Stock Market Today: Markets Dip Despite Upbeat Jobs Data

Good news about the state of the labor market just a day ahead of the monthly payrolls report stirred anxiety about inflation and rising interest rates.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stocks closed lower Thursday after strong jobs data got traders fretting once again about the specter of inflation.

With tomorrow's monthly payrolls report on deck, today we learned weekly initial unemployment claims dropped below 400,000 for the first time since March 2020, an indication of a labor market on the mend. ADP's own data puts May's new-jobs number at 1 million, a figure well ahead of economists' estimates.

Although April's dismal numbers surprised and disappointed investors, the possibility of a red-hot May report tomorrow morning was enough to stoke inflation fears and, in turn, anxiety over interest rates.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"This morning’s economic data has rates moving higher," writes Michael Reinking, senior market strategist at the New York Stock Exchange. "Just as the Street seemed to coalesce around the idea of another disappointing jobs number tomorrow, the ADP employment report came in at 1.5-times the Street estimate. Keep in mind, last month’s ADP report was also much stronger than the official data."

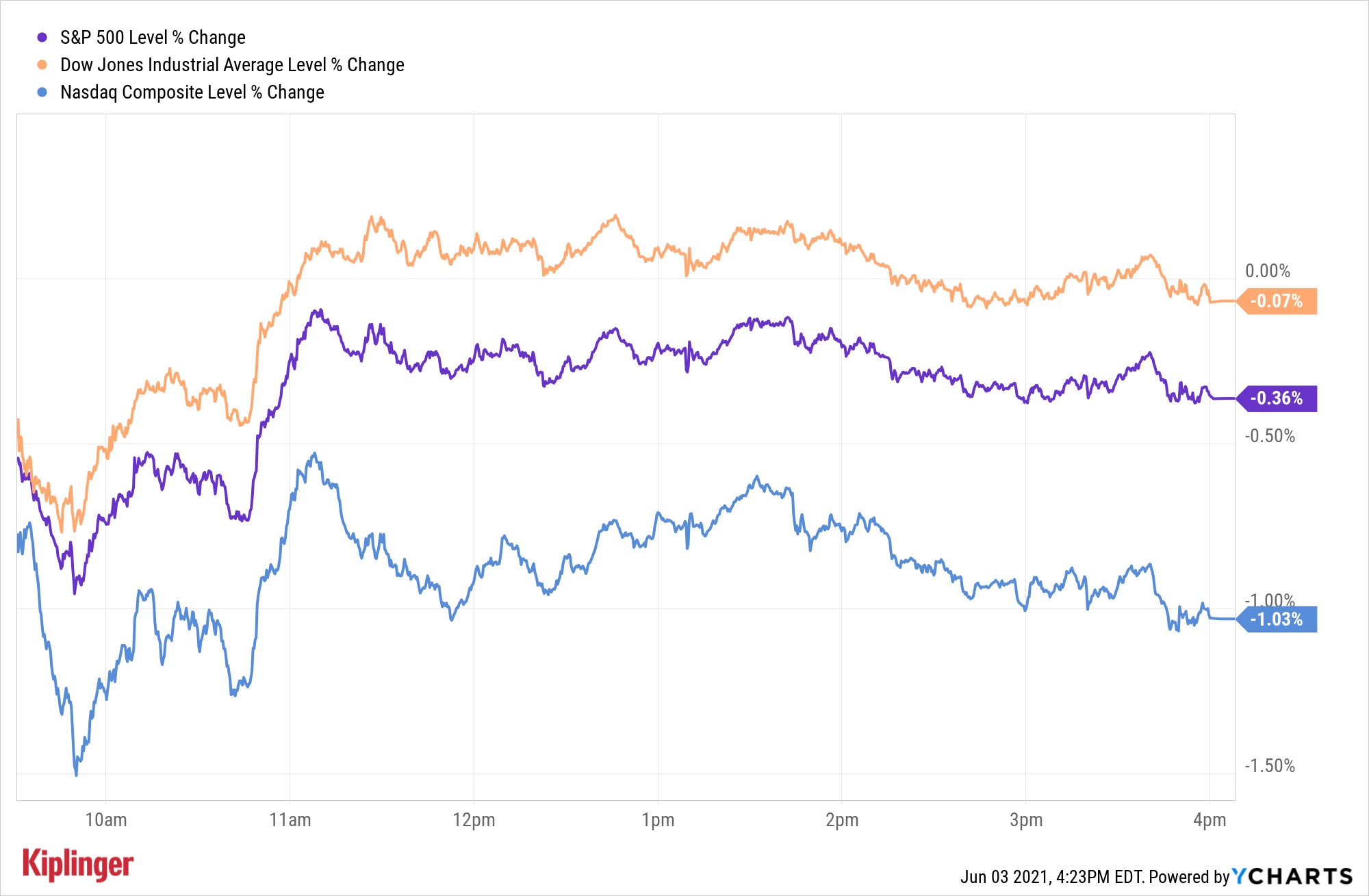

As has been the pattern, big, pricey tech stocks such as Microsoft (MSFT, -0.6%), Amazon.com (AMZN, -1.5%) and Apple (AAPL, -1.2%) suffered the brunt of the selling. The more value-oriented Dow Jones Industrial Average slipped less than 0.1% to close at 34,577, while the broader S&P 500 dipped 0.4% to finish at 4,192. The tech-heavy Nasdaq Composite was the laggard of the major indexes, falling 1.0% to settle at 13,614.

Other action in the stock market today:

- The Russell 2000 small-cap index fell 0.8% to close at 2,279.

- AMC Entertainment (AMC, -17.9%) swung wildly as it sold a total of 11.6 million shares at an average price of $50.85 a share. The offering, which raised $587.4 million in new equity, coincided with the stock falling almost 40% at one point during the session.

- Tesla (TSLA, -5.3%) tumbled on a report that the electric-vehicle maker's orders in China fell by nearly half in May compared with April.

- U.S. crude oil futures rose 0.1% to $68.89 a barrel.

- Gold futures gained 1.9% to $1,873.20 an ounce.

- Bitcoin prices increased 2.3% to $38,623. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Traders trade and investors invest

And that difference between the two often affords the latter an advantage.

It is, of course, too soon to know if inflation fears are overblown or not, but the "good news is bad news trade" we saw Thursday has long been a staple of bull markets. Such markets are also said to "climb a wall of worry," among too many other cliches.

As dizzying as traders' daily mood swings can be, they do give long-term investors a chance to buy good stocks at lower prices. Just have a look at some of the stocks billionaires are buying these days. The big money is scooping up lagging tech stocks, in some cases even starting big positions in names as unloved as Dow stock Intel (INTC).

Indeed, bargain hunters can find value picks aplenty throughout the tech sector. And it's not for nothing that some of Wall Street's highest-rated stocks can be found in the market-lagging Nasdaq Composite index.

So before you follow skittish traders blindy out of tech and other growthier stocks this year, consider that it might be time to go shopping while some of these names are on sale. With that in mind, have a look at 11 of the best tech stocks to buy for the rest of 2021.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

The Cost of Leaving Your Money in a Low-Rate Account

The Cost of Leaving Your Money in a Low-Rate AccountWhy parking your cash in low-yield accounts could be costing you, and smarter alternatives that preserve liquidity while boosting returns.

-

I want to sell our beach house to retire now, but my wife wants to keep it.

I want to sell our beach house to retire now, but my wife wants to keep it.I want to sell the $610K vacation home and retire now, but my wife envisions a beach retirement in 8 years. We asked financial advisers to weigh in.

-

How to Add a Pet Trust to Your Estate Plan

How to Add a Pet Trust to Your Estate PlanAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.