Stock Market Today: Dow Leads in a Mixed May Start for Stocks

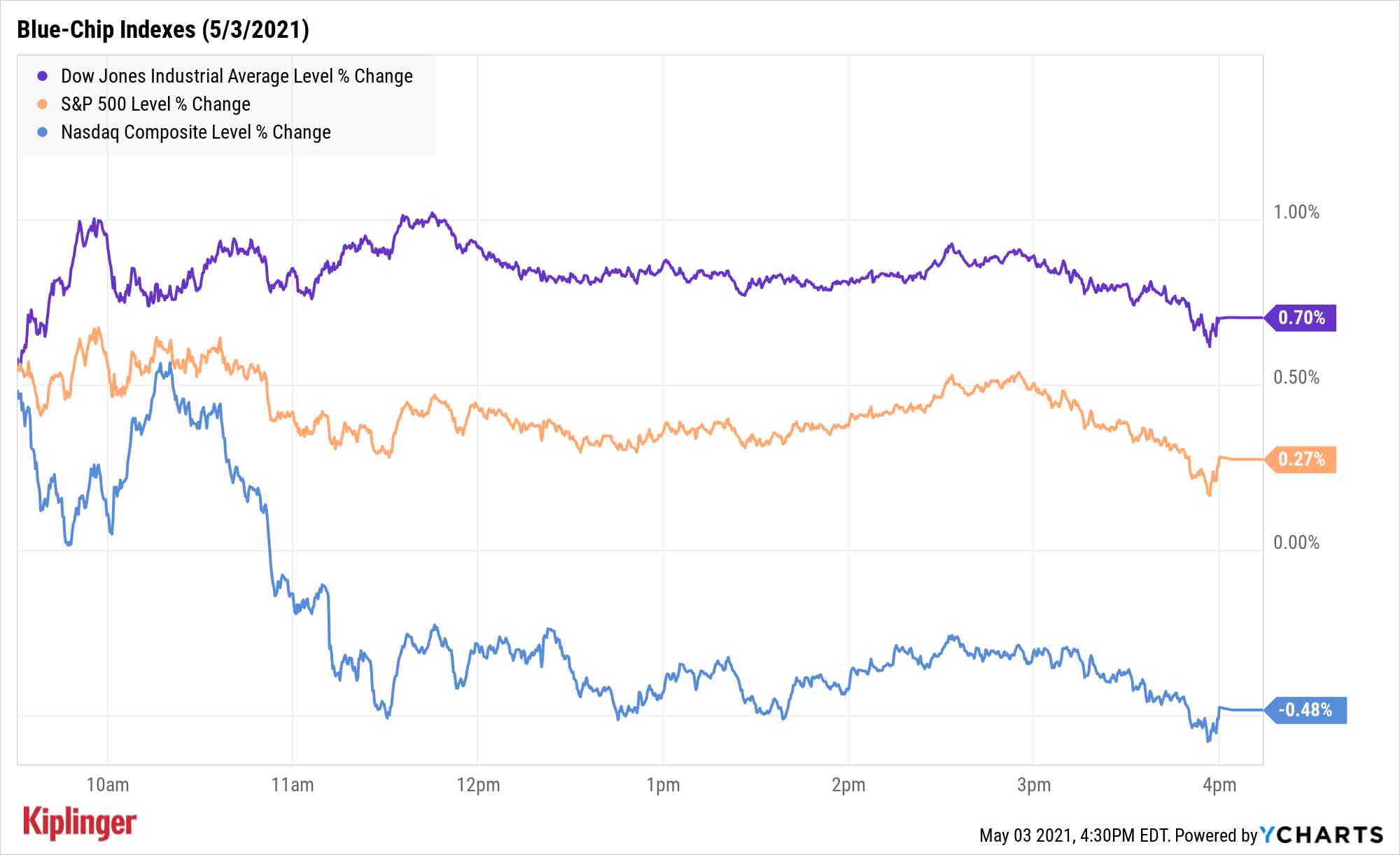

The "rotation trade" popped its head back up Monday, as the Dow advanced and the Nasdaq slipped to start the new month.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The Dow Jones Industrial Average kicked off the month with a 0.7% gain to 34,113 on Monday that came despite a weaker-than-expected Institute of Supply Management manufacturing report.

Supply bottlenecks resulted in an April reading of 60.7 – a slower rate of expansion than March's 64.7 reading indicated, but expansion nonetheless.

"Although the composite was a fair bit below expectations (Barclays 64.5; consensus 65.0), the decline comes off of a robust March reading that was the highest since 1983," says Barclays economist Jonathan Millar. "Indeed, components of the composite continue to point to very strong growth, which comes as no surprise, given highly favorable demand conditions amid fiscal stimulus, easing of social distancing restrictions, and ongoing progress in vaccinations."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

We're glad to see that at least some investors heeded our advice to ignore the urge to "sell in May and go away." But stocks weren't exactly up across the board. The Nasdaq Composite (-0.5% to 13,895) struggled, thanks to weakness in mega-cap tech and tech-esque names such as Tesla (TSLA, -3.5%), Amazon.com (AMZN, -2.3%) and Salesforce.com (CRM, -2.9%).

"For the first time in a while there is a clear value/cyclical bias while growth/tech is under pressure," says Michael Reinking, senior market strategist for the New York Stock Exchange. "Tech wobbled last week despite blowout numbers from the mega-cap stocks. This is especially concerning as the rate environment remains in check."

Other action in the stock market today:

- The S&P 500 gained 0.3% to 4,192.

- The small-cap Russell 2000 also finished in the black, up 0.5% to 2,277.

- Berkshire Hathaway (BRK.B, +1.7%) held its 2021 annual shareholder meeting this weekend. Chairman and CEO Warren Buffett and Executive Vice Chairman Charlie Munger addressed a number of topics, including trimming Berkshire's stake in Apple (AAPL) in Q4 2020. "It was probably a mistake," said Buffett, adding that AAPL's stock price is a "huge, huge bargain" given how "indispensable" the company's products are to people. Also of note: Berkshire grew fourth-quarter operating income by 20%, to $5.9 billion, while cash grew 5% to $145.4 billion.

- Domino's Pizza (DPZ, +2.6%) was a notable winner today. The pizza chain revealed an accelerated stock buyback program, saying in a regulatory filing that it will pay Barclays $1 billion in cash for roughly 2 million DPZ shares.

- U.S. crude oil futures jumped 1.4% to end at $64.49 per barrel.

- Gold futures snapped a four-day losing streak, adding 1.4% to settle at $1,791.80 an ounce.

- The CBOE Volatility Index (VIX) declined 2.3% to 18.18.

- Bitcoin prices improved by 1.1% to $57,530.32. More impressive was the 18.6% improvement in Ethereum, to $3,300.64 (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Another Big Week of Reports ... And Dividends

What should investors be looking forward to this week?

On Thursday and Friday, we'll get the latest weekly unemployment filings and April jobs data, respectively, but throughout the week, another heaping helping of earnings reports, anchored by the likes of General Motors (GM), Pfizer (PFE), Under Armour (UAA) and PayPal (PYPL).

And given that many companies tend to synchronize their dividend and buyback actions with their earnings reports, you also can expect plenty of news on the dividend-growth front.

In some cases, those raises might be token upticks meant to secure current or future membership in the Dividend Aristocrats. But others are bound to compete with this year's most explosive payout hikes – improvements of 15%, 20% or even 30% that drastically change the income aspect of current shareholders' investments. Ideally, of course, investors want the best of both worlds: income longevity and generosity.

These 10 dividend stocks just might fit the bill. This group of mostly blue-chip household names offer a strong history of payout increases, a sharp level of recent hikes compared to their peers, and the operational quality to continue affording these annual raises.

Kyle Woodley was long AMZN, CRM, PYPL and Ethereum as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

Dow Soars 588 Points as Trump Retreats: Stock Market Today

Dow Soars 588 Points as Trump Retreats: Stock Market TodayAnother up and down day ends on high notes for investors, traders, speculators and Greenland.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Dow Dives 870 Points on Overseas Affairs: Stock Market Today

Dow Dives 870 Points on Overseas Affairs: Stock Market TodayFiscal policy in the Far East and foreign policy in the near west send markets all over the world into a selling frenzy.