Stock Market Today: Quick Crypto Crash Briefly Shakes Market

Stocks struggled early amid rapid double-digit declines in digital currencies, as well as asset-bubble worries from the ECB, but closed Wednesday with merely mild losses.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

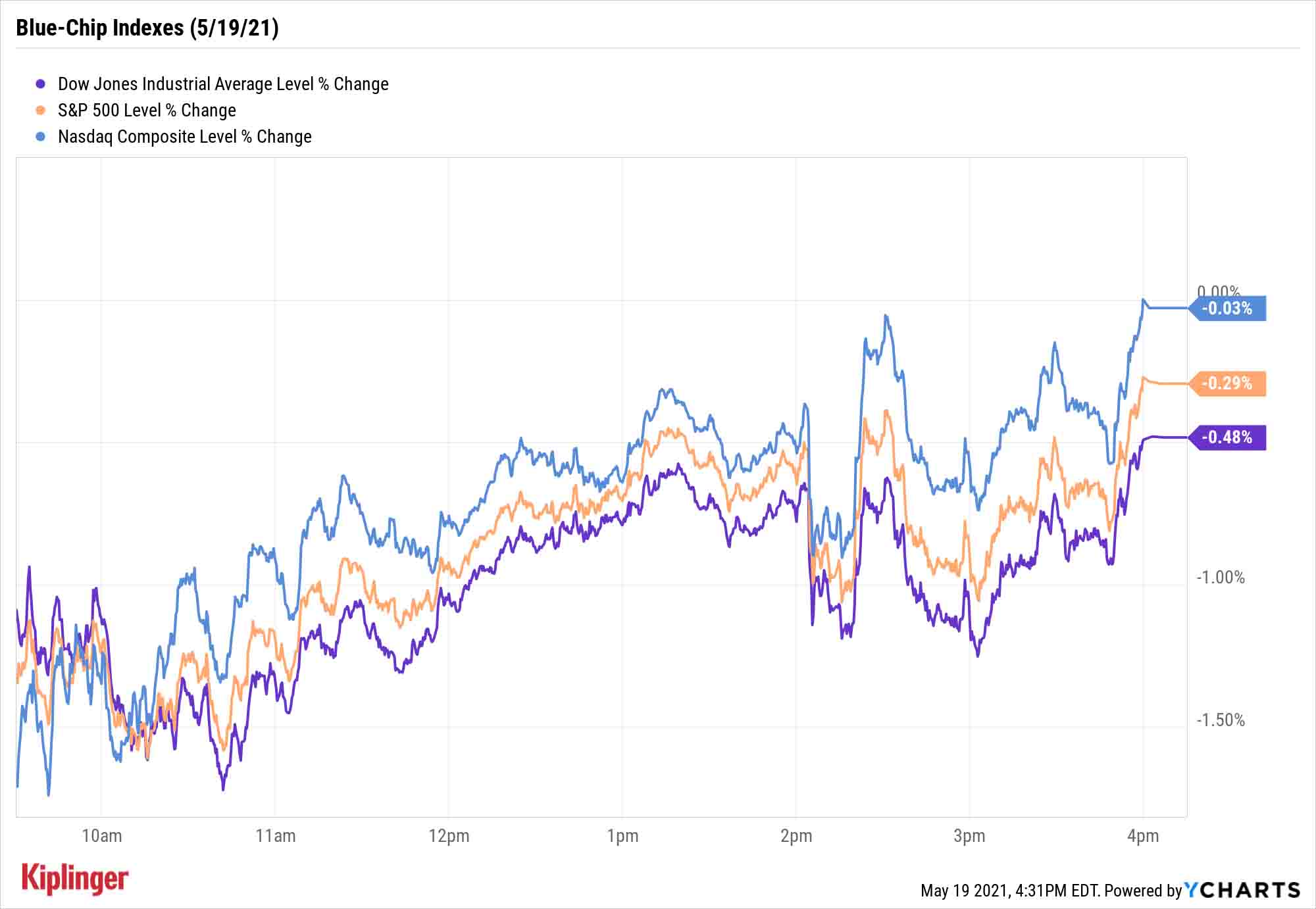

The Dow Jones Industrial Average absorbed its third consecutive loss on Wednesday amid a broad but ultimately mild selloff sparked by continued worries over a bubble in financial assets.

The European Central Bank's Financial Stability Report today declared that "some market segments continue to show signs of elevated valuations and may be at risk of a correction," echoing similar sentiment from the U.S.'s Federal Reserve.

Several analysts also posited that investors were unnerved by a nasty spill in digital currencies, with major players Bitcoin and Ethereum hemorrhaging as much as 32% to 45%, respectively, before recovering much of those losses. Bitcoin closed off 9.8% to $39,146.44, while Ethereum finished down 22.2% to $2,638.73. (Cryptocurrencies trade 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Benjamin Tsai, president and managing partner of registered investment advisor Wave Financial, cited a laundry list of reasons for the plunge, from Tesla CEO Elon Musk's sudden 180 on Bitcoin because of energy consumption concerns, to China's move to ban financial institutions from accepting crypto payments, to $8.5 billion in automated selling.

"Also, given the size of this selloff, some market participants could have made it worse due to their inexperience in managing risk," he says. "The retail and corporate class that just entered after the start of 2021 … are more likely to de-risk and also sell into the market, creating a small cascading effect."

Within cryptocurrencies, however, this kind of volatility is far from rare.

"Bitcoin has gone through more than 20 20% drops since it was created in 2010," says Lule Demmissie, President of Ally Invest. "It can be risky to invest in an up-and-coming space, and it's hard to say where Bitcoin should be trading now without any cash flows or financial data to base the valuation on."

Stocks dropped sharply early on but regained some ground in the afternoon. The Dow finished off its lows declining 0.5% to 33,896. Relative strength in tech helped the Nasdaq Composite finish with a marginal decline to 13,299.

"The selloff also reflects growing investor unease about inflation and whether it would warrant the Fed to act to rein it in earlier than expected," says Anu Gaggar, senior global investment analyst for Commonwealth Financial Network, a registered investment adviser and independent broker/dealer. "While a lot of red on the screen may make investors uncomfortable, such market actions are quite normal for a well-functioning market and not cause for much concern or an indication of a more sustained underlying trend just yet.

Other action in the stock market today:

- The S&P 500 retreated 0.3% to 4,115.

- The small-cap Russell 2000 dipped 0.8% to 2,193.

- Advanced Micro Devices (AMD, +2.4%) stock was in the minority today, spending most of the afternoon in positive territory and closing higher after the chipmaker said its board of directors approved a $4 billion share repurchase program.

- Target (TGT, +6.1%) was another name that ended comfortably in the green. Shares of the retailer got a boost after TGT reported a 23% surge in sales to $24.2 billion in its first quarter, handily beating expectations. Earnings of $3.69 per share also came in well above the consensus estimate.

- Home improvement retailers remained in focus today, after Lowe's (LOW, -1.1%) released higher-than-anticipated first-quarter earnings this morning – following in the footsteps of Home Depot (HD, -0.7%) which reported its impressive quarterly results yesterday. "HD and LOW both delivered strong earnings this week, reflecting the strength in the home improvement space as well as the meteoric rise in lumber prices," says David Keller, chief market strategist at StockCharts.com. "Consumers are clearly investing in their homes, and the strength in HD and LOW has mirrored the strength in homebuilders and related names." And while both stocks fell in the wake of upbeat earnings, this is likely "due to inflation concerns and broader selling in the equity markets," Keller adds.

- U.S. crude oil futures slumped 3.3% to settle at $63.36 per barrel, after data from the Energy Information Administration showed domestic crude inventories unexpectedly rose last week.

- Gold futures nabbed a fifth straight win in today's risk-off session, rising 0.7% to end at $1,881.50 an ounce.

- The CBOE Volatility Index (VIX) finished 3.9% higher to 22.18.

If You Want to Take a Stab at Growth ...

The market appears to be increasingly risk-averse at the moment. For most investors, that simply means hunkering down in core positions and avoiding aggressive bets.

But tactical investors might consider raising a little cash in anticipation of taking some swings should better prices present themselves in the coming months.

What kind of swings?

Traditionally, small-cap stocks are a natural fit given their high-risk, high-reward profiles; growth plays such as these seven picks, for instance, could be a bumpy ride in the short term, but analysts have strong conviction that they'll pan out over the longer term.

The same goes for companies positioned to leverage mega-trends, such as these solar stocks; the industry has cooled off after a red-hot run in 2020's back half, making them more appealing for those seeking growth over a longer time horizon.

And there's always the true "Wall Street casino": biotech stocks.

OK, OK. The industry has both swelled in size and matured over the years, and many biotechnology plays are now respectable blue chips with diverse product lineups. But the truth remains that many biotech stocks can generate massive swings around events such as trial data releases and FDA rulings.

The summertime is peppered with several such potential catalysts, so we've compiled a list of important dates for investors to watch if they plan to chase the biotech dragon.

Kyle Woodley was long AMD as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Soars 588 Points as Trump Retreats: Stock Market Today

Dow Soars 588 Points as Trump Retreats: Stock Market TodayAnother up and down day ends on high notes for investors, traders, speculators and Greenland.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Small Caps Can Only Lead Stocks So High: Stock Market Today

Small Caps Can Only Lead Stocks So High: Stock Market TodayThe main U.S. equity indexes were down for the week, but small-cap stocks look as healthy as they ever have.

-

Dow Adds 292 Points as Goldman, Nvidia Soar: Stock Market Today

Dow Adds 292 Points as Goldman, Nvidia Soar: Stock Market TodayTaiwan Semiconductor's strong earnings sparked a rally in tech stocks on Thursday, while Goldman Sachs' earnings boosted financials.

-

Visa Stamps the Dow's 398-Point Slide: Stock Market Today

Visa Stamps the Dow's 398-Point Slide: Stock Market TodayIt's as clear as ever that President Donald Trump and his administration can't (or won't) keep their hands off financial markets.