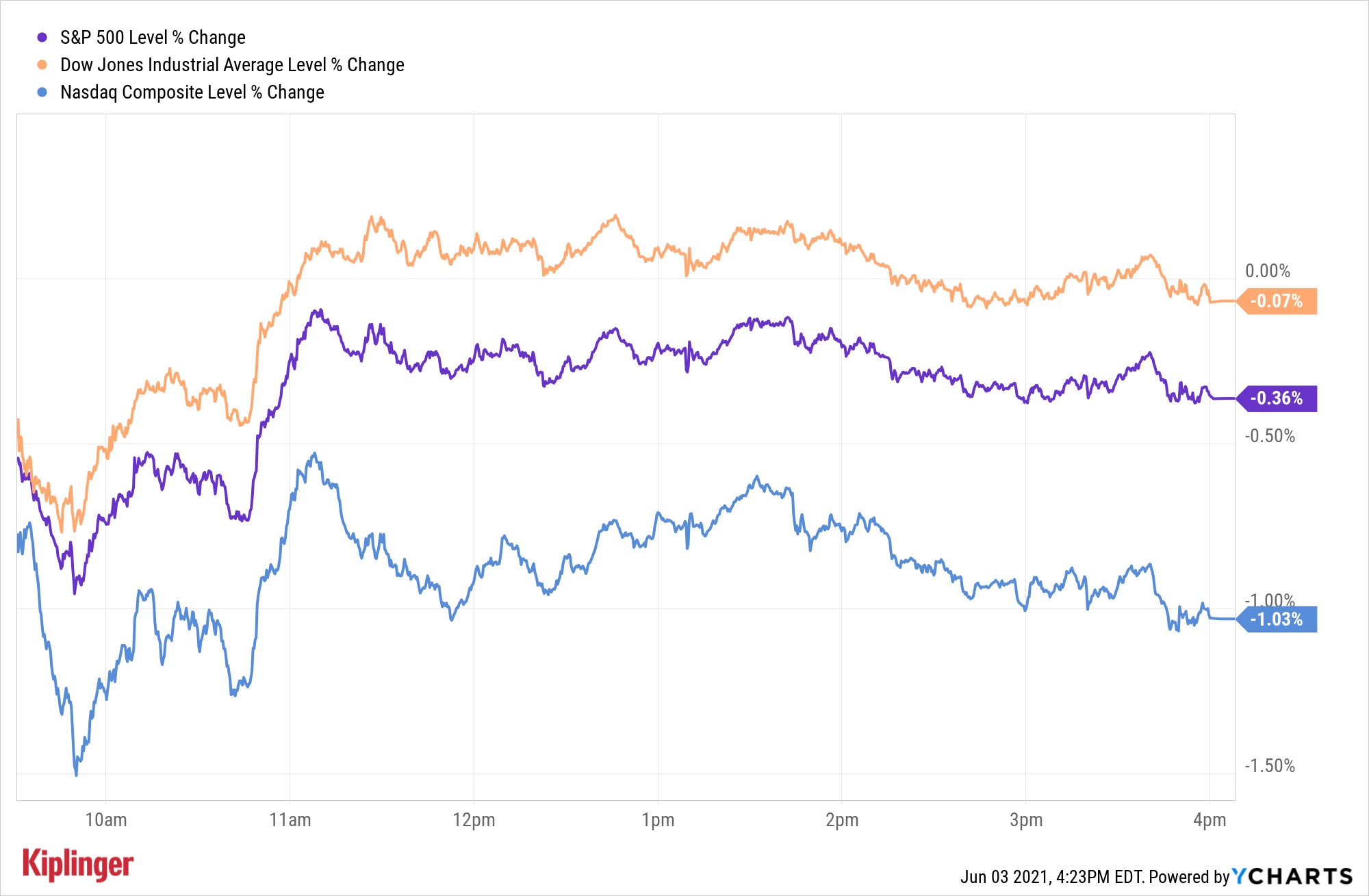

Stock Market Today: Stocks Close Mixed as Banks Sink, Tech Rebounds

The Dow and S&P 500 lost ground amid a slide in financial shares, while Facebook helped the Nasdaq come back from a steep loss in the previous session.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stocks finished the week in mixed fashion as the Dow Jones Industrial Average was weighed down by financial stocks, but the tech-heavy Nasdaq Composite rebounded following yesterday's heavy selloff.

Big banks turned lower after the Federal Reserve declined to extend a pandemic-era exemption that allowed them to hold less loss-absorbing capital on their books. Because banks use money to make money, the market typically boos any increase in capital requirements, which lowers banks' revenue potential. JPMorgan Chase (JPM, -2.3%) and Goldman Sachs (GS, -1.0%) were among the Dow's top laggards as a result.

Tech stocks, meanwhile, returned to their winning ways after a Thursday spike in bond yields stoked inflation fears that sent traders scrambling out of the highest-flying names. Facebook (FB, +4.1%) popped on news that it is working on a version of its Instagram site suitable for children under the age of 13.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"Treasury yields pulled back slightly overnight following yesterday’s scary-looking spike, and that helped the bounce in the tech sector even as global risk assets remained under pressure in the wake of yesterday's dip on Wall Street," wrote Ken Berman, founder and CEO of GorillaTrades. "The fact that the Fed didn't extend an emergency rule that allowed banks to keep less reserves caused some turmoil among financials in early trading, but volatility remained relatively low in the other sectors."

At Friday's closing bell, the blue-chip Dow lost 0.7% to close at 32,628, while the Nasdaq gained 0.8% to 13,215. The broader S&P 500 split the difference, dipping 0.1% to finish at 3,913.

Other action in the stock market today:

- Visa (V) plunged 6.2% on a report that the Justice Department is opening an antitrust probe.

- FedEx (FDX) jumped 6.1% after beating analysts' earnings estimates.

- The small-cap benchmark Russell 2000 added 0.9% to 2,287.

- Gold futures managed a 0.5% improvement to $1,741.90 per ounce.

There's something to be said for sticking to what's working.

Despite a couple of days of underwhelming performance, the Dow is outpacing the Nasdaq by a wide margin so far this year.

Partly that's because investors in priced-to-perfection tech stocks have been quick to sell after years of big gains. And partly that's because the Dow contains some of the largest and most liquid ways to play promising contemporary trends.

After all, if you're investing in stocks set to benefit from the return of travel, leisure and hospitality, you're surely checking out Dow stock Walt Disney (DIS). If you're looking for stocks that offer exposure to a wider reopening of the economy, you'll recognize longtime Dow component Coca-Cola (KO) as a smart play. And there's no way you can add bets on big-time infrastructure spending to your portfolio without including Dow stalwart Caterpillar (CAT).

Indeed, whether you're looking to bet on a rotation into more value-oriented names or the potential outperformance of the most cyclical stocks, the Dow's 30 stocks contain multitudes. To get an idea of what the blue-chip average can do for you, have a look at how analysts' rate all 30 Dow stocks at this point in the economic cycle.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.