Stock Market Today: With Powell On Deck, Investors Hold Their Breath

The Dow's seven-day win streak ended Tuesday and stocks broadly struggled as investors looked ahead to Wednesday's FOMC announcements.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The Federal Reserve kicked off its two-day Federal Open Market Committee meeting Tuesday, and the stock market took a breather ahead of tomorrow’s commentary from Chair Jerome Powell.

"The FOMC meeting on the 17th will be one of the most critical events for the Fed in some time," BofA Global Research analysts say. "Fed Chair Powell will have to strike the right balance between a more upbeat assessment of the outlook and the asymmetric (flexible average inflation targeting) reaction function."

"Wednesday's FOMC meeting will undoubtedly be the main focus this week given ongoing volatility in Treasury yields," adds Deutsche Bank senior economist Brett Ryan. "(A) more robust outlook should be reflected in the Committee's updated projections with a substantial upward revision to expected growth, lower unemployment forecasts, and a modestly higher inflation trajectory."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

How important is the Fed meeting? BofA Global Research’s March survey of global fund managers showed that for the first time since February 2020, the biggest perceived tail risk to stocks isn’t COVID-19 – inflation and "taper tantrums" have taken its place.

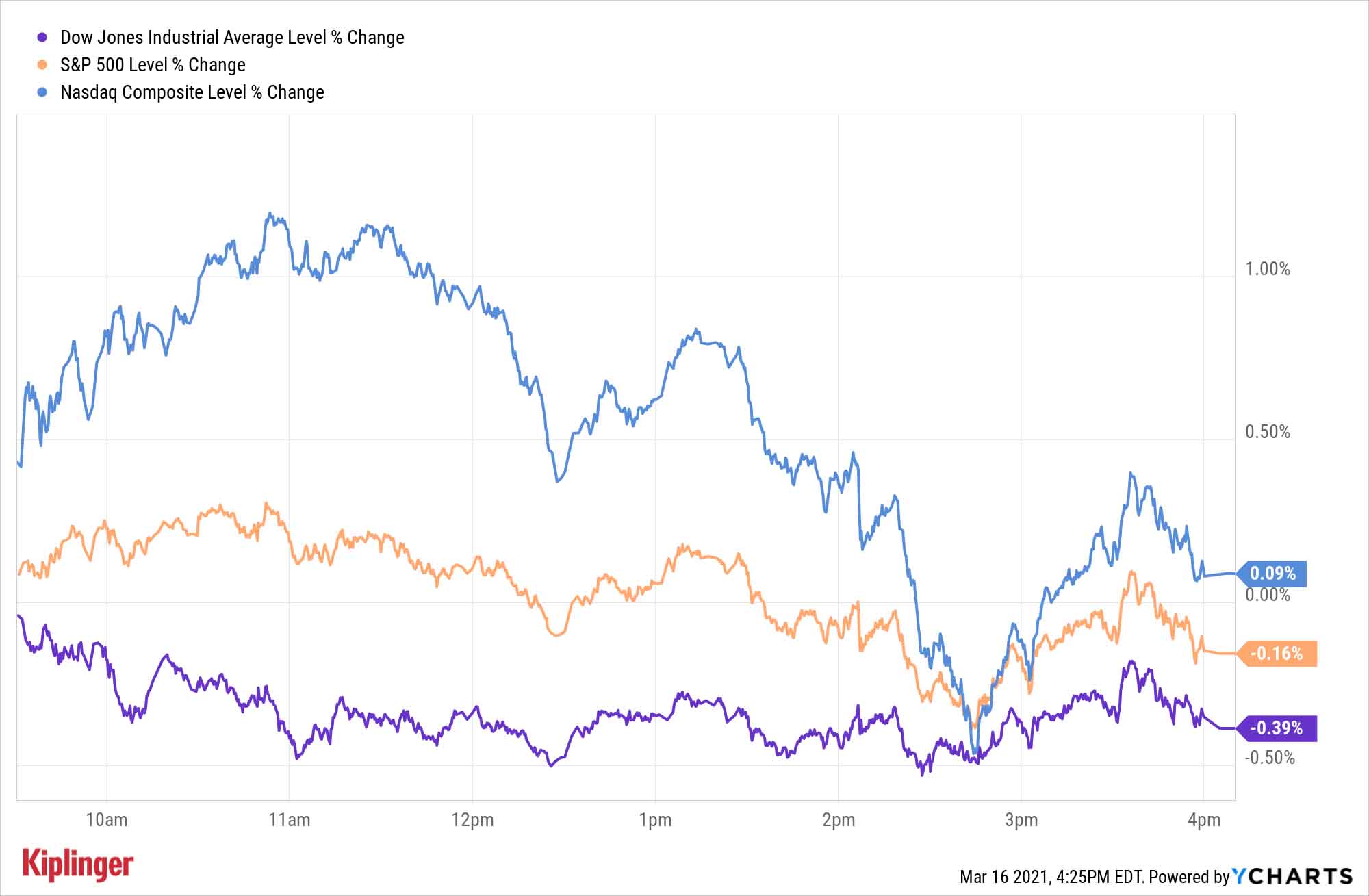

With little else for investors to focus on, stocks broadly lost their momentum for a day. The Dow Jones Industrial Average's seven-session win streak was snapped, though the decline was a modest 0.4% to 32,825. It was led lower by Boeing (BA, -4.0%) and American Express (AXP, -2.6%), among others.

The Nasdaq Composite finished with a small 0.1% gain to 13,471, but that was well off its intraday high of 13,620. Among notable gainers there were Starbucks (SBUX, +2.2%), Applied Materials (AMAT, +3.2%) and Facebook (FB, +2.0%).

Other action in the stock market today:

- The S&P 500 closed 0.2% lower to 3,962.

- The Russell 2000 slumped 1.7% to 2,319.

- U.S. crude oil futures dropped again, this time by 0.9%, to settle at $64.80 per barrel.

- Gold futures managed a small 0.1% improvement to $1,730.90 per ounce.

- Bitcoin prices struggled again, off 1.6% to $55,745. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Higher Rates? Probably. But High Rates? Probably Not.

You’re well aware of Wall Street’s general angst about rising interest rates, but exactly how high are they headed?

Kiplinger’s forecast is for the 10-year Treasury to rise to at least 2% by the end of the year. Deutsche Bank, as another example, sees rates going a little higher and getting there faster: "Our baseline macroeconomic outlook and the balance of risks are consistent with further increases in longer-term interest rates, with the UST 10y yield moving to 2.0 to 2.25% by this summer," say DB’s David-Folkerts-Landau and Peter Hooper.

Among many other things, that means investors’ options for significant yield will remain limited in the short-term. Bond rates still would be historically low, and the S&P 500 (at 1.5% presently) doesn’t offer up much help, either.

But income-minded investors can find much more generous yields if they just eat their "alphabet soup" – namely, acronymed special classes such as real estate investment trusts (REITs) and business development companies (BDCs), among others.

If you’d like to start your search with a few of each, consider this list of 10 high-yield income investments. This sampling includes at least one pick from each of the major high-yield categories, including a fund that wraps all of them up into one portfolio.

Kyle Woodley was long BA as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.