Stock Market Today: Energy, Industrials Lead a Slow Day for Stocks

A traffic jam at the Suez Canal hoisted energy prices Wednesday, but most of the rest of the market struggled to keep its head above water.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

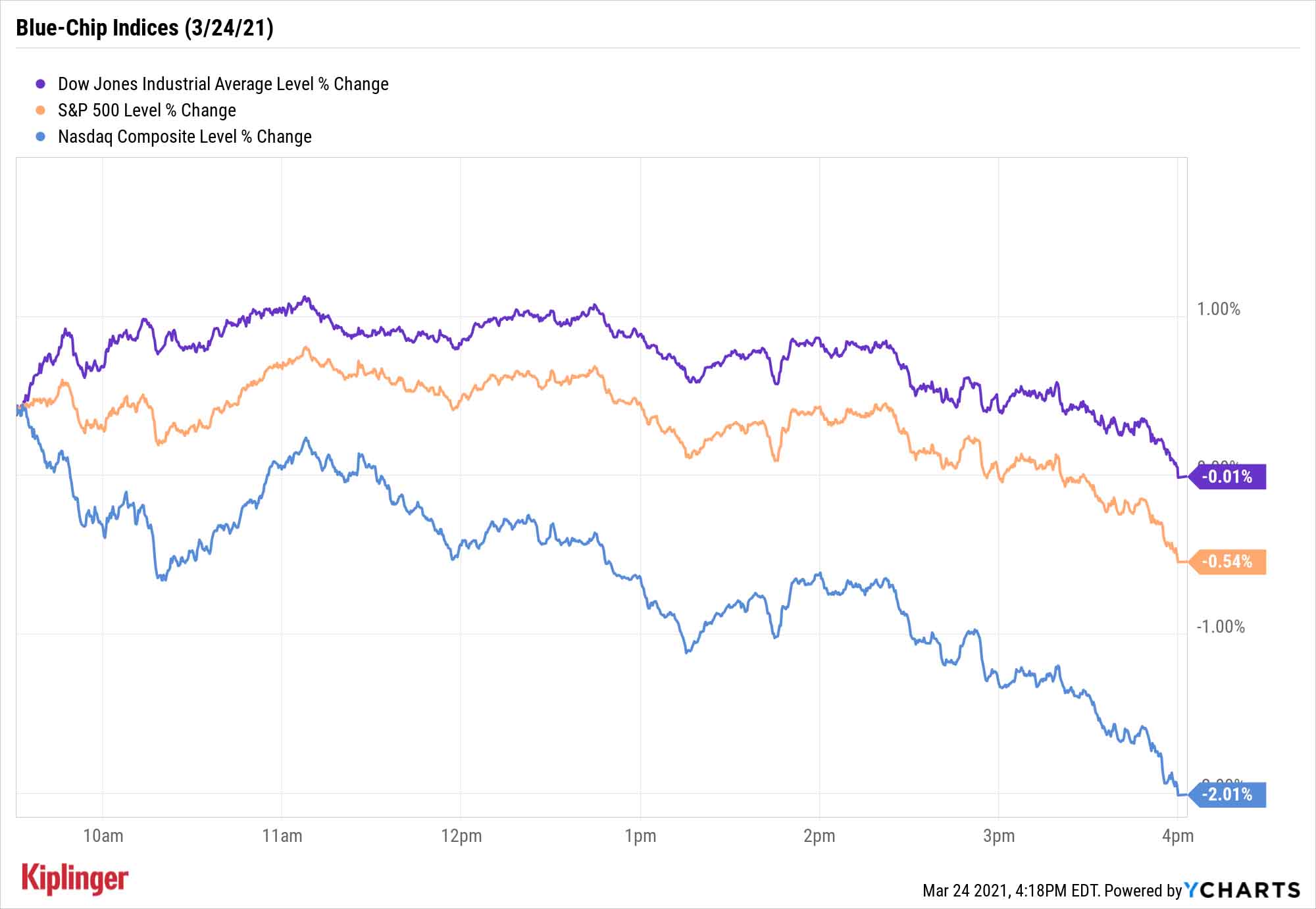

An afternoon slide sent the major indices lower Wednesday, though the Dow's losses were minimal amid a rebound in energy and industrial stocks.

Oil prices rose sharply thanks in part to a logjam in the Suez Canal. (Really: A Panamanian container ship ran aground Tuesday, clogging the Egyptian passage through which 10% of the world's seaborne oil trade passes.)

While the impact on prices is expected to be short-lived, U.S. crude oil futures jumped 5.9% to $61.18 per barrel, sparking strong gains in Dow component Chevron (CVX, +2.7%) as well as other large energy stocks including ConocoPhillips (COP, +2.9%) and EOG Resources (EOG, +4.2%).

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Also Wednesday, IHS Markit's "flash" reading of the service industry's February performance revealed the strongest growth in more than six years, while manufacturing also sped up.

The Dow Jones Industrial Average, which had traded in the black for all but the final couple minutes of Wednesday's session, declined marginally to 32,420. Chevron provided ballast, as did industrial firms Caterpillar (CAT, +1.4%) and Honeywell (HON, +1.7%).

Financials (XLF, +0.4%) also exhibited a little relative strength. In her Congressional testimony on Wednesday, U.S. Treasury Secretary Janet Yellen "made an interesting comment on stock buybacks," notes Anu Gaggar, senior global investment analyst for Commonwealth Financial Network. "She said that financial institutions look healthier and should have the flexibility to return capital to shareholders. Greater flexibility for buybacks and dividends could be a positive for bank stocks."

Other action in the stock market today:

- The S&P 500 dipped 0.6% to 3,889.

- The Russell 2000 had another brutal session, finishing 2.4% lower to 2,134. The small-cap index has dropped nearly 9% in the past week.

- GameStop (GME, -33.8%) was in the spotlight after reporting its fourth-quarter earnings Tuesday evening, and its shares provided fireworks ... just not the right kind. "Sales declined 30.2% to $1.0B, missing consensus, with comps falling 24.6%, also missing expectations," says CFRA analyst Camilla Yanushevsky. "After surging 135% year-to-date, very little has changed in GME's fundamental story. We hold concerns over GME's ability to maintain competitive positioning, namely due to high dependence on brick-and-mortar and secular shift away from physical gaming and toward digital and mobile."

- Gold futures improved by 0.5% to settle at $1,733.20 per ounce.

- Bitcoin prices tumbled 4.4% to $54,770. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

The Nasdaq's Turbulence Continues

Other parts of the market traversed much choppier waters. The on-again, off-again Nasdaq Composite declined 2.0% to 12,961, hobbled by the likes of Tesla (TSLA, -4.8%) and Facebook (FB, -2.9%).

We can't blame the usual bugaboo, though; Treasury yields were on the decline Wednesday. But that's not the only problem the index faces.

"The Nasdaq could drop 20% and still be trading at 30 times (earnings), and the S&P could drop 20% and still have a P/E over 20. Those are both historically high," says Sean O'Hara, president of Pacer ETFs. "We are getting reports of great earnings growth and GDP growth, but both earnings and GDP are still below where they were going into 2020. So, the broad market is expensive."

Among other things, that means it might pay to identify growthier trends, then wait for the right moments to buy at lower prices, be they video game stocks, 5G plays or a host of other high-quality (but overheated) picks.

Meanwhile, remember: Dividends ensure you get paid, even in sideways markets. While there are dozens of ways to peel that orange, one of the simplest is hunkering down into a diversified income fund or two, and keeping fees low so you enjoy more of your yield. Among your options are a quartet of highly thought-of Vanguard dividend and income funds that we've just evaluated – a blend of actively managed and index funds for stock and bond investors alike.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.