Stock Market Today: Stocks Rise as Jarring Jobs Miss Cools Taper Talk

The Dow and S&P 500 ended the week at new highs after a big nonfarm payrolls miss eased anxiety the Fed will tighten the purse strings.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

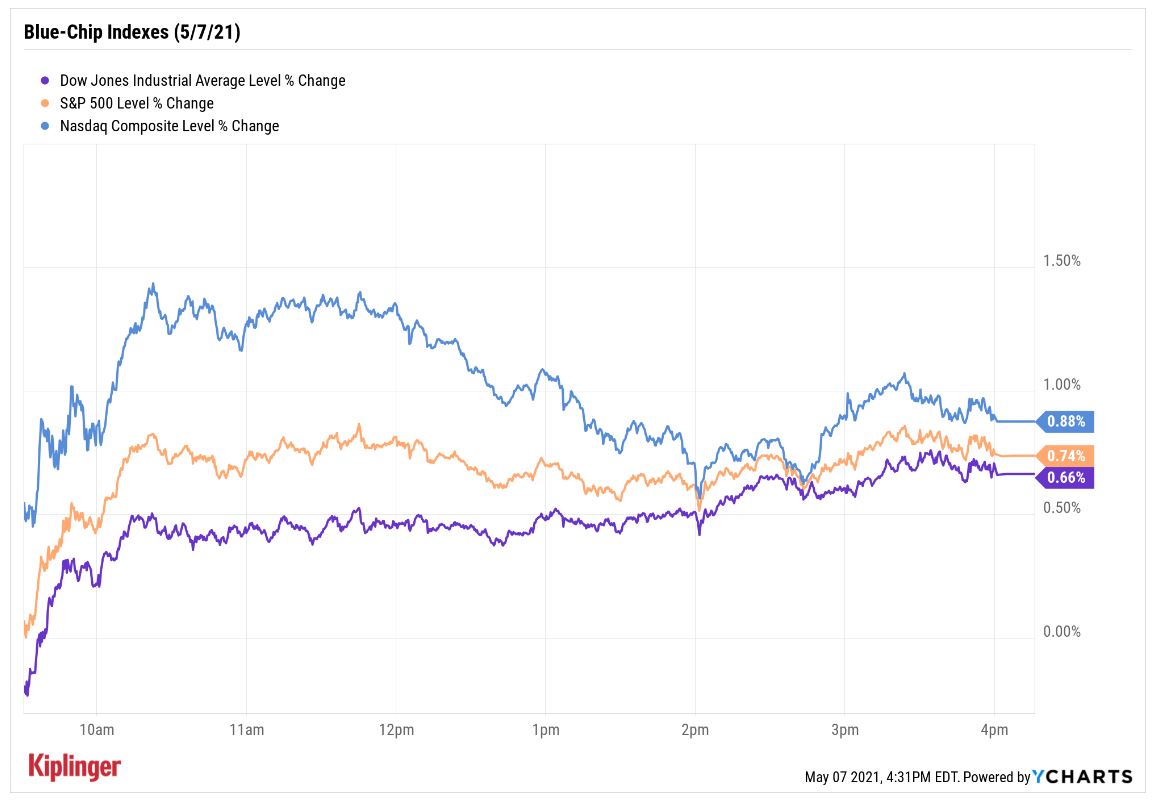

Stocks brushed off a dismal April jobs report Friday, with the Dow Jones Industrial Average and S&P 500 Index ending the week at new highs.

This morning's nonfarm payrolls update from the Labor Department showed the U.S. added 266,000 jobs last month, well below the nearly 1 million expected by economists, while the unemployment rate ticked higher to 6.1% from 6.0%. March figures were revised lower, too.

It wasn't all doom and gloom, though.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"The payroll data does not suggest that the reopening is stalling," says Brian Timberlake, head of fixed income research at Voya Investment Management. "On a non-seasonally adjusted basis, 1.1 million jobs were added."

Plus, the slight rise in the unemployment rate occurred in conjunction with an increase in overall labor force participation. "As a result, the employment-to-population ratio – which we view as more representative of the current labor market dynamics – increased for the month from 57.8% to 57.9%."

So why exactly did stocks rise today? The disappointing jobs number will likely "give Fed Chair Powell some relief on the urgency to talk about tapering," says Timberlake. In other words, no changes to the central bank's bond-buying program and no interest-rate hikes quite yet.

When the closing bell rang, the Dow was up 0.7% at 34,777, and the S&P 500 was 0.7% higher at 4,232 – both fresh peaks. The Nasdaq Composite finished strong, too, gaining 0.9% to 13,752.

Other action in the stock market today:

- The small-cap Russell 2000 closed up 1.4% at 2,271.

- Square (SQ, +4.2%) was a big earnings winner today. The fintech firm reported higher-than-expected profit of 41 cents per share in its first quarter. Revenues, meanwhile, surged 266% year-over-year to $5.06 billion, thanks in part to a $3.5 billion boost from bitcoin.

- Roku (ROKU, +11.6%) also gained ground after its first-quarter results. The streaming name swung to a per-share profit of 54 cents, compared to a quarterly loss in the year prior. Revenues spiked 79% to $574.2 million – its highest quarterly growth rate on record.

- U.S. crude oil futures gained 0.3% to end at $64.90 per barrel.

- Gold futures rose 0.9% to settle at $1,831.30 an ounce – their highest finish since Feb. 10.

- The CBOE Volatility Index (VIX) fell 9.2% to 16.69.

- Bitcoin prices rose 2.7% to $57,658.05. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

How to Get Your Foot In the Investing Door

"Where should I start?" For new investors, it's easy to be overwhelmed, especially with so many new investing apps and investments that have popped up in recent years.

In fact, as a beginner, your first investment is time – researching not only where to invest your money, but also how to invest your money. Unfortunately, there's one group of investors that has very little time on their hands: new moms, who typically prioritize everyone else's needs over their own.

Finding even a few minutes here and there to start investing "will pay dividends down the road," says Zuzana Brochu, vice president of financial planning strategy at People's United Advisors. This Mother's Day, treat yourself (or the new mom in your life) to 15 minutes of portfolio building – it will feel good, and you've certainly earned it! Our gift to you: a list of five simple steps for new moms to start investing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Look Out for These Gold Bar Scams as Prices Surge

Look Out for These Gold Bar Scams as Prices SurgeFraudsters impersonating government agents are convincing victims to convert savings into gold — and handing it over in courier scams costing Americans millions.

-

How to Turn Your 401(k) Into A Real Estate Empire

How to Turn Your 401(k) Into A Real Estate EmpireTapping your 401(k) to purchase investment properties is risky, but it could deliver valuable rental income in your golden years.

-

My First $1 Million: Retired Nuclear Plant Supervisor, 68

My First $1 Million: Retired Nuclear Plant Supervisor, 68Ever wonder how someone who's made a million dollars or more did it? Kiplinger's My First $1 Million series uncovers the answers.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

Stocks Chop as the Unemployment Rate Jumps: Stock Market Today

Stocks Chop as the Unemployment Rate Jumps: Stock Market TodayNovember job growth was stronger than expected, but sharp losses in October and a rising unemployment rate are worrying market participants.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.