Stock Market Today: Tech Takes Off as Bond Yields Taper Off

The Nasdaq's mega-caps take flight as Treasury yields pull back, and Tesla joins in amid another vote of confidence from Ark Invest's Cathie Wood.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

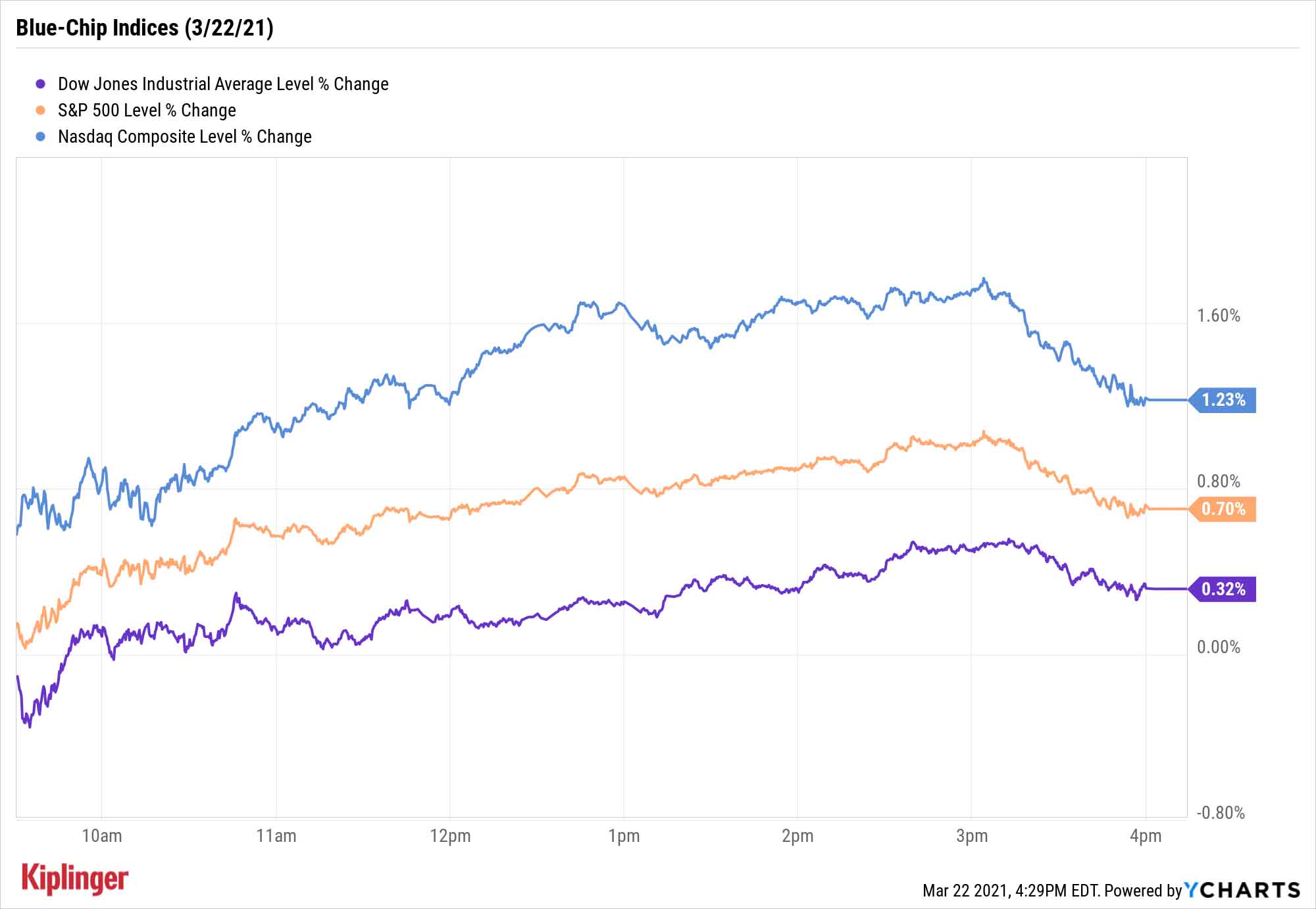

The Nasdaq Composite kicked off the trading week by taking its cue from the bond market yet again, with the tech-heavy index outpacing its peers Monday as Treasury yields stepped back.

A number of mega-cap tech stocks put up solid gains, including Apple (AAPL, +2.8%), Facebook (FB, +1.2%) and Nvidia (NVDA, +2.7%), powering a 1.2% gain in the Nasdaq to 13,377.

Electric vehicle maker Tesla (TSLA, +2.3%) headed higher too, though you can also chalk that up to an exuberant statement from Cathie Wood. The Ark Invest CEO said over the weekend that TSLA shares, which fetched almost $655 at the end of last week, would reach $3,000 by 2025.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Tesla also likely was reacting well to CEO Elon Musk's response to China, which restricted use of its EVs by state personnel after a Chinese security review revealed vehicle sensors could record images of their surroundings. Musk said Tesla "would never provide" the U.S. with such data.

"We believe this statement (while assumed) was important for Tesla and Musk to make directly to the Chinese and the government in Beijing given the strategic importance of its EV ambitions within China," says Wedbush analyst Daniel Ives, who rates TSLA at Hold.

The other major indices put up slightly smaller gains Monday, with the Dow Jones Industrial Average up 0.3% to 32,731, and the S&P 500 up 0.7% to 3,940.

One factor potentially weighing on more economically sensitive stocks in the short term? While vaccinations are being administered at a rapid pace, COVID-19 cases are rising across more than half of the U.S. – likely the result of both the introduction of more contagious variants and the phasing-out of various social distancing restrictions.

Other action in the stock market today:

- The Russell 2000 bucked the trend, dropping 0.9% to 2,266.

- Kansas City Southern (KSU) jumped 11.1% after fellow railroad operator Canadian Pacific Railway (CP, -5.8%) offered to buy the firm out for $25 billion.

- U.S. crude oil futures slipped 0.2% to $61.55 per barrel.

- Gold futures finished with a similar decline, off 0.2% to $1,738.10 per ounce.

- Bitcoin prices slumped 6.0% from their Friday levels, reaching $55,853 on Monday. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Is Infrastructure About to Take Off?

Still, the market is trending up, and another emerging bullish driver could help sustain that momentum.

The New York Times, citing people familiar with the plans, say the Biden administration is prepping pitches for $3 trillion in spending across several initiatives, including (and likely starting with) a massive infrastructure bill.

This effort would reportedly "spend heavily on infrastructure improvements, clean energy deployment and the development of other 'high-growth industries of the future' like 5G telecommunications" – key themes behind our top "Biden" stocks and potential catalysts for these 12 infrastructure-minded stocks.

An infrastructure push also would be yet more wind in the sails of commodity prices and, by extension, the companies that help produce them.

A wide variety of commodities, from metals to oil to timber, have rallied for several months on the prospects of a global economic rebound – and, by and large, Wall Street believes many of them still have more room to run.

Read on as we look at five commodity stocks that stand out right now.

Kyle Woodley was long NVDA as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.