Stock Market Today: Stocks Jump to Life on Manufacturing Data, J&J Vaccine

The bulls were out in force Monday amid a big lift in U.S. manufacturing activity and another COVID vaccine approval.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

A confluence of positive drivers jolted the bulls awake Monday, triggering an across-the-board rally to kick off March.

The Institute for Supply Management's manufacturing index rose 2.1 points to a two-year high of 60.8, with any number above 50 implying expansion in activity. That was much better than the consensus expectation of 58.9.

"These readings suggest that factories are still struggling to catch up with strong goods demand – from final sales and restocking – in the face of intensified supply constraints," says Jonathan Millar, deputy chief U.S. economist at Barclays Investment Bank.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Over the weekend, the Food and Drug Administration approved Johnson & Johnson's (JNJ, +0.5%) single-dose COVID-19 vaccine for emergency use, with distribution expected to begin soon. Also over the weekend, the House narrowly passed President Joe Biden's $1.9 trillion stimulus package.

Declining rates on most U.S. government bonds Monday also tamped down fears that held back equities last week.

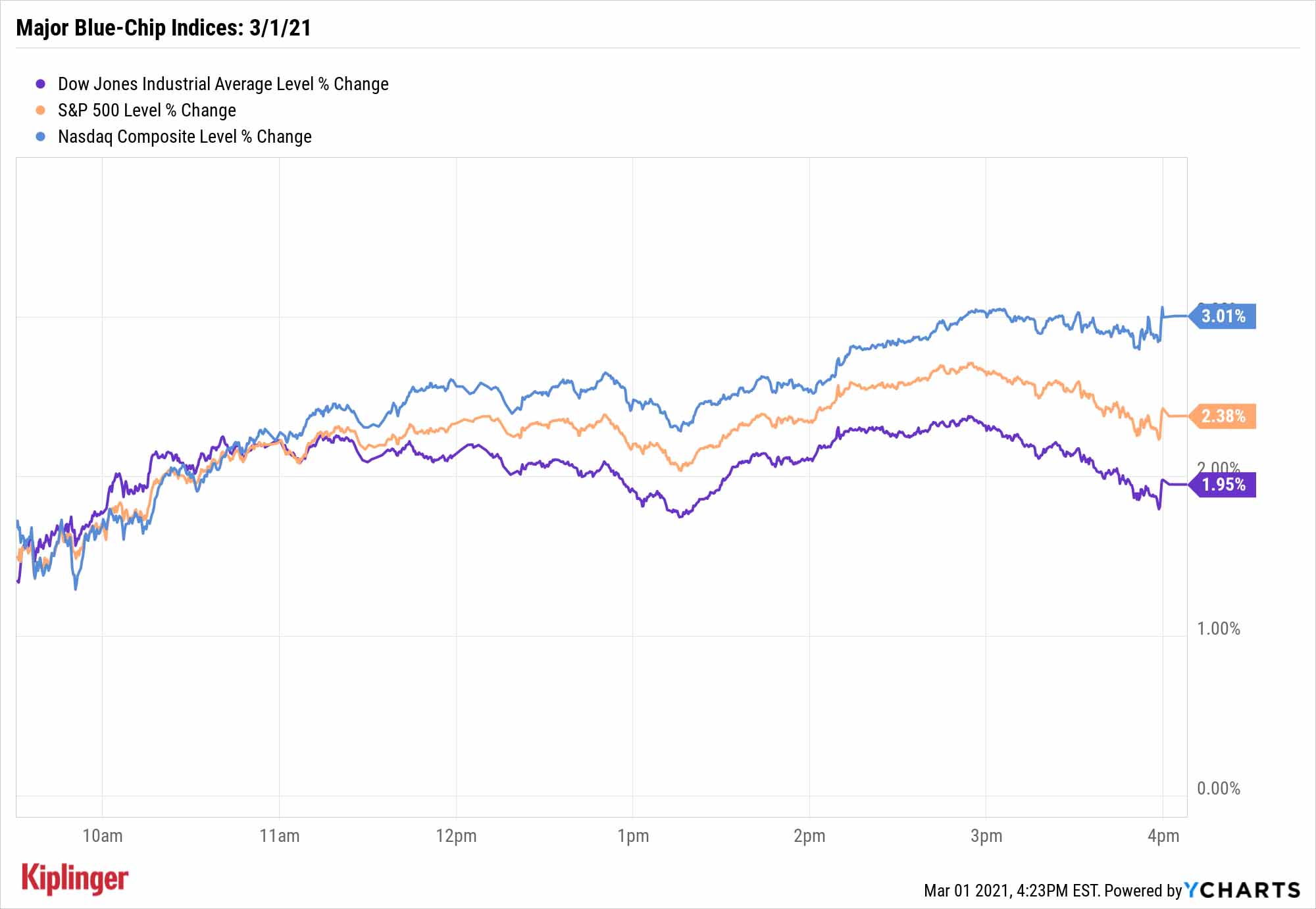

Every sector finished in the green, with financial stocks and technology shares leading the way. The Nasdaq Composite was tops among the blue-chip averages, gaining 3.0% to 13,588; strong performance from Tesla (TSLA, +6.4%) and Apple (AAPL, +5.4%) helped push the tech-heavy index higher.

Other action in the stock market today:

- The Dow Jones Industrial Average improved by 2% to 31,535.

- The S&P 500 climbed 2.4% to 3,901.

- The small-cap Russell 2000 shot 3.4% higher to 2,275.

- U.S. crude oil futures declined 1.5% to settle at $60.57 per barrel.

- Gold futures slipped 0.3% to $1,723 per ounce.

- Bitcoin prices, at $46,381 on Friday, slumped to the $44,500 level during the weekend but finished Monday at $48,266, a 4.1% improvement. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

The Stage Is Set for Dividends

Could dividend stocks be set up for a long stint of outperformance? It's an idea posited by a team of BlackRock strategists and portfolio managers.

In a "BlackRock Multi-Asset Income Insight," the team points out that high-dividend stocks lagged the S&P 500 by 30% last year; while admitting that history won't necessarily repeat itself, they write that "the last time we saw this big of a performance differential was in 1999. Thereafter, dividend stocks outperformed equities for the next seven years."

In addition to that history lesson, BlackRock's team points out many stocks are offering higher yields than their corporate bonds, while also reminding investors that yields on dividends can rise; bond coupons are fixed.

It's difficult to have a conversation about dividends (and certainly dividend growth) without mentioning the Dividend Aristocrats, 65 stocks that have proven their financial mettle by increasing their payouts without interruption for a minimum of 25 years. But the true royalty within this group are the Dividend Kings, which have upped the ante each year like clockwork for at least half a century.

It's a shorter list, to be sure, but one that includes some of the most durable dividends on Wall Street – in several cases, these payouts have grown steadily for a century or longer.

Read on as we look at our updated list of these seemingly unstoppable dividend payers.

Kyle Woodley was long Bitcoin as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.