Stock Market Today: Dow Swings Lower to Snap Win Streak

Stocks started the day higher, but ran out of steam as the day wore on.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stocks started the day on solid footing, but eased back as investors digested a round of economic updates.

Kicking things off was the S&P CoreLogic Case-Shiller 20-city composite index, which showed home prices in the U.S. jumped 13.3% on an annual basis in March.

This spike likely had a trickle-down effect to those looking to buy, with the Census Bureau reporting new home sales fell almost 6% in April, though they are still up 48% on a year-over-year basis.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

And the Conference Board said its consumer confidence index, which reflects prevailing business conditions, remained relatively unchanged from its April reading.

"Consumers' assessments of the present situation have improved substantially and continuously over the past four months, with the index having gained 59pts since January," says Barclays economist Pooja Sriram.

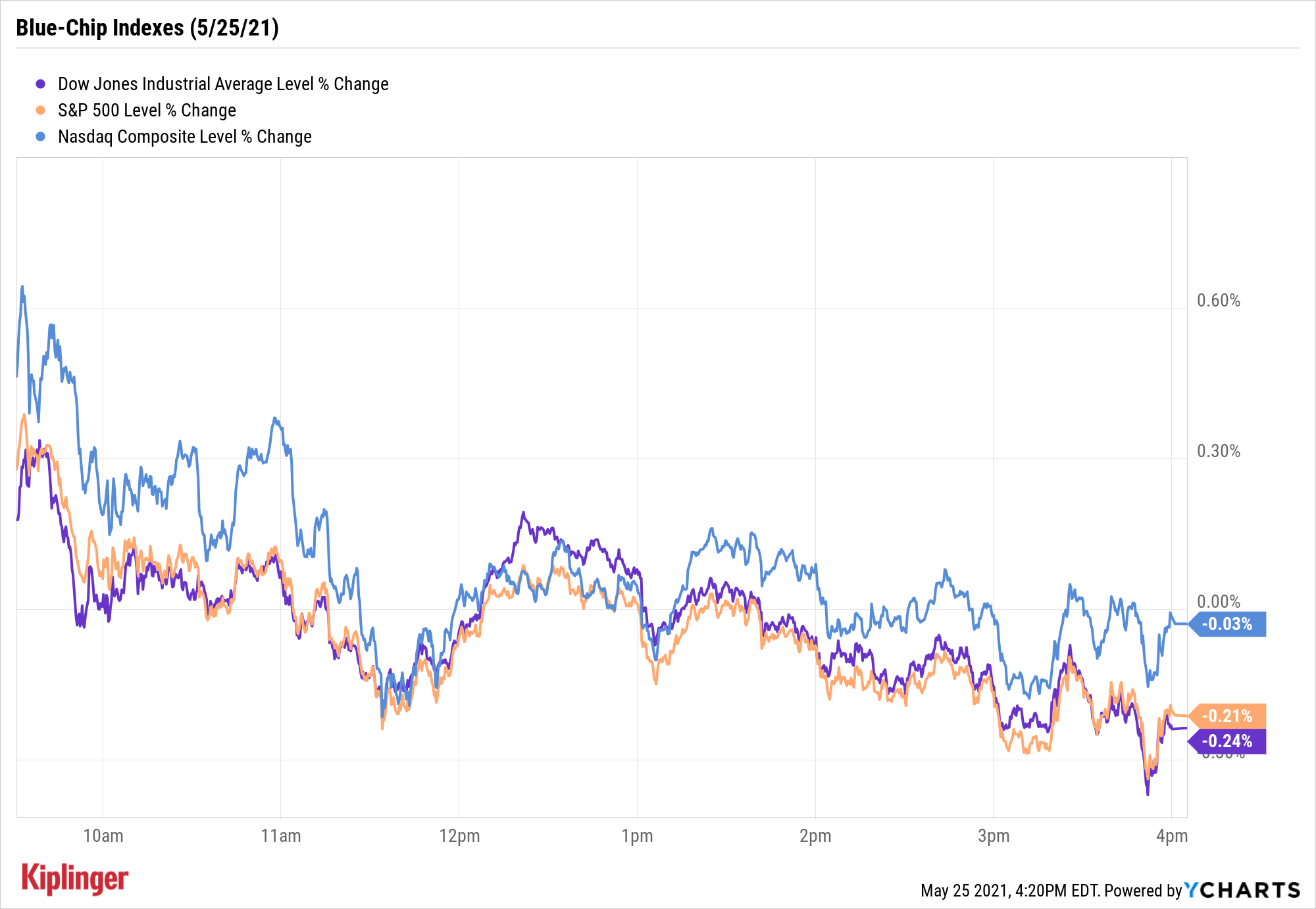

Following three days of gains, the Dow Jones Industrial Average closed today's session down a modest 0.2% at 34,312. The S&P 500 Index also ended the day with a slight loss, off 0.2% at 4,188.

Other action in the stock market today:

- The Russell 2000 fell 1.0% to 2,205.

- The Nasdaq Composite slipped 0.03% to 13,657.

- Lordstown Motors (RIDE, -7.5%) took a hit today, after the Ohio-based electric vehicle maker more than halved its full-year production guidance. The company's CEO Steve Burns said it has "encountered some challenges" ahead of the manufacturing of its Endurance electric pickup truck, and that RIDE needs "additional capital to execute our plans."

- Amazon.com (AMZN, +0.4%) was in the headlines today after the Wall Street Journal reported the company is nearing a deal to buy Hollywood studio MGM Holdings for $9 billion, according to people familiar with the matter. Additionally, the District of Columbia today said it filed an antitrust suit against the e-commerce giant for alleged illegal pricing practices.

- U.S. crude oil futures eked out a fractional gain to settle at $66.07 per barrel.

- Gold futures gained 0.7% to finish at $1,898.00 an ounce.

- The CBOE Volatility Index (VIX) rose 2.4% to 18.8.

- Bitcoin prices fell 6% to $37,281.98. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Worried About Inflation? Read On.

How diversified is your portfolio?

This is a question Lauren Goodwin, economist and portfolio strategist at New York Life Investments, wants investors who are concerned about inflation to ask themselves. "Diversification is still important for investors, but the yield from traditional fixed-income assets may remain lower than long-term historical averages," says Goodwin, who recommends considering a multi-asset approach to investing.

If you're looking for opportunities to increase the income-building part of your portfolio, consider value stocks and steady dividend payers, which she says typically do well in a rebounding economy.

"The combination of long-term trends, cyclical macro tailwinds and careful security selection could create the foundation for a strong 'new economy' core allocation." Read on as we explore 11 of 2021's best monthly dividend stocks and funds for easier income planning.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Dow Dives 870 Points on Overseas Affairs: Stock Market Today

Dow Dives 870 Points on Overseas Affairs: Stock Market TodayFiscal policy in the Far East and foreign policy in the near west send markets all over the world into a selling frenzy.