Stock Market Today: Small Caps Shine as Meme Stocks Rise Again

Is it the return of the "meme stock"? Gains in GameStop, AMC Entertainment led a Wednesday rally in the small-cap Russell 2000.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Wednesday marked the 125th anniversary of the Dow Jones Industrial Average's founding, but the spotlight belonged to small caps thanks in part to a resurgence in so-called meme stocks.

GameStop (GME, +15.8%), which made headlines earlier this year amid a massive short squeeze, has rocketed higher yet again recently after the company quietly revealed that it was getting into non-fungible tokens (NFTs).

Meanwhile, AMC Entertainment (AMC, +19.2%), a movie-theater chain that was also caught up in January's short-squeeze action, flew higher today on no positive news; in fact, B. Riley analyst Eric Wold downgraded the stock to Neutral, saying "we are moving to the sidelines with an inability to justify taking that ($16 price target) any higher at this point." AMC closed Wednesday's trading at $19.54.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

These gains – as well as advances in many small-cap reopening plays, such as Express (EXPR, +25.9%) and Bed Bath & Beyond (BBBY, +11.6%) – helped the Russell 2000 jump 2.0% to 2,249.

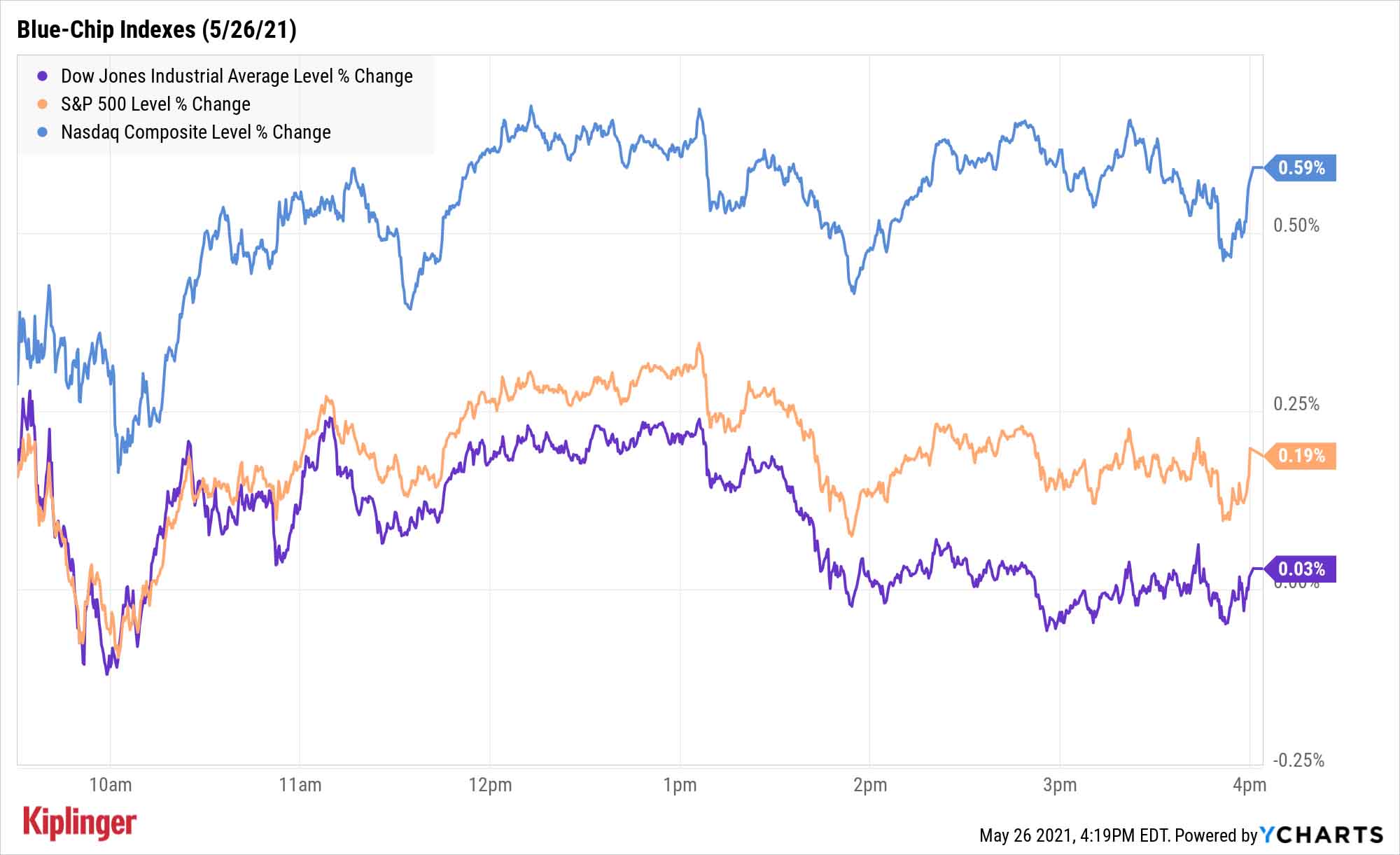

The larger indexes were positive, too, though more modestly so. The Nasdaq finished 0.6% higher to 13,738, and the S&P 500 gained 0.2% to 4,195.

The Dow wasn't particularly celebratory on its 125th birthday, closing out with a marginal gain to 34,323.

"Today marks, in many ways, the birthday of my profession. On May 26, 1896, Charles Dow first published a list of 12 industrial companies, combining their prices in an index for the first public index of the stock market," says Brad McMillan, chief investment officer for Commonwealth Financial Network. "Note that phrase, because a standard of measurement – an index – was the necessary first step in transforming a market of stocks (i.e., individual companies) into a stock market.

"Before, we had a bunch of trees, and it was hard for investors to see the forest. Dow put the forest front and center with his index."

Other action in the stock market today:

- Retail earnings are rolling in, and results from department store chain Nordstrom (JWN, -5.8%) and specialty apparel maker Urban Outfitters (URBN, +10.0%) were in focus today. A wider-than-expected first-quarter loss knocked JWN shares lower, while URBN stock got a lift after the retailer reported top- and bottom-line beats in its Q1 and said same-store sales surged 51% year-over-year.

- Ford (F, +8.5%) was a big winner after the automaker made a number of well-received announcements at its annual investor day. As part of new CEO Jim Farley's new Ford+ plan, the company is aiming to boost investment in electric vehicles (EVs) to $30 billion through 2025 – $8 billion more than it announced in February – and said it expects 40% of its global sales to come from EVs by 2030.

- U.S. crude oil futures edged up 0.2% to settle at $66.21 per barrel – a fourth consecutive gain.

- Gold futures rose 0.2% to finish at $1,901.20 per ounce, their loftiest settlement since Jan. 7.

- The CBOE Volatility Index (VIX) declined 7.0% to 17.52.

- Bitcoin prices rebounded 3.4% to $38,544.90. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Keep Your Eyes on Value

The Q1 earnings calendar is winding to a close, leaving precious few potential earnings beats to help offset investors' concerns during a volatile stretch for the markets.

Still, the pros are signaling that 2021 should remain a productive year.

"CFRA has raised its 12-month target price for the S&P 500 to 4,620, representing a 10.3% projected price appreciation from the May 25 closing value," says Sam Stovall, chief investment strategist for CFRA.

While he admits that gains could be tamped down by a smaller infrastructure package and inflation concerns, he says "equity prices should continue to be propelled by increasingly encouraging global GDP and EPS growth projections as the worldwide economy continues to emerge from the COVID clampdown."

That should mean additional upside for airline stocks, restaurant picks and other travel-related plays, which have cooled off in recent weeks. However, you can also set yourself up for gains by sticking with value – in the few places you can find it, anyway.

The broader market is downright frothy at the moment, but we've identified a number of value-priced income picks – specifically, S&P 500 Dividend Aristocrats that are cheaper than the market at current prices. Read on as we explore these relative bargains.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.

-

Dow Adds 472 Points After September CPI: Stock Market Today

Dow Adds 472 Points After September CPI: Stock Market TodayIBM and Advanced Micro Devices created tailwinds for the main indexes after scoring a major quantum-computing win.