Finally, on the Brink of Dow 36,000

The main thrust of our book was that buying and holding a diversified stock portfolio is by far the best strategy.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

In early 1998, my American Enterprise Institute colleague Kevin Hassett, a well-credentialed academic who would later become chairman of the Council of Economic Advisers during the Trump administration, came to me with an idea. Over the previous three-fourths of a century, stocks had returned an annual average of about 11% and government bonds 5.5%. Yet over the long run, stocks were no more risky than bonds—a phenomenon that economist Jeremy Siegel had demonstrated in his 1994 classic, Stocks for the Long Run. “It is very significant,” Siegel wrote, “that stocks, in contrast to bonds or bills, have never delivered to investors a negative real return over periods lasting 17 years or more.”

In other words, stocks carried a big premium compared with bonds to compensate investors for the extra risk they were taking, but there was no extra risk!

This paradox is called the equity premium puzzle, and Kevin and I believed that people were solving the conundrum by bidding up the prices of stocks to their proper level. Higher prices today mean lower future returns, allowing the two asset classes to reach a logical equilibrium.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

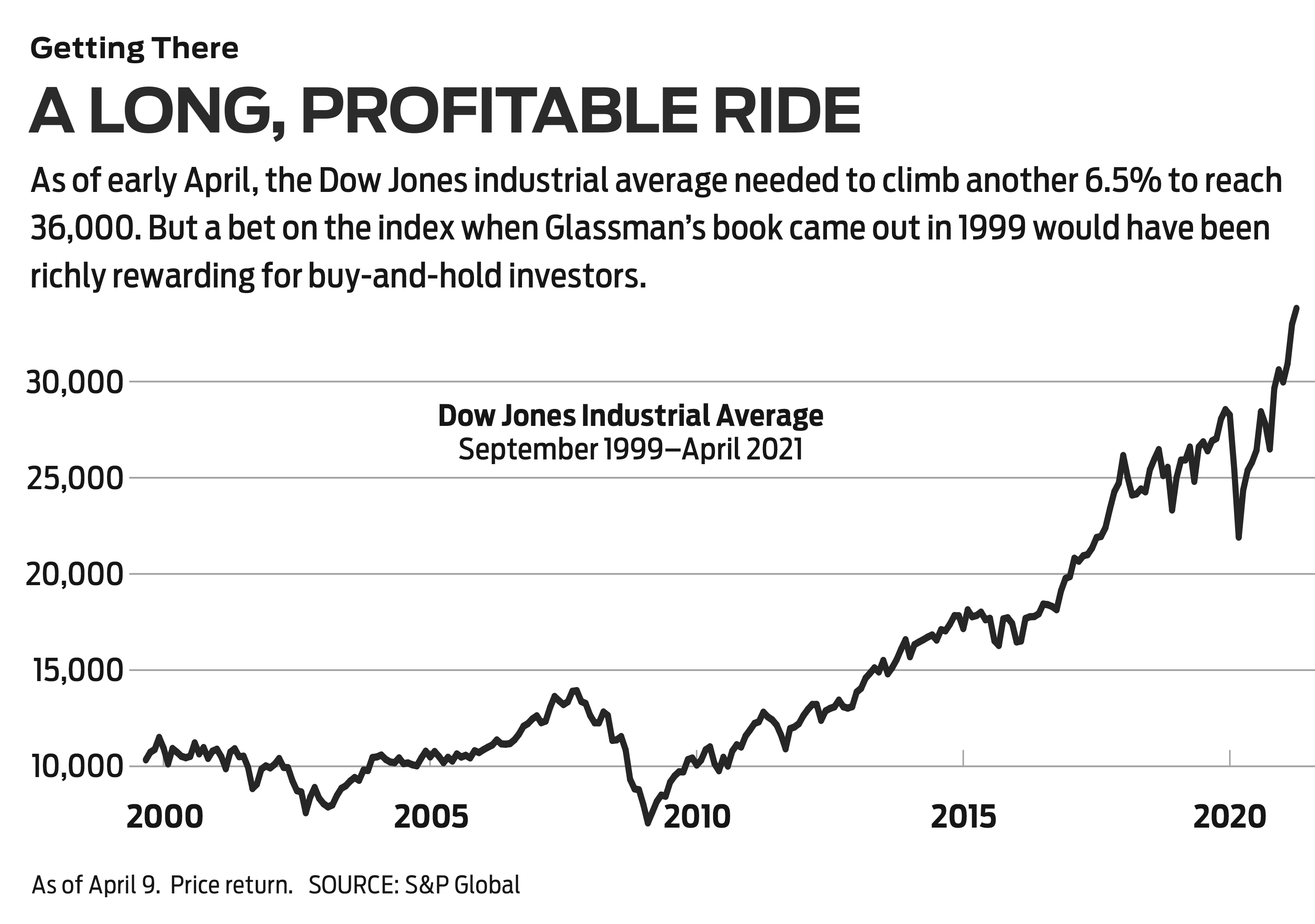

The road to 36,000. We went public with our insight in an op-ed that the Wall Street Journal published on March 3, 1998, with the headline, “Are Stocks Overvalued? Not a Chance.” At the time, the Dow Jones industrial average was 8782. We suggested, with many caveats, that the Dow ought to be 35,000. A year and a half later, with a few adjustments, our thesis became a book called Dow 36,000. As for the Dow itself, well, it has taken longer than we thought to reach the magic number, but arrival seems imminent with just 6.5% to go as of April 9.

The main thrust of our book was that buying and holding a diversified portfolio of stocks is by far the best investment strategy, and the second half of Dow 36,000 was devoted to advice on how to build strong portfolios—the simplest way being to purchase the 30 stocks of the Dow itself. Investors who did that, plowing the dividends back into the shares, would have achieved satisfying returns: 451% since the publication of our book or 576% since our Wall Street Journal article came out.

Although we were right about buy-and-hold investing, we were wrong about our theory that the gap in returns between stocks and bonds would quickly vanish. The equity risk premium has remained roughly the same over the past two decades. This is actually good news. It means that investors can expect the future to be like the past: sizable returns for stock investors with a long view and the courage to persist.

Nevertheless, our theory went wrong. Why? The best answer comes from the grandfather of buy-and-hold investing, Burton Malkiel. In 1974, the Princeton economist wrote one of the greatest investment books of all time, A Random Walk Down Wall Street. In it, he said that stocks move in a pattern “in which future steps or directions cannot be predicted on the basis of past actions.” The reason is that all information relevant to a company’s value at this moment is reflected in today’s stock price. Future information, as it appears, will move the price in a way that’s unknowable at present.

Malkiel reviewed Dow 36,000 in the Wall Street Journal in September 1999. He understood our thesis and presented it more succinctly than we did: “The extra 5.5 percentage points from owning stocks over bonds…is unjustified.” He dismissed the mathematical carping of some critics as “beside the point.”

Malkiel’s own criticism was that he found it “hard to accept that even over the long run equities are no riskier than government bonds”—no matter what Professor Siegel’s data showed. Malkiel used this thought experiment: Suppose you want to retire in 20 years and could buy a 20-year zero-coupon U.S. Treasury bond that yields 6.65%. Alternatively, you could invest in a diversified portfolio of stocks with an expected total return of 6.65%. Who would possibly choose the stocks? Malkiel writes that it is, therefore, “illogical to assume” that the stock portfolio would be priced to achieve the same return as the bond.

In other words, investors set the price for stocks, and they demand a higher return from them, no matter what history shows. Investors are more frightened of what can happen to the prices of stocks than to the value of U.S. government bonds, which are seen as a safe haven even though their value can be depleted dramatically because of inflation. This fear is a fact. As Malkiel writes, despite the spread of free markets, “the world is still a very unstable place, and economic events are always surprising us.”

In the short term, stuff happens. Indeed, just a few months after he wrote his review, high-flying tech stocks crashed to earth. Solid companies such as Intel and Oracle lost 80% of their value. A year and a half later, the twin towers of the World Trade Center crashed to the ground. Seven years after that, the U.S. suffered its worst financial disaster since the Great Depression, and unemployment hit 10%. Eleven years later, a virus suddenly swept the world, killing 561,000 Americans and counting.

Financial risk is defined as the volatility of the value of an asset—the extremes of its ups and downs. Over 20-year periods or more, stocks have displayed remarkably consistent returns—and no losses after inflation. But investors have perceived overall risks to be higher because, in the short term, terrible things can happen. But despite many terrible things since the publication of Dow 36,000, your $10,000 investment in the Dow would still have become more than $50,000.

Years ago, I wrote a column for another publication that divided investors into two categories: “outsmarters,” who think that the way to make money in stocks is to beat the system by trying to time the market or putting large short-term bets on hot equities, and “partakers,” who try to find good businesses and become partners over the long haul or simply purchase the market as a whole, or large parts of it, via index funds with low expenses.

A few of those choices: SPDR Dow Jones Industrial Average (symbol DIA, $338), an exchange-traded fund nicknamed Diamonds, which mimics the Dow and charges 0.16% annually; Vanguard Total Stock Market Admiral (VTSAX), which attempts to replicate all listed U.S. stocks, with an expense ratio of just 0.04%; Schwab 1000 (SNXFX), a mutual fund that reflects the 1,000 largest U.S. stocks, charging 0.05%; and SPDR S&P 500 ETF Trust (SPY, $411), known as Spiders, which is linked to the popular large-cap benchmark and charges 0.095%.

With Dow 36,000, I tried to have it both ways. I advocated that investors adhere to a partaker approach, but I tried to be an outsmarter myself by predicting people would lose their fear of stocks and act rationally at last. What I was really saying was that I knew better than the mass of investors. My error provides an important lesson: Respect the market.

But there’s another lesson as well. Professor Malkiel concluded his review by saying that Dow 36,000 inspired “a degree of optimism and complacency that can be, for some, truly perilous.” If by “optimism and complacency” he meant investing in the Dow and forgetting about it, well, that has turned out just fine.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

How the Stock Market Performed in the First Year of Trump's Second Term

How the Stock Market Performed in the First Year of Trump's Second TermSix months after President Donald Trump's inauguration, take a look at how the stock market has performed.

-

What the Rich Know About Investing That You Don't

What the Rich Know About Investing That You Don'tPeople like Warren Buffett become people like Warren Buffett by following basic rules and being disciplined. Here's how to accumulate real wealth.

-

How to Invest for Rising Data Integrity Risk

How to Invest for Rising Data Integrity RiskAmid a broad assault on venerable institutions, President Trump has targeted agencies responsible for data critical to markets. How should investors respond?

-

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)State Taxes Living in one of these places could lower your 2025 investment taxes — especially if you invest in real estate.

-

What Tariffs Mean for Your Sector Exposure

What Tariffs Mean for Your Sector ExposureNew, higher and changing tariffs will ripple through the economy and into share prices for many quarters to come.

-

How to Invest for Fall Rate Cuts by the Fed

How to Invest for Fall Rate Cuts by the FedThe probability the Fed cuts interest rates by 25 basis points in October is now greater than 90%.

-

Are Buffett and Berkshire About to Bail on Kraft Heinz Stock?

Are Buffett and Berkshire About to Bail on Kraft Heinz Stock?Warren Buffett and Berkshire Hathaway own a lot of Kraft Heinz stock, so what happens when they decide to sell KHC?

-

How the Stock Market Performed in the First 6 Months of Trump's Second Term

How the Stock Market Performed in the First 6 Months of Trump's Second TermSix months after President Donald Trump's inauguration, take a look at how the stock market has performed.