Stock Market Today: Markets Settle Down, But Backdrop Remains Rosy

The IMF upgraded its U.S. and global growth forecasts, and another jobs datapoint impressed, but stocks mostly spent Tuesday treading water.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

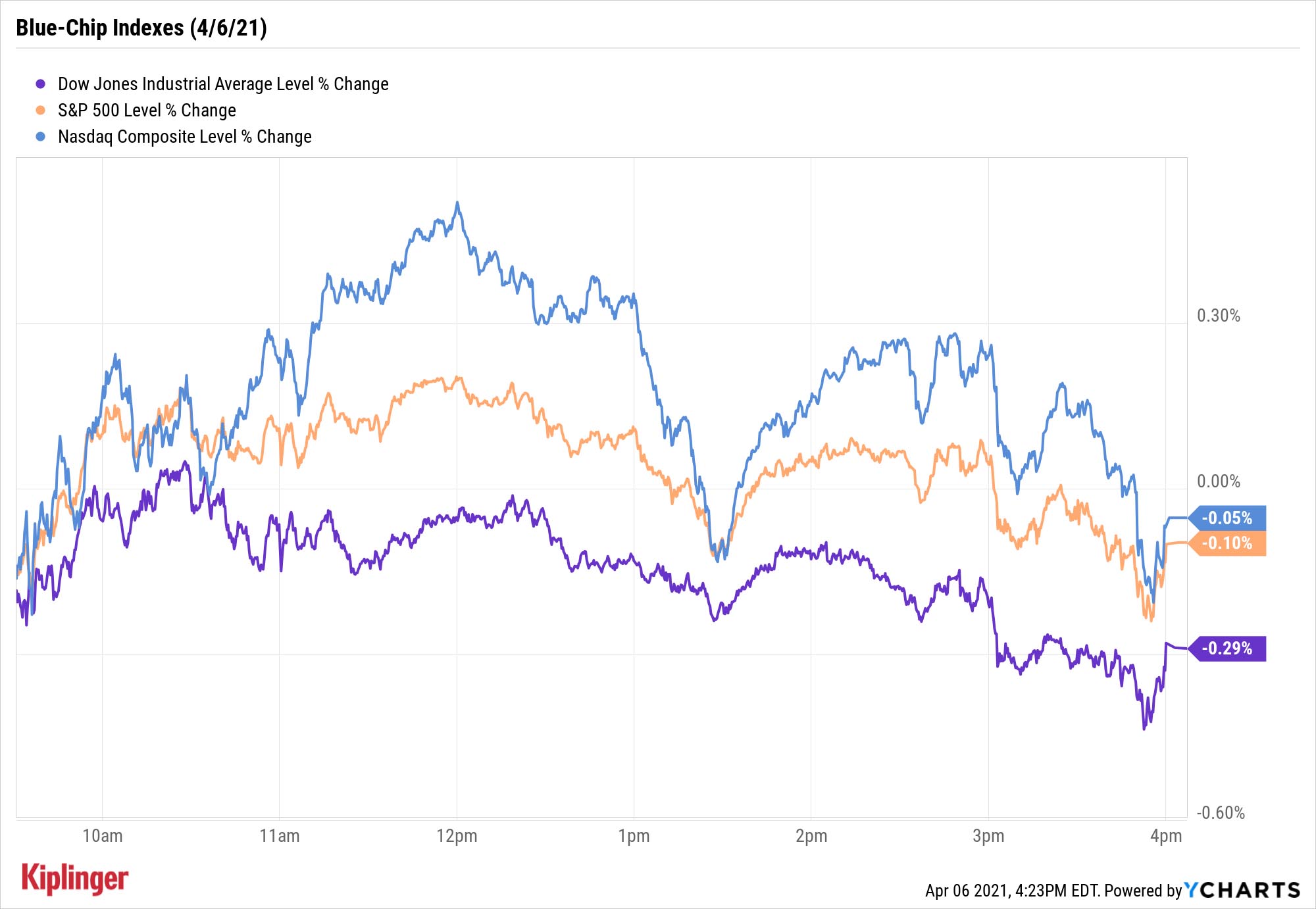

Monday's blowout session that sent the Dow Jones Industrial Average and S&P 500 to new heights was followed by much calmer, more horizontal, trading on Tuesday.

But it wasn't for a lack of additional positive ammunition following Friday's blockbuster jobs report.

This morning's Job Openings and Labor Turnover Survey (JOLTS) was another window into an improving employment situation, showing that U.S. job openings hit a two-year high in February. Also, the International Monetary Fund (IMF) upgraded its 2021 outlook for both U.S. economic growth (from 5.1% to 6.4%), and global economic expansion (from 5.5% to 6.0%).

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Still, the major indices spent Tuesday digesting the prior session's gains; the Dow slipped 0.3% to 33,430, the S&P 500 was off 0.1% to 4,073, and the Nasdaq Composite was marginally off to 13,698.

Recovery-oriented stocks were among the day's individual winners, especially those in the restaurant industry. Yum Brands (YUM, +3.1%), Domino's Pizza (DPZ, +2.4%) and Chipotle Mexican Grill (CMG, +2.4%) all finished solidly in the black.

Other action in the stock market today:

- The small-cap Russell 2000 declined by 0.3% to 2,259.

- U.S. crude oil futures improved by 1.2% to $59.33 per barrel.

- Gold futures also were higher, by 0.8%, to $1,743 per ounce.

- Bitcoin prices closed 1.3% lower to $58,242. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

E-Commerce Can Still Get It Done

As great as "reopening plays" have been of late, don't fall into the trap of thinking that all of 2020's COVID-assisted trends are duds.

Take e-commerce, for instance.

While you might imagine a vaccinated America abandoning its keyboards for the malls, the smart money recognizes that COVID only further entrenched the already growing digital-spending trend, and they see further promise even as more people get ready to go out.

"The convenience offered by eCommerce will continue to be an important consideration to consumers as they return to travel and social activities, and those people who tried shopping online for the first time during COVID are likely to continue using these services with greater frequency moving forward," says a team of Canaccord Genuity analysts.

Many of the best individual plays are the very same stocks that enjoyed a COVID lift, and some are considered among the market's most innovative companies -- an important quality that can drive outsized long-term returns.

But if you're hesitant to put all your chips on one or two individual names that could get choppy over the short term, we don't blame you, and we have a solution: e-commerce funds. Read on as we highlight nine e-commerce ETFs that leverage the growth in digital spending in a variety of ways, and explain how each one might suit different individual investors' tastes.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.

-

Stocks Sink with Meta, Microsoft: Stock Market Today

Stocks Sink with Meta, Microsoft: Stock Market TodayAlphabet was a bright light among the Magnificent 7 stocks today after the Google parent's quarterly revenue topped $100 billion for the first time.