Stock Market Today: Stocks Reverse Late, Absorb Minor Losses

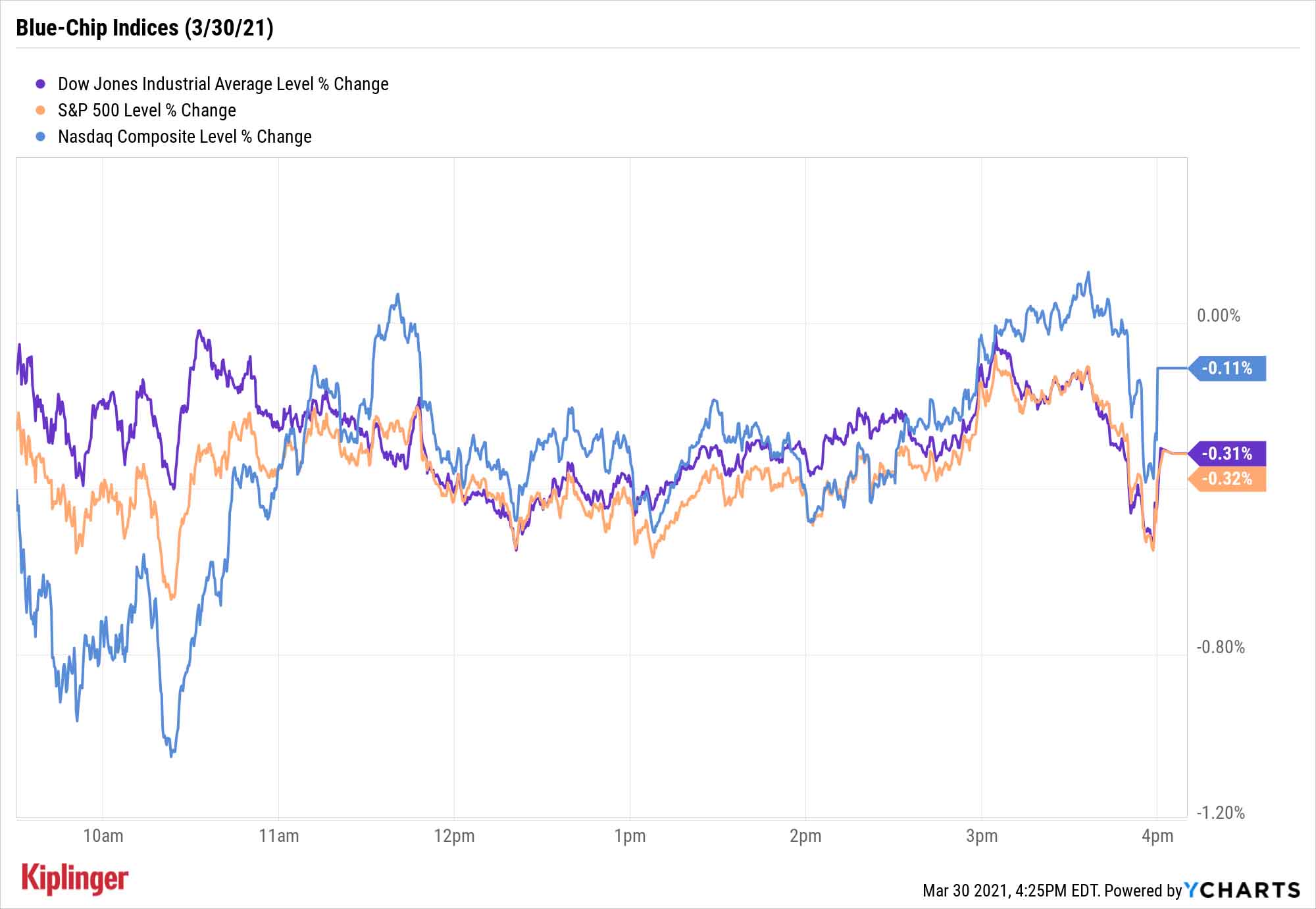

A slip in the final hour of Tuesday's trading session pulled the Nasdaq into the red and sent the Dow and S&P to shallow declines.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Traders kicked off Tuesday skittish before warming up in the afternoon … but unlike Monday's activity, a late-day U-turn lower sent most of the major indices to modest losses.

The Conference Board's consumer confidence index reached a one-year high of 109.7 in March, which Barclays economist Pooja Sriram says "was likely driven by the swift progress on vaccinations and additional fiscal stimulus."

But the big data point still on investors' radar is the March jobs report, due out Thursday.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"Some economists have suggested the number of jobs added could reach 1 million. The consensus expectation is for a still solid 680k added jobs; the last time we saw 1mm+ jobs added was in August last year, on the back of the economic rebound," says Lindsey Bell, Chief Investment Strategist for Ally Invest. But she adds that "with the S&P 500 up 51% in the past year and sitting near a new all-time high, a lot of the good news may be priced in, including a blockbuster jobs report."

The Dow Jones Industrial Average finished off 0.3% to 33,066, led by a host of healthcare names: Amgen (AMGN, -2.0%), Merck (MRK, -1.7%) and UnitedHealth Group (UNH, -1.5%) all finished in the red.

Other action in the stock market today:

- The S&P 500 declined 0.3% to 3,958.

- The small-cap Russell 2000 continued to zigzag, this time jumping 1.7% to 2,195.

- The Suez Canal logjam is finally clearing up, putting downward pressure on U.S. crude oil futures, which declined 1.9% to $60.42.

- Gold futures were off 1.7% to $1,684.80 per ounce.

- Bitcoin prices rose once again, gaining 2.4% to $59,017. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Keep Your Eye on Innovators

The Nasdaq Composite was the best of the major large-cap indices, albeit with its own small 0.1% loss to 13,045.

That hardly bridged the gap that's been building in the first quarter, though – the Nasdaq (+1.2% year-to-date) is easily underperforming both the Dow (+8.0%) and S&P 500 (+5.4%) over that period.

But while analysts do see better things for value and cyclical industries than growth and tech over the short term, they shouldn't ignore the latter for the long term.

Rick Lear, Founder and Managing Partner of Lear Investment Management, for one, still has hope for tech in 2021, saying his firm "favors companies capitalizing on the proliferation of information created by 5G including AI, the Internet of Things, cloud computing, cybersecurity and machine learning."

Also long term, there's massive growth to be found in fields like space exploration, which prompted the launch of yet another space-focused ETF today.

Those looking to take advantage of a tough stretch for many of Wall Street's most forward-thinking firms could consider stocks like those in the Argus Innovation Model Portfolio. If you look back at the past few years, many of the best-performing stocks belong to companies that boast creativity, originality and a commitment to research and development. So we looked through Argus Research's picks, which reflect many of these qualities, and took a deeper dive into 15 stocks the rest of Wall Street's pros agree stand apart.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Dow Hits New High Then Falls 466 Points: Stock Market Today

Dow Hits New High Then Falls 466 Points: Stock Market TodayThe Nasdaq Composite, with a little help from tech's friends, rises to within 300 points of its own new all-time high.

-

Stocks Struggle for Gains to Start 2026: Stock Market Today

Stocks Struggle for Gains to Start 2026: Stock Market TodayIt's not quite the end of the world as we know it, but Warren Buffett is no longer the CEO of Berkshire Hathaway.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.