Stock Market Today: Dow Jones Cruises to Record Altitude

The Dow set a fresh high in a calm but optimistic session, buoyed by dovish commentary by Fed Chair Jerome Powell.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

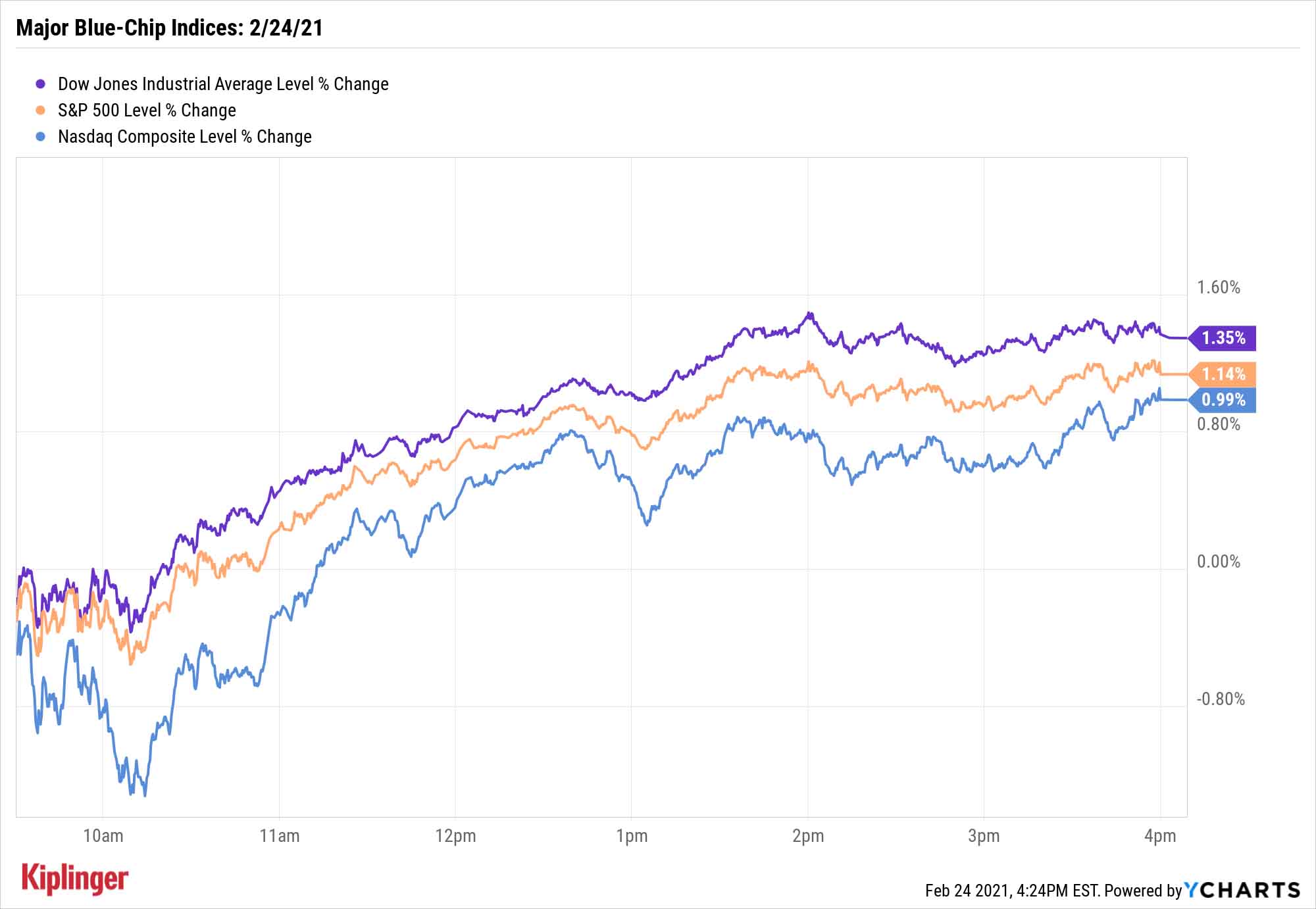

The Dow Jones Industrial Average surged into record territory Wednesday, as more dovish language from the Federal Reserve and good news on the COVID front drove an unambiguously positive tone on Wall Street.

In testimony before Congress, Fed Chair Jerome Powell said the central bank's focus remained on economic recovery, and isn't in a rush to let interest rates rise.

"Any of the market's (we think unjustified) fear of a taper tantrum are not within eyesight," says Rick Rieder, BlackRock's chief investment officer of Global Fixed Income, "as today's communication was clear that it is not time to communicate any change."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Also on Wednesday, the Food and Drug Administration said that Johnson & Johnson's (JNJ, +1.3%) COVID-19 vaccine was both safe and effective. So-called "recovery" plays screamed ahead: Royal Caribbean (RCL, +7.3%) hit one-year highs, while energy stocks such as Chevron (CVX, +3.7%) and Exxon Mobil (XOM, +3.0%) continued to rally.

The Dow, up 1.4% to a new high of 31,961, was led by Boeing (BA, +8.1%), which rebounded amid reports that recent issues with its 777 models involved Pratt & Whitney engines, not Boeing engineering. The aircraft maker also forecast strong Latin American demand.

Other action in the stock market today:

- The S&P 500 improved by 1.1% to 3,925, putting it within mere points of its all-time highs.

- The Nasdaq Composite closed 1.0% higher to 13,597.

- The small-cap Russell 2000 rebounded violently, jumping 2.4% to 2,284.

- GameStop (GME, +103.9%) shares were briefly halted after more than doubling by late afternoon in a quick surge on seemingly no news.

- Tesla (TSLA, +6.2%) shares rebounded from yesterday’s selloff, in part on data showing Ark Invest CEO and portfolio manager Cathie Wood’s funds bought more shares on the dip.

- U.S. crude oil futures rocketed 2.6% higher to $63.26 per barrel, a 13-week high.

- Gold futures dipped 0.4% to $1,797.90 per ounce.

- Bitcoin prices, at $47,140 on Tuesday, finished 3.3% higher to $48,712. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Sit Back and Relax With the Pros

For many stock investors, Wednesday was a "mental health" day of sorts – no massive swings, just a nice, gentle updraft throughout the day.

It's the kind of calm more routinely enjoyed by investors who primarily "set it and forget it" with a portfolio of diversified funds.

That feeling is all the more enhanced when you're relying on skilled, seasoned managers to make the tough decisions – a trait shared by a pair of T. Rowe Price mutual funds (one equity, one bond) that have earned independent research firm CFRA's top five-star ratings. (Note: If you're a 401(k) investor, it's possible that your plan doesn't offer these options; that's OK, we've got your back with these widely available T. Rowe products.)

But whether it's T. Rowe Price, Vanguard, or even smaller, more specialized shops, adept active management can help you invest confidently and with a cooler head, regardless of the market's ups and downs. If you're curious about the best such funds the market has to offer, check out our latest iteration of the Kiplinger 25 – a list of our favorite low-cost, actively managed mutual funds.

Kyle Woodley was long BA and Bitcoin as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

The Cost of Leaving Your Money in a Low-Rate Account

The Cost of Leaving Your Money in a Low-Rate AccountWhy parking your cash in low-yield accounts could be costing you, and smarter alternatives that preserve liquidity while boosting returns.

-

I want to sell our beach house to retire now, but my wife wants to keep it.

I want to sell our beach house to retire now, but my wife wants to keep it.I want to sell the $610K vacation home and retire now, but my wife envisions a beach retirement in 8 years. We asked financial advisers to weigh in.

-

How to Add a Pet Trust to Your Estate Plan

How to Add a Pet Trust to Your Estate PlanAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.