Stock Market Today: Hedge Fund Brouhaha Fails to Rattle Dow

A hedge fund's margin call default caused pain for U.S. communications stocks Friday, and for a few global banks Monday, but the blue-chip indices held up.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The broader indices kicked off a holiday-shortened trading week with fairly mixed results, but one of Monday's biggest stories was about Friday trading activity.

"As we start the week and the final three days of Q1, investors have been bracing for potential further block trades following a wave of sales on Friday that saw a number of U.S. media companies and Chinese technology firms lose significant ground," says Deutsche Bank analyst Henry Brown.

"Multiple news outlets have cited sources saying that Archegos Capital was behind the trades, with ViacomCBS (VIAC, -6.7%) and Discovery (DISCK, -2.3%) both seeing their largest ever daily declines on Friday, as each fell by more than -27%."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Many of those sales were in positions held by large U.S. hedge fund Archegos Capital, founded by Julian Robertson protégé Bill Hwang. Archegos reportedly defaulted on margin calls sparked by considerable declines in its portfolio.

Credit Suisse (CS, -11.5%) and Nomura Holdings (NMR, -14.1%) both sank today as they warned shareholders of significant losses linked to a large U.S. client. While neither bank specifically named the client, it was largely believed to be Archegos.

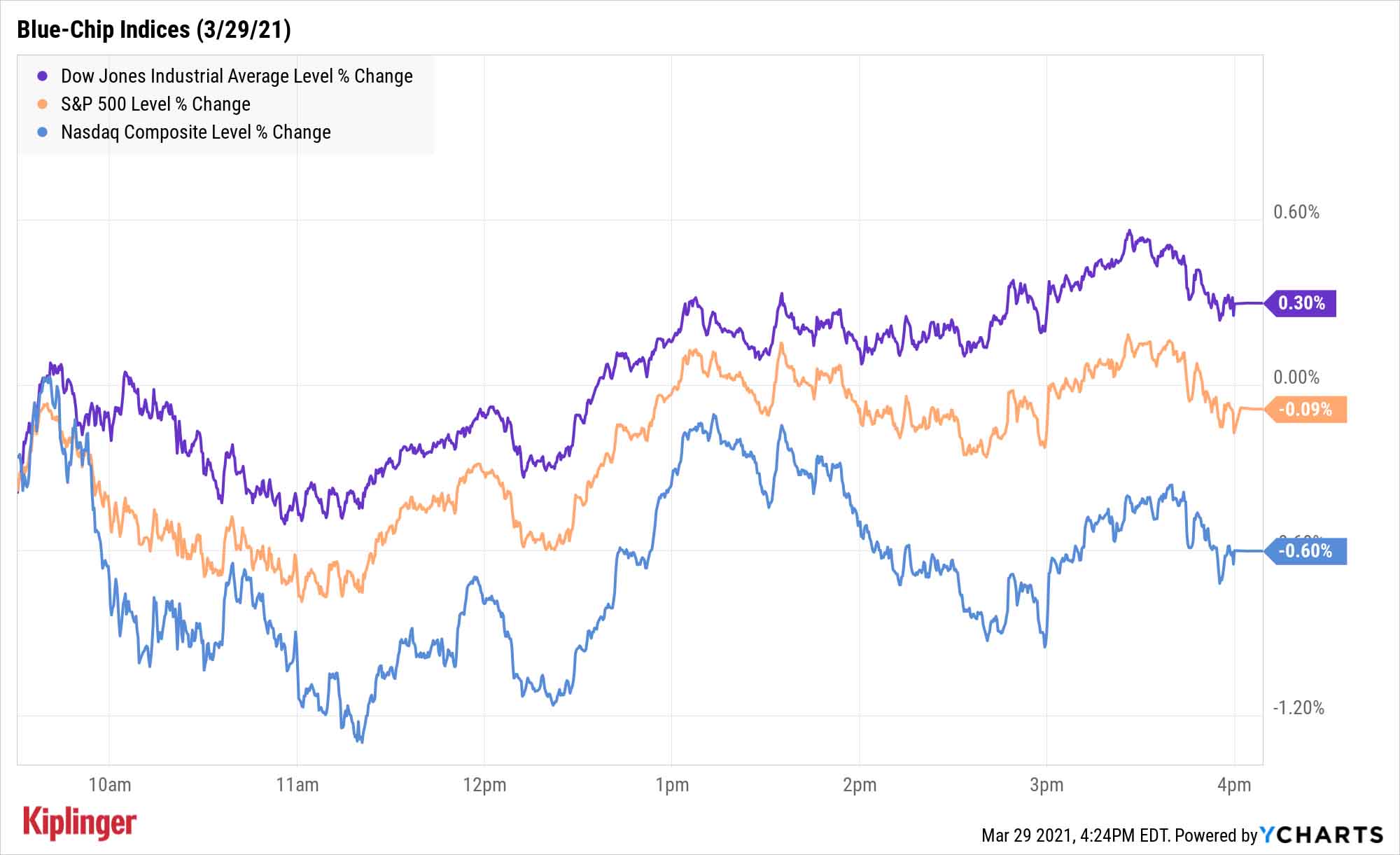

The major indices appeared to shrug off any immediate worries of further contagion, however. The Dow Jones Industrial Average finished 0.3% higher to 33,171, while the S&P 500 closed down a modest 0.1% to 3,971.

Other action in the stock market today:

- The Nasdaq Composite declined 0.6% to 13,059.

- The small-cap Russell 2000 plunged 2.8% to 2,158.

- U.S. crude oil futures improved by 0.8% to $61.44 per barrel.

- Gold futures declined 1.2% to $1,712.20 per ounce.

- Bitcoin prices were completely disconnected from the rest of the day's malaise, jumping 7.1% to $57,642. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Why It Pays to Diversify

These recent drops in the likes of ViacomCBS and Credit Suisse are a searing reminder of risks we often take for granted in stock investing.

Sure, as just about any bear turn (see: 2020) proves out, the entire market is always susceptible to sharp declines. Risk is everywhere. But individual stocks can drop farther and faster – and on triggers as unforeseeable to retail investors as a hedge fund's sudden belly flop.

That's why investors looking for stability and reliability can do well to build a portfolio core of diversified funds holding dozens, hundreds or even thousands of stocks or bonds, then use individual "satellite" holdings to try to generate a little outperformance here and there.

If you're an ETF investor, this group of 8 Vanguard ETFs exemplifies a variety of core holdings; or you can find core ETFs (and tactical plays) outside the Vanguard family in our 21 best ETFs for 2021. If you prefer mutual funds, you can check out top 401(k) options here.

But if you're not constrained to a work-sponsored program, consider our "Kip 25" instead. This list of 25 low-cost, no-load mutual funds is a who's who of Buy-worthy actively managed products, covering a number of stock and bond strategies.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.

-

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have TodayBank of America stock has been a massive buy-and-hold bust.