Stock Market Today: Giddy Up, Growth! Tech and Comms Lead Gains

The technology and communication services sectors set the pace Thursday amid broad gains sparked by another pandemic low in unemployment filings.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The pendulum swung in the bulls' direction Thursday amid a couple of rosy economic data releases.

The spotlight belonged to new weekly unemployment claims, which yet again set a fresh pandemic-era low of 444,000 during the week ended May 15, down 34,000 filings from a week prior and below analysts' expectations.

Also, the Conference Board Leading Economic Index, which is used to gauge the direction of economic activity, improved 1.6% month-over-month in April, marking its best improvement since July 2020.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"The U.S. economic recovery is now in full swing," says Ryan Detrick, chief market strategist at registered investment advisor and broker-dealer LPL Financial. "Despite the natural challenges of ramping back up, the recovery still seems capable of providing upside surprises."

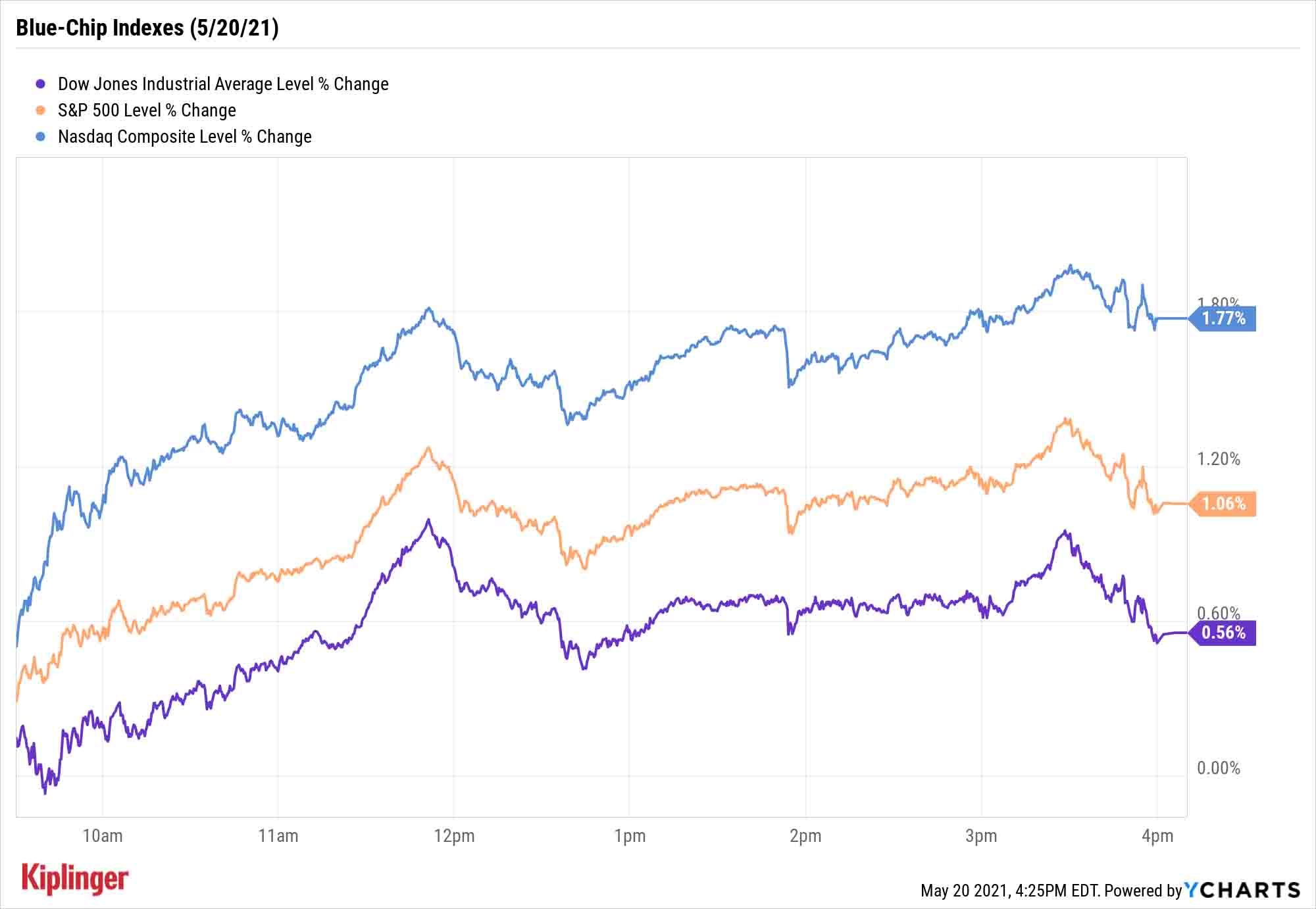

Growthier sectors such as technology and communication services stocks, which have lagged of late, sprung to life, with Netflix (NFLX, +2.9%), Nvidia (NVDA, +3.9%) and Adobe (ADBE, +2.3%) helping to propel the Nasdaq Composite 1.8% higher to 13,535.

The Dow Jones Industrial Average (+0.6% to 34,084) and S&P 500 (+1.1% to 4,159) also finished in the black.

Other action in the stock market today:

- The small-cap Russell 2000 improved by 0.6% to 2,207.

- Snap (SNAP, +5.9%) was a big winner after the Snapchat parent said it reached 500 million monthly active users. It was the first time the social media name released this metric, previously delivering updates solely on its daily active users. This was just one of a slew of headlines coming out of the company's 2021 Snap Partner Summit, with others including news on the company's push into e-commerce.

- Among stocks that didn't gain ground today was Ralph Lauren (RL, -7.0%), which plunged despite the retailer's strong fiscal fourth-quarter earnings report. RL unveiled an unexpected adjusted profit in the first three months of the year and higher-than-anticipated revenues, as well as a reinstated quarterly dividend payment and potential plans for more store closings.

- U.S. crude oil futures fell for a third straight day on expectations that the global supply of crude could build if nuclear deal talks between the U.S. and Iran progress. At the close, futures were off 2.2% to $61.94 per barrel.

- Gold futures extended their daily win streak to six – the longest such stretch of the year – eking out a marginal gain to settle at $1,881.90 an ounce.

- The CBOE Volatility Index (VIX) retreated by 7.1% to 20.60.

- Bitcoin rebounded 3.4% to $40,480.14. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Big-Time Stocks, Big-Time Growth

We frequently analyze larger publicly traded companies because of the numerous perks they provide to investors who keep their eye on the retirement ball.

They're typically less volatile than their smaller brethren, which provides a psychological advantage – one that helps investors keep a steady hand and avoid self-inflicted wounds in the face of market turbulence.

They also tend to be more financially stable, which allows them to dole out regular dividends that form the backbone of many retirement accounts. It's no accident that the market's most reliable dividend payers, and most of our favorite income-producing retirement stocks, are typically companies valued in tens (or hundreds) of billions.

But typecast large-cap stocks at your own peril – they can deliver potent price gains, too.

While shares of most companies are trying to catch their breath at elevated levels, a number of blue-chip stocks are expected to resume climbing the mountaintop. If you're trying to identify growth opportunities but don't want to crank up the risk dial too far, consider the following batch of five large-cap stocks with price targets implying returns of at least 20% by this time next year.

Kyle Woodley was long NVDA as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.