Stock Market Today: Dow, S&P 500 Reach New Highs Again as Earnings Impress

A slew of better-than-expected financial-sector earnings helped keep the market's momentum going Friday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Investors weren't given much macro data to chew on Friday, though they still had plenty of positive points throughout the past week to digest.

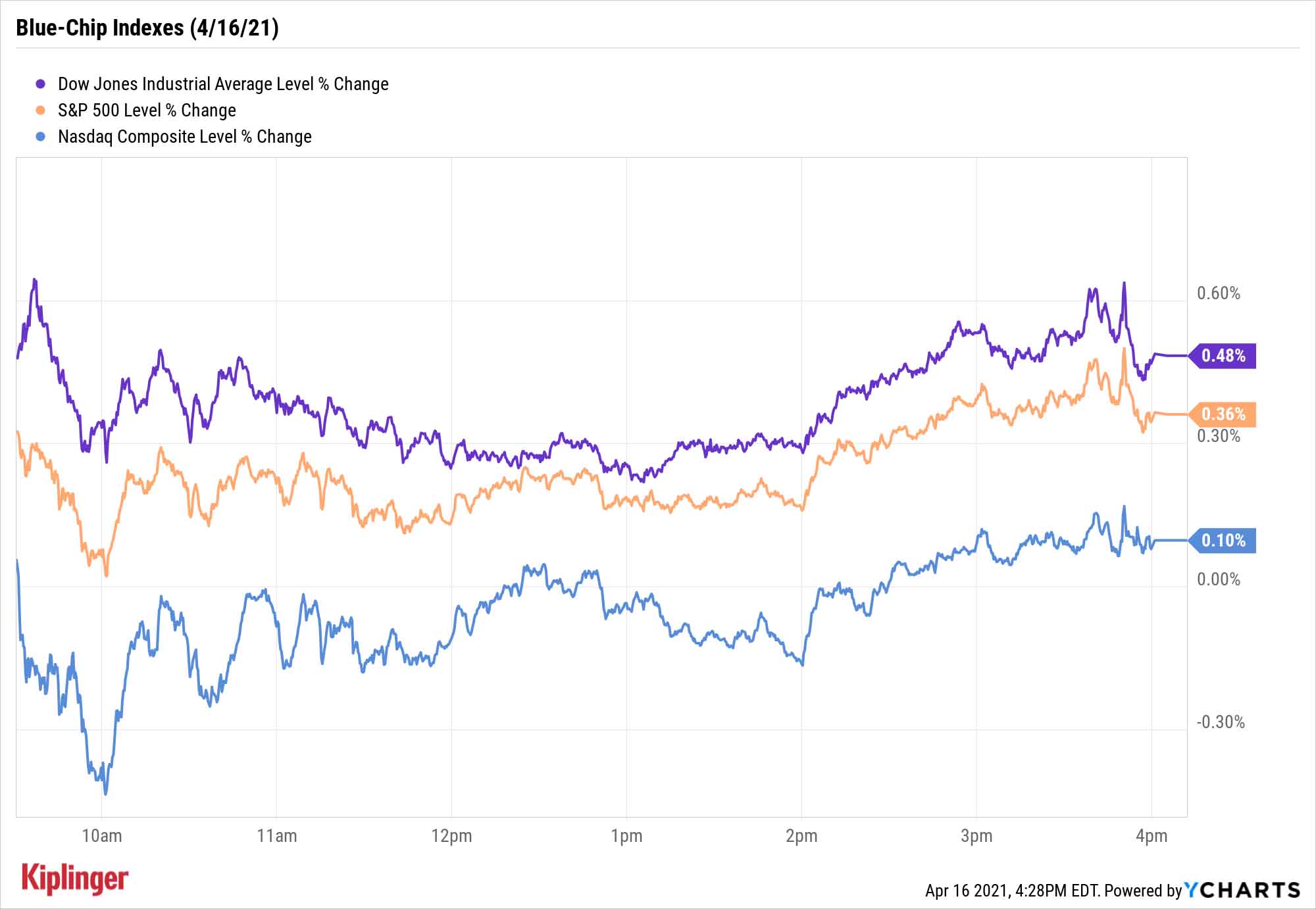

However, a slew of promising first-quarter earnings reports helped give the Dow Jones Industrial Average and other indexes a gentle nudge higher to finish the week.

Morgan Stanley (MS, -2.8%) more than doubled its year-ago Q1 earnings and posted an adjusted profit of $2.20 per share that easily bested analyst expectations. Shares declined, but that can be at least partly chalked up to the revelation that it suffered $911 million in losses connected to the collapse of capital management firm Archegos Capital.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

PNC Financial Services (PNC, +2.3%) and Ally Financial (ALLY, +0.2%) also reported Street-beating results.

The Dow finished 0.5% higher to 34,200 to secure yet another all-time high, as did the S&P 500, which closed up 0.4% to 4,185. Tech, seemingly taking its cue again from improving interest rates, helped restrain the Nasdaq Composite (+0.1% to 14,052) to a modest gain.

Other action in the stock market today:

- The Russell 2000 closed 0.3% higher to finish at 2,262.

- U.S. crude oil futures slipped by 0.2% to finish the week at $63.33 per share.

- Gold futures improved by 0.8% to $1,780 per ounce.

- The CBOE Volatility Index (VIX) declined again, off 3.0% to 16.07.

- Bitcoin prices declined 2.6% to $61,832. Instead, Friday's crypto spotlight belonged on Dogecoin, the digital currency that was created as a joke. Dogecoin rocketed from 16.3 cents per share to as high as 45 cents Friday before settling in with "just" a 90.2% gain to 31.0 cents. (Bitcoin and Dogecoin trade 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

The Calm Before the Storm Before the Calm?

Lately, analysts have been a lot more liberal with the phrase "we'd be buyers on dips," nodding to lofty prices after an 11%-plus run for the market in this still-young year.

Well, that dip could be coming – and that's OK, says Ryan Detrick, Chief Market Strategist for LPL Financial:

"Overall market breadth is extremely strong. This could suggest near-term there could be an exhaustion point, but this isn’t what you see at the end of bull markets, in fact, it tends to usually happen at the start of new bull markets," he says. "Currently, more than 95% of the components in the S&P 500 are above their 200-day moving average, a level only seen two other times, in December 2003 and September 2009. Looking back at 2004 and 2010, 2004 saw consolidation a good part of the year, while 2010 had a well-deserved 16% correction after the huge gains off the March 2009 lows.

"But the key point is after extreme market breadth like we are seeing now, overall higher prices and the bull market lasted for many more years."

Portfolio ballast goes a long way of surviving such periods with your nerves intact. We typically suggest income as a way to smooth out such rides, whether it's payout-growing stocks like Dividend Aristocrats and Dividend Kings, or stocks that pay high (and frequent) dividends.

But at a more basic level, you can find a certain level of stability and security from companies that boast unassailable balance sheets and responsible financial management, dividend or not. Consider this list of 25 blue chips, made up of longtime dividend payers and "growthy" nonpayers alike, that have the financial wherewithal to navigate any type of environment in the months to come.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Small Caps Can Only Lead Stocks So High: Stock Market Today

Small Caps Can Only Lead Stocks So High: Stock Market TodayThe main U.S. equity indexes were down for the week, but small-cap stocks look as healthy as they ever have.

-

Dow Adds 292 Points as Goldman, Nvidia Soar: Stock Market Today

Dow Adds 292 Points as Goldman, Nvidia Soar: Stock Market TodayTaiwan Semiconductor's strong earnings sparked a rally in tech stocks on Thursday, while Goldman Sachs' earnings boosted financials.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.