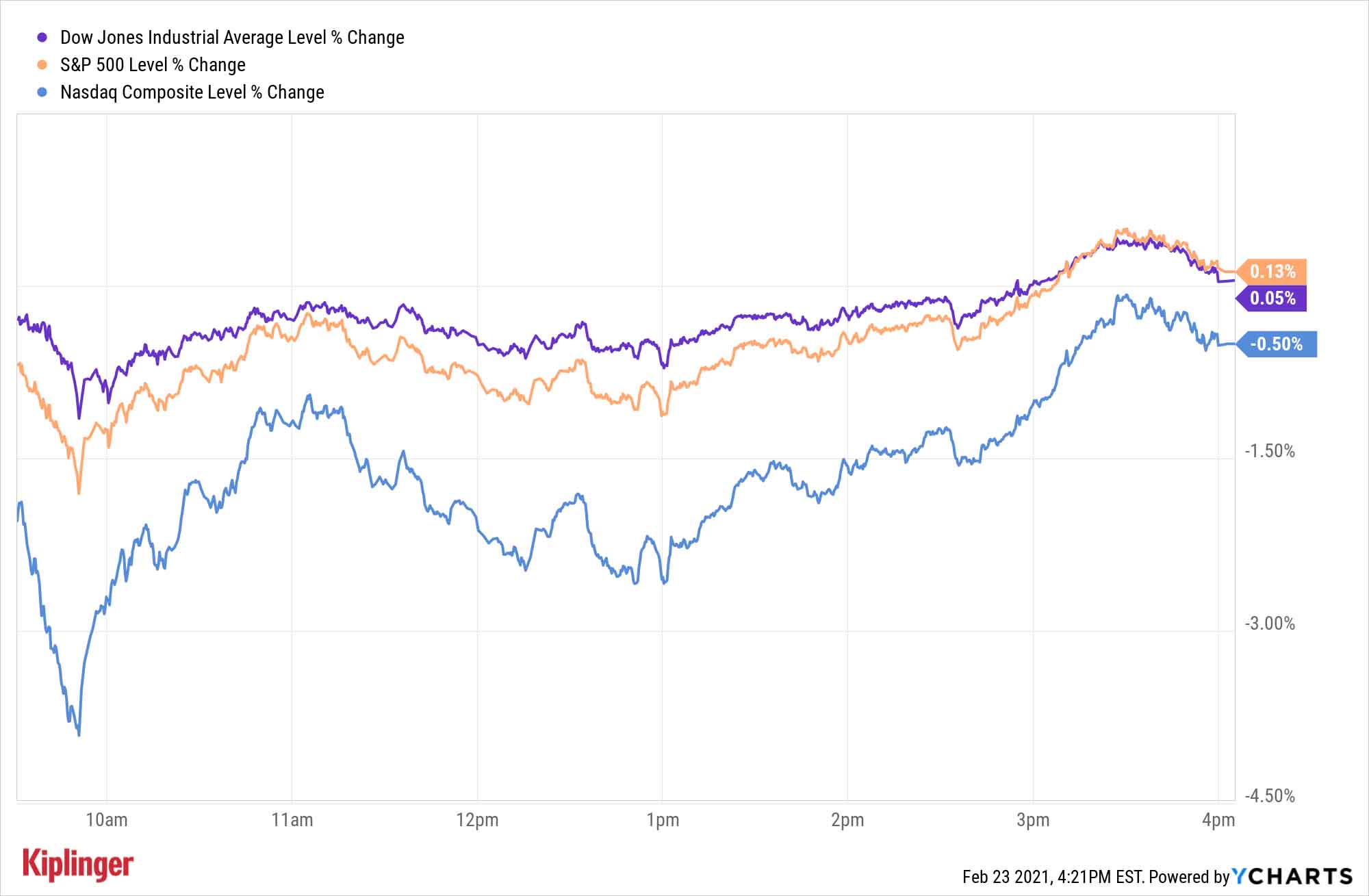

Well, that was a turn of events.

At Tuesday's open, Wall Street appeared determined to continue the recent bloodletting in technology stocks. The culprit, again, was inflation fears.

"(There's a) sudden realization that huge amounts of fiscal and monetary stimulus could lead to rising inflation and interest rates," says Scott Knapp, Chief Market Strategist at CUNA Mutual Group. "The longer-duration technology names that led the market higher in the aftermath of the pandemic are leading it lower today as expectations about the economy change very quickly."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

However, after opening sharply lower and dropping further in the market's opening minutes, the tech-heavy Nasdaq Composite pivoted hard to the upside. Stocks were in part encouraged by Federal Reserve Chairman Jerome Powell's commentary about inflationary worries, saying "the economy is a long way from our employment and inflation goals, and it is likely to take some time for substantial further progress to be achieved."

The Nasdaq, which was off by as much as 3.9% at its worst, closed with a mere flesh wound, dropping 0.5% to 13,465. That was reflected in the action of many of its largest components, including Tesla (TSLA, -2.2%) which was off by as much as 13.3%, and Apple (AAPL, -0.1%), which had sunk by as much as 6.0%.

Other action in the stock market today:

- The Dow rebounded from a 1.1% decline to a marginal gain, closing at 31,537.35.

- The S&P 500 similarly recovered, gaining 0.1% to 3,881.

- The small-cap Russell 2000 slumped again, shedding 0.9% of its value to finish Tuesday at 2,231.

- U.S. crude oil futures were off marginally to $61.67 per barrel.

- Gold futures also settled lower, off 0.1% to $1,805.90 per ounce.

- Bitcoin prices took it on the chin, swinging from $54,009 on Monday to $47,696 – an 11.7% decline. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Take a Breath, Just Don't Let Down Your Guard

Crisis averted? Er … not necessarily. Knapp believes "this correction will likely continue due to exceedingly high valuations in previously favored names that preceded today's selloff."

He's not alone. Dan Wantrobski, technical strategist and associate director of research at Janney Montgomery Scott, notes that updated chart studies "indicate that the tech-laden Nasdaq-100 may continue to underperform ... on a short- to-intermediate-term basis; possibly even leading the charge in a bigger market correction this year than we have thus far experienced."

And Tony Dwyer, Canaccord Genuity analyst, says "It wouldn't take much of a rotation out of the (stay-at-home) theme to cause the S&P 500 to correct as the economic recovery theme outperforms" – meaning more pain for tech, but upside for favored sectors including industrials, energy, materials and financials.

Indeed, the likes of Visa (V, +1.8%) and Chevron (CVX, +1.3%) helped the Dow recover from a 1.1% decline to a marginal gain, closing at 31,537.35. And the industrial average, which isn't as heavily weighted in tech as its blue-chip index brethren, could continue to overachieve in this environment.

Just remember: All Dow stocks aren't created equally.

We've just taken a fresh look at the analyst community's consensus on the 30 Dow components, and they're definitely playing favorites at the moment. Read on as we look at each of these blue chip stocks, and explain what makes the pros lukewarm – or red hot – on each.

Kyle Woodley was long Bitcoin as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.