Stock Market Today: Stocks Fall Again as Energy Sector Swoons

Weakness in energy stocks and dismal housing data weighed on stocks today.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

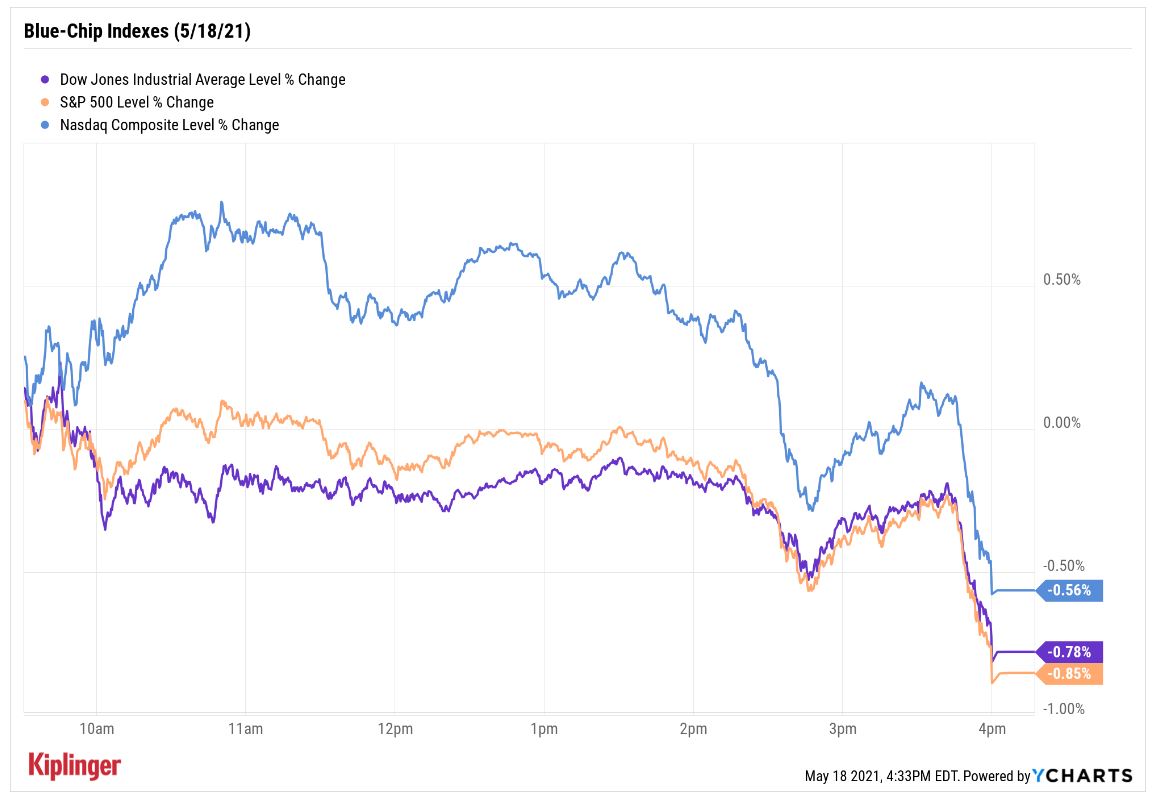

Stocks were hit with a second day of selling, as the energy sector (-2.3%) retreated following its recent run higher and data showed new housing starts fell dramatically in April.

"Commodities markets are self-correcting… [and] what sometimes happens is a surge in prices can sap demand," says Michael Reinking, senior market strategist for the New York Stock Exchange.

"This was somewhat on display this morning as the new housing starts number fell 9.5% (month-over-month) following the well-documented surge in lumber prices over the last year. There is still plenty of underlying demand as building permits were flat m/m."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

One bright spot today was Walmart (WMT, +2.2%), which jumped after the mega-retailer reported stronger-than-expected Q1 results and raised its full-year forecast.

"Walmart was the top-performing member of the Dow today based on a positive earnings surprise and implications that big box stores are weathering the coronavirus reopening phase in good shape," says David Keller, chief market strategist at StockCharts.com.

"The stock jumped up to $145 earlier today, taking the stock above key trendline resistance and continuing the recovery from a low around $125 in earlier March. Walmart would need to remain above the $135 level to continue its current bullish trend. The real question for WMT is the sustainability of recent price gains in the face of broad selling pressure for equities and uncertainty about economic conditions in the coming months."

WMT's strength wasn't enough to keep the Dow Jones Industrial Average in the black, with the index falling 0.8% to 34,060 on weakness in oil major Chevron (CVX, -3.0%). The S&P 500 Index followed suit, shedding 0.9% to 4,127.

Other action in the stock market today:

- The Nasdaq Composite couldn't hold on to earlier gains, falling 0.6% to 13,303.

- The Russell 2000 dropped 0.7% to 2,210.

- Home Depot (HD, -1.0%) reported first-quarter earnings and revenues that easily beat estimates. The Dow stock still closed lower amid broad-market headwinds.

- U.S. crude futures gave back 1.2% to settle at $65.49 per barrel.

- Gold futures eked out a fractional gain to end at $1,868.00 an ounce.

- The CBOE Volatility Index (VIX) spiked 8.2% to 21.34.

- Several high-profile retail earnings roll in this week, with Cisco Systems (CSCO) among the top ones to watch.

Buffett's Latest Stock Picks

The most important announcement over the past 24 hours, for Buffettologists at least, was the release of Berkshire Hathaway's (BRK.B) latest holdings list.

Warren Buffett, the famed CEO of Berkshire, revealed his firm's highly anticipated 13F filing on Monday night, showing the Oracle of Omaha and his team did a lot more selling than buying in the first quarter of 2021.

In addition to reversing course on a Dow stock that Berkshire had just piled into in the second half of 2020, Buffett continued to take a hatchet to the Berkshire Hathaway equity portfolio in big bank stocks. There was some notable action on the buy side, too, with "Uncle Warren" boosting his stake in a major grocery chain and opening a new position, fittingly, in the insurance industry.

To see which stocks Buffett bought and sold to start the year, read on as we take a closer look at the 18 moves he made in his portfolio over the most recent quarter.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

4 Estate Planning Documents Every High-Net-Worth Family Needs

4 Estate Planning Documents Every High-Net-Worth Family NeedsThe key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares in This Situation

How to Get the Fair Value for Your Shares in This SituationWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.