Stock Market Today: Inflation Fears Wreck Tech Again

A jump in the yield on the benchmark U.S. 10-year Treasury note heightened inflation fears, and high-flying stocks in the technology sector once again paid the price.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

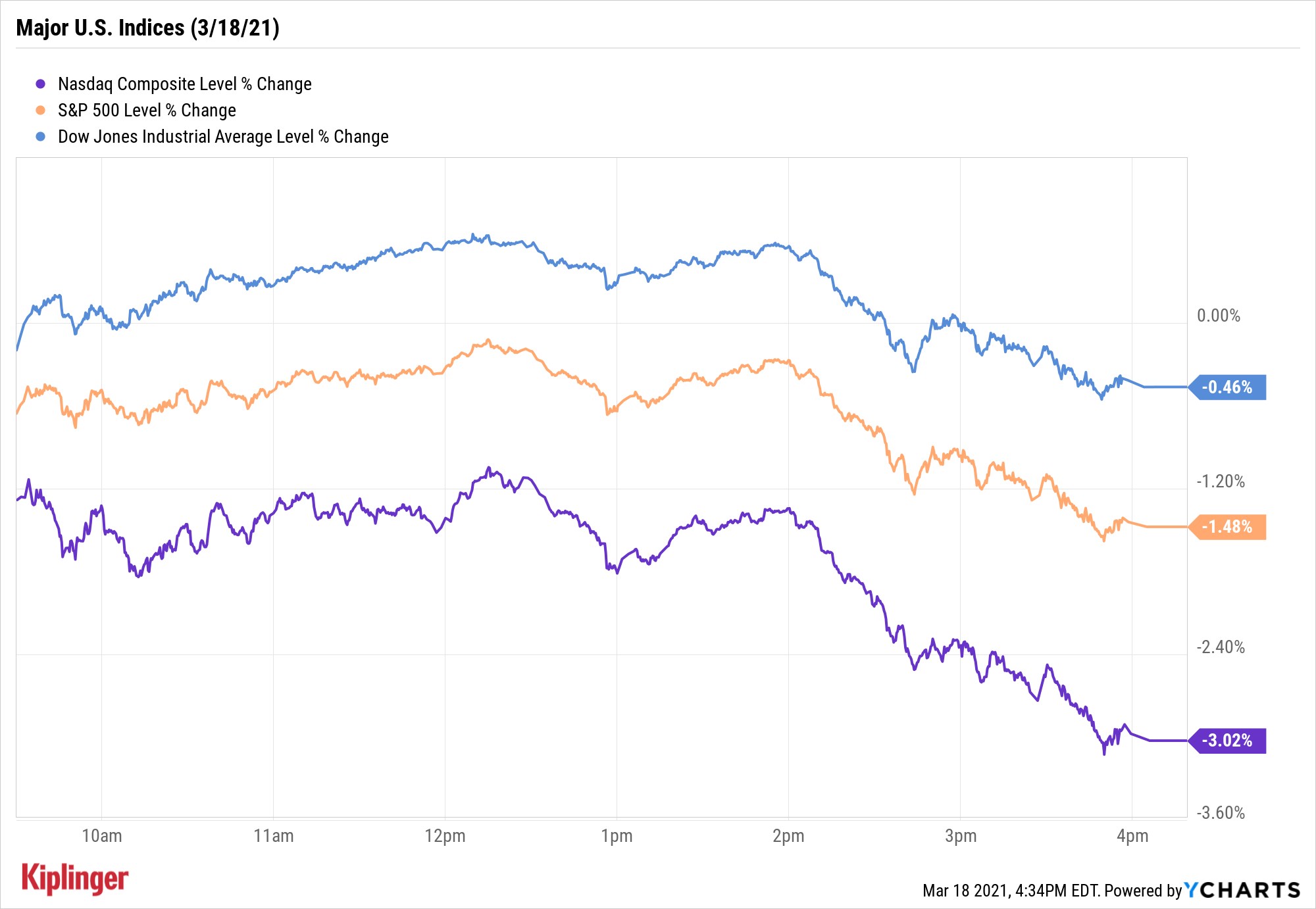

Rising bond yields put heavy pressure on technology stocks Thursday, a day after the Dow Jones Industrial Average surpassed 33,000 for the first time in history thanks to dovish comments from the chairman of the Federal Reserve.

The see-saw trade is emblematic of a market trying to balance optimism about robust future economic growth and fears that rapid expansion could spark a profit-sapping wave of inflation.

The proximate cause for Thursday's selloff was the yield on the benchmark Treasury note hitting a 14-month high. But the equity strategy team at Bank of America Global Research says the bond market's inflation fears are both predictable and overwrought.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"There is always some reason or the other since the start of this bull market to complain or worry about," the BofA analysts wrote in a note to clients. "That's why bull markets climb a wall of worry. The latest worry is rising bond yields and inflation. Interestingly, we have gone from all that skepticism about no V-shaped recovery straight to the opposite end -- inflation! All within a few months. Worriers are going to worry."

Priced-to-perfection big tech stocks once again bore the brunt of the selling, with Apple (AAPL, -3.4%) and Microsoft (MSFT, -2.7%) among the Dow's biggest laggards. Amazon.com (AMZN, -3.4%) and Google-parent Alphabet (GOOGL, -2.9%) likewise took their lumps.

The blue-chip Dow slipped 0.5% to finish at 32,862, while the broader S&P 500 fell 1.5% to 3,915. The tech-heavy Nasdaq Composite tumbled 3.0% to settle at 13,116.

In economic news, weekly jobless claims rose to 770,000 from 725,000 a week ago.

Other action in the stock market today:

- The small-cap benchmark Russell 2000 declined 2.9% to 2,267.

- U.S. crude oil futures declined for a fifth consecutive session, off 8.2% to $59.28 per barrel.

- Gold futures ticked up 0.4% to $1,734 an ounce.

- The U.S. Dollar Index rose 0.5% to 91.86.

Don't just do something; stand there

When the federal government is pumping almost $2 trillion into the economy, it's easy for investors to feel like they must act.

Rising borrowing costs, incipient margin pressure, higher inflation expectations or the perennial "fear of missing out" are just some of the anxieties gnawing on the market's increasingly brittle psyche these days.

Partly that's due to an overabundance of choices for how to profit in these pivotal times. For example, analysts have identified a load of stocks set to benefit from both an increase in revenue from stimulus spending and an influx of retail investors' stimulus checks. Stockpickers are also full of ideas for how to play the reflation trade, or names set to take off thanks to a healthy general rise in prices. And then there are all the ways in which to take advantage of changes in federal spending priorities, such as stocks primed to outperform on a massive infrastructure push.

When confronted with an almost exhausting number of choices, it's not a bad idea to remember first principles. Namely, a rising tide lifts all boats.

Rather than lose sleep trying to pick the winners from the losers, consider cheap, diversified investments that offer ample exposure to any upside, as well as a cushion against any downside. Take a deep breath, and consider senior investing editor Kyle Woodley's 21 ETF picks for 2021 -- there's an ETF play for every investing objective.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.