Stock Market Today: Stocks End Higher Ahead of Long Holiday Weekend

A better-than-expected reading on personal income and Salesforce earnings helped boost indexes ahead of Memorial Day.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The handful of investors that stuck around today ahead of the long holiday weekend (U.S. stock markets will be closed Monday for Memorial Day) weren't fazed by the latest sign of rising inflation.

"The Fed's favorite inflation indicator – the core personal consumption expenditures (PCE) index – just put in the highest reading since 1992, coming in at a blistering 3.1% year-over-year," says Cliff Hodge, chief investment officer for Cornerstone Wealth. "We anticipate at least another couple of months of these hot readings before we get some cooling off."

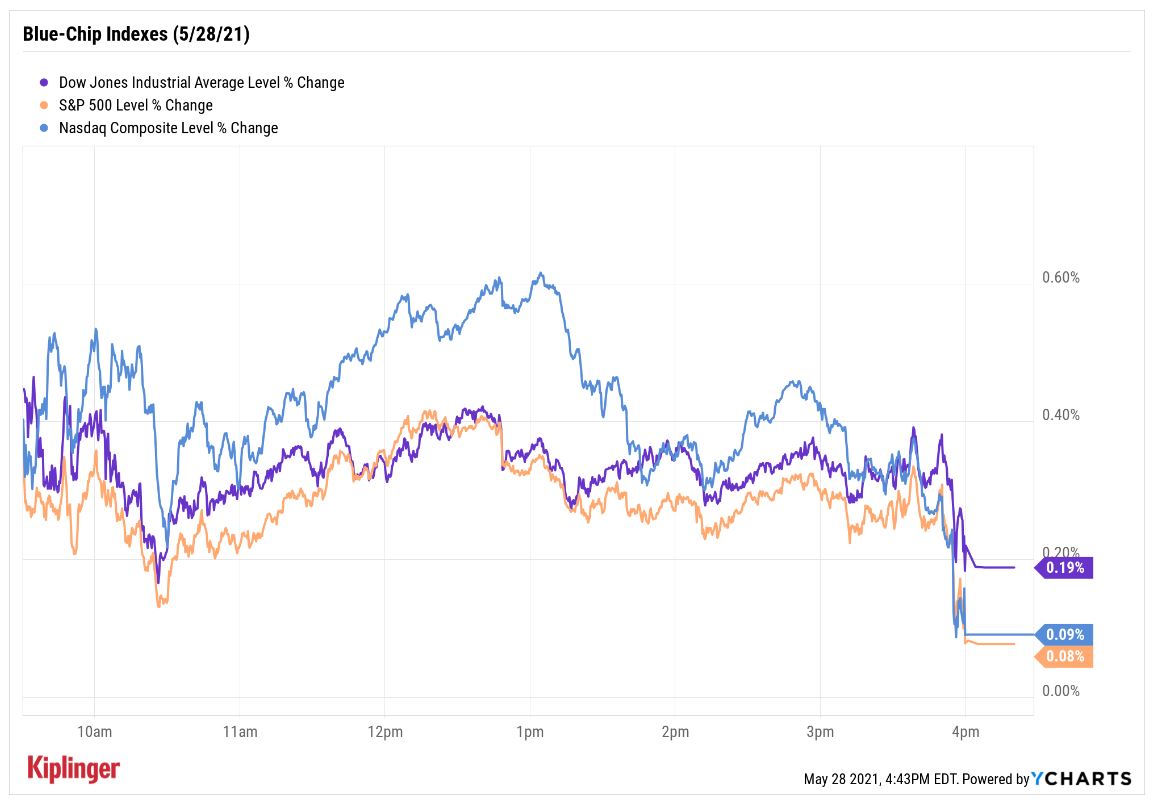

Nevertheless, the broad-market indexes all closed the week with modest gains, as additional data released today showed a slimmer-than-expected fall in personal income in April and a big spike in business activity in Chicago this month.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Stronger-than-forecast earnings from cloud-based software company Salesforce.com (CRM, +5.5%) also helped lift the collective mood on Wall Street, with the Dow Jones Industrial Average adding 0.2% to 34,529. The S&P 500 Index and Nasdaq Composite followed suit, gaining 0.1% to 4,204 and 0.1% to 13,748, respectively.

Other action in the stock market today:

- The small-cap Russell 2000 slipped 0.2% to 2268.

- AMC Entertainment Holdings (AMC, -1.5%) eased back today following a blistering rally for meme stocks this week. Despite closing in the red today, AMC shares more than doubled on a week-over-week basis.

- Boeing (BA, -1.5%) was the worst Dow stock today. The shares closed lower after the Wall Street Journal reported the company has paused deliveries of its 787 Dreamliners after the U.S. Federal Aviation Administration (FAA) requested additional production information, according to people familiar with the matter.

- U.S. crude oil futures fell 0.8% to end at $66.32 per barrel.

- Gold futures rose 0.4% to settle at $1,905.30 an ounce.

- The CBOE Volatility Index (VIX) edged up 0.1% to 16.76.

- Bitcoin prices slumped 7.7% to $35,861.38. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

A Lumber Market "Supercycle"?

The lumber market could be entering a "supercycle" of sustained growth in demand that drives lumber prices higher and higher.

"Given the demand strength we continue to see from U.S. homebuilding activity, we still believe the lumber markets could be settling into a structurally 'higher for longer' price environment," say Raymond James analysts.

While futures prices for the commodity have eased back from mid-May record highs, a red-hot housing market, robust home-repair activity and limited sawmill capacity could create the perfect storm for timber prices to continue to gain ground – and lift lumber stocks along the way.

Throw in a post-pandemic economic recovery and infrastructure spending through President Biden's American Jobs Plan, and the surge in lumber prices could last for years. Read on as we explore seven lumber stock picks that could benefit from more upside in the commodity.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Stocks Struggle for Gains to Start 2026: Stock Market Today

Stocks Struggle for Gains to Start 2026: Stock Market TodayIt's not quite the end of the world as we know it, but Warren Buffett is no longer the CEO of Berkshire Hathaway.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

Stocks End Volatile Year on a Down Note: Stock Market Today

Stocks End Volatile Year on a Down Note: Stock Market TodayAfter nearing bear-market territory in the spring, the main market indexes closed out the year with impressive gains.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

AI Stocks Lead Nasdaq's 398-Point Nosedive: Stock Market Today

AI Stocks Lead Nasdaq's 398-Point Nosedive: Stock Market TodayThe major stock market indexes do not yet reflect the bullish tendencies of sector rotation and broadening participation.

-

Small Caps Hit a New High on Rate-Cut Hope: Stock Market Today

Small Caps Hit a New High on Rate-Cut Hope: Stock Market TodayOdds for a December rate cut remain high after the latest batch of jobs data, which helped the Russell 2000 outperform today.