Stock Market Today: Dow Hits Record, Nasdaq Snaps Skid After Late Push

A sharp drop in unemployment claims had the Dow poised for another record, but an afternoon push got the Nasdaq into the black, too.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Better-than-expected data on the jobs front Thursday kept the wheels rolling on the rotation trade – from growth stocks to cyclical and value plays – that has been in high gear all week.

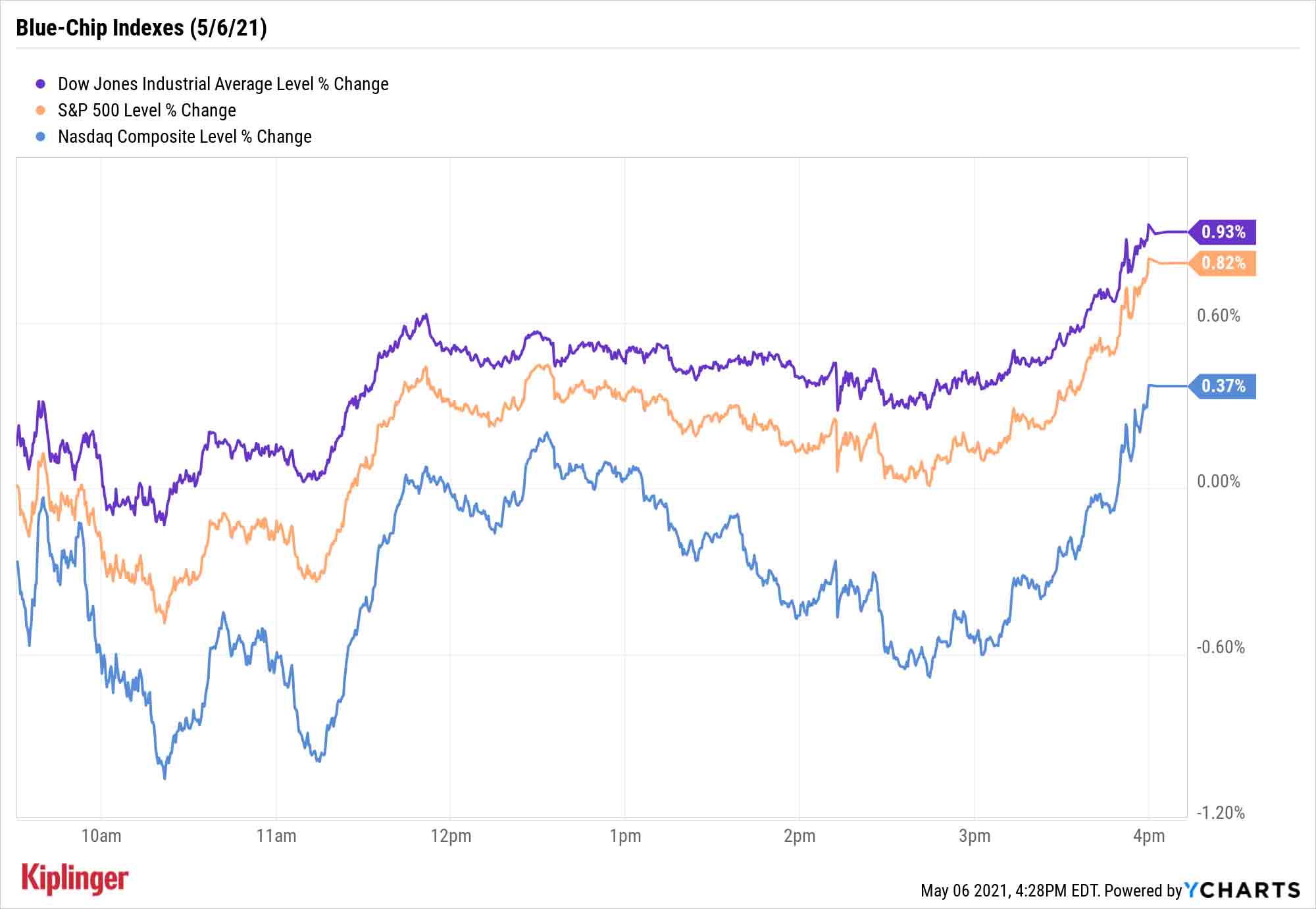

But a late-day push led not just to new highs in the Dow Jones Industrial Average, but a sniff of positive territory for the recently maligned Nasdaq Composite.

The Labor Department said this morning that new unemployment filings declined to 498,000 for the week ended May 1. Not only was that 92,000 claims fewer than the week prior, but it also was significantly below analysts' consensus expectations for 538,000 filings.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The best-performing sectors Thursday included safe havens such as consumer staples and utilities, and also financials.

But the Dow's 0.9% gain to a record 34,548 was led by value-oriented tech stocks Cisco Systems (CSCO, +2.6%) and International Business Machines (IBM, +2.2%). Meanwhile, the Nasdaq (+0.4% to 13,632), which was staring at a fifth consecutive decline for most of the day, was helped into the black courtesy of a late-day broader-market rally.

Other action in the stock market today:

- The S&P 500 gained 0.8% to 4,201.

- The small-cap Russell 2000 was breakeven 2,241.

- Etsy (ETSY, -14.6%) took a big hit after its earnings report. The online marketplace reported first-quarter profit and revenue above estimates, but in a letter to investors, CEO Josh Silverman warned of a "deceleration" in current-quarter gross merchandise sales.

- Norwegian Cruise Line Holdings (NCLH, -6.8%) also declined in reaction to earnings. The cruise operator said its first-quarter loss was wider than anticipated and revenue fell more drastically than expected. And while the company has planned on resuming operations in July, NCLH CEO Frank Del Rio cautioned "the path forward is a bit rockier and a bit steeper than originally expected," after the Centers for Disease Control and Prevention (CDC) issued new reopening guidelines yesterday for cruise operators.

- U.S. crude oil futures shed 1.4% to settle at $64.71 per barrel.

- Gold futures jumped 1.8% to finish at $1,815.70 an ounce. A weaker U.S. dollar helped boost the commodity to its highest settlement since mid-February.

- The CBOE Volatility Index (VIX) declined by 4.0% to 18.39.

- Bitcoin prices declined 1.6% to $56,166.30. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Abundant Action in the Digital Realm

The major stock indexes have mostly been stuck in a grind of small advances and declines for weeks, but you don't have to look too far afield for flashier fireworks. The cryptocurrency space continues to grow – and in a couple of cases, grow weirder.

For instance, Dogecoin – the digital coin that was quite literally created as a joke – has rocketed 88% higher over the past week and 6,507% year-to-date, even despite today's 7% spill in the Shiba Inu-inspired token. Whether investors should take seriously the cryptocurrency, which now accounts for $75 billion in investor assets, is up for intense debate; many experts prefer other cryptocurrencies such as Bitcoin that have wider moats and clearer utility.

But digital investing trends aren't constrained to just currencies – in the past few months, we've also seen rapidly rising interest in secure digital collectibles (think images, video and music) called NFTs, or non-fungible tokens, with one such NFT selling for more than $69 million at a Christie's auction in March.

If you're curious about this latest craze, read on as we catch you up on the basics of NFTs.

Kyle Woodley was long NCLH as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

Stocks Slip to Start Fed Week: Stock Market Today

Stocks Slip to Start Fed Week: Stock Market TodayWhile a rate cut is widely expected this week, uncertainty is building around the Fed's future plans for monetary policy.

-

Crypto Trends to Watch in 2026

Crypto Trends to Watch in 2026Cryptocurrency is still less than 20 years old, but it remains a fast-moving (and also maturing) market. Here are the crypto trends to watch for in 2026.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.