Stock Market Today: Nasdaq, S&P 500 Hit New Highs to Start Packed Trading Week

The Nasdaq and S&P 500 made their way into record territory Monday on the back of strong performances by chipmakers and energy stocks.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

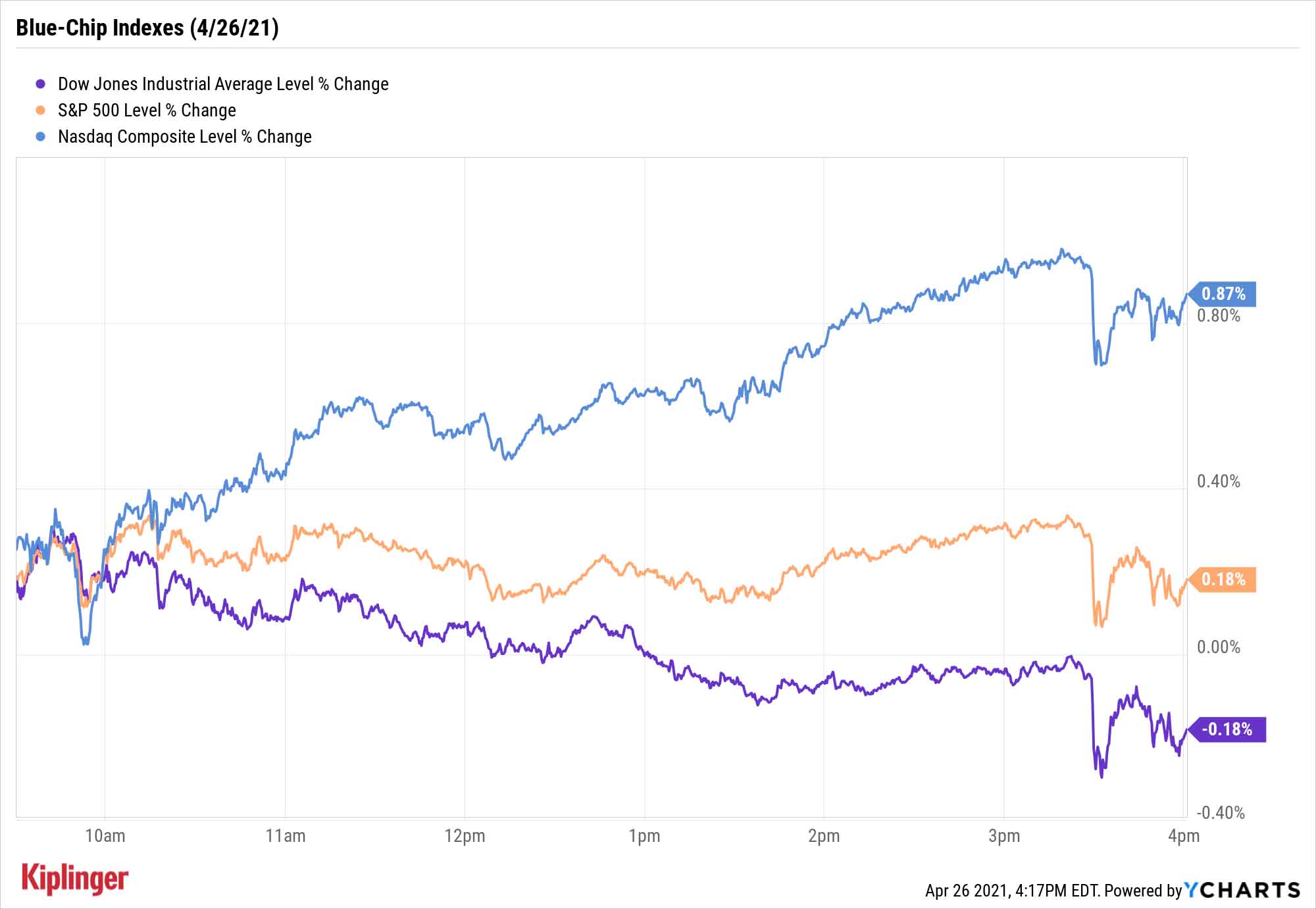

Stocks kicked off what will be a headline-packed week with largely positive action Monday that pushed the S&P 500 and Nasdaq Composite into record territory.

"This week will be full of catalysts which will include: over one-third of companies in the S&P 500 announcing earnings (that number is much higher when viewed as % of market-cap), a Fed rate decision and ... the first look at Q1 GDP and inflation data," says Michael Reinking, NYSE senior market strategist.

Monday was data-light, however; headline durable-goods orders rebounded in March after a February drop but came in below estimates.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Chip stocks including Advanced Micro Devices (AMD, +3.2%) and Qualcomm (QCOM, +2.6%) lifted the Nasdaq by 0.9% to a record close at 14,138.

The S&P 500 (+0.2% to 4,187) also eked out a new high, with a boost from energy names such as Schlumberger (SLB, +2.5%) and APA (APA, +2.6%).

The Dow Jones Industrial Average wasn't quite so fortunate, finishing Monday with a 0.2% loss to 33,981.

Other action in the stock market today:

- Spotify (SPOT, +4.9%) jumped today on news the audio-streaming service is planning on raising prices on some of its subscriptions, with a price hike on its U.S. family plan coming as soon as this Friday.

- Amazon.com (AMZN, +2.0%) rose solidly, but not on solid news. Instead, AMZN got a lift from the rumor mill today, with shares popping on unconfirmed buzz about a possible stock split – one that theoretically would be announced during its Q1 earnings report, due out after Thursday's close.

- American Express (AXP, +4.2%) managed to brush off broader weakness in the Dow. The stock gained ground as several analysts hiked their price targets after the company reported better-than-expected Q1 profits last Friday.

- U.S. crude oil futures fell 0.4% to settle at $61.91 per barrel.

- Gold futures gained 0.1% to finish at $1,780.10 an ounce.

- The CBOE Volatility Index (VIX) gained 2.7% to close at 17.80.

- Bitcoin prices sank by 4.8% to $52,967. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

A Surge in Small-Cap Strength

Leading the way today was the "little guy," with the small-cap Russell 2000 jumping 1.2% to 2,298. Reinking notes that "the Russell's outperformance is emblematic of some broader risk-on trading behavior seen not only in equities but in other asset classes as well."

And there's reason to believe that behavior will continue in the midst of America's economic recuperation.

"Since 2009, the risk-on cycle has repeated every three to four years. We have observed significant returns in small-cap stocks, cyclical sectors and low-valuation companies, relative to the S&P 500 Index, during the first year of a risk-on cycle," says Chao Ma, global portfolio and investment strategist for the Wells Fargo Investment Institute.

We've recently highlighted a selection of growth-oriented small caps that investors can use to leverage this continuing trend. Today, however, we take a fresh look at 11 small-cap stocks that analysts were bullish on at the start of 2021. The good news? All but one of those picks – which range from high-octane biotechs to real estate plays with market-topping yields – remain buys.

Kyle Woodley was long AMZN as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Should You Do Your Own Taxes This Year or Hire a Pro?

Should You Do Your Own Taxes This Year or Hire a Pro?Taxes Doing your own taxes isn’t easy, and hiring a tax pro isn’t cheap. Here’s a guide to help you figure out whether to tackle the job on your own or hire a professional.

-

Trump $10B IRS Lawsuit Hits an Already Chaotic 2026 Tax Season

Trump $10B IRS Lawsuit Hits an Already Chaotic 2026 Tax SeasonTax Law A new Trump lawsuit and warnings from a tax-industry watchdog point to an IRS under strain, just as millions of taxpayers begin filing their 2025 returns.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

Dow Soars 588 Points as Trump Retreats: Stock Market Today

Dow Soars 588 Points as Trump Retreats: Stock Market TodayAnother up and down day ends on high notes for investors, traders, speculators and Greenland.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.