Stock Market Today: Russell 2000 Leads Again as Dow, S&P Churn

The rally in small-cap stocks continued Tuesday, putting the Russell 2000 Index within a whisper of its all-time high.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Small-cap stocks continued to shine Tuesday, with the Russell 2000 climbing 1.1% to 2,343 – putting it within striking distance of its March 15 record high of 2,360.

Among the names elevating the small-cap index was Stitch Fix (SFIX, +14.1%), which popped after the online styling service reported a slimmer-than-expected per-share loss and stronger-than-forecast revenues. Workhorse Group (WKHS, +11.8%) and Casper Sleep (CSPR, +16.2%) were among other the Russell's other massive gainers.

Also grabbing the spotlight was mid-cap Clover Health Investments (CLOV, +85.8%) – the "meme stock" du jour – more than doubling in price at its session peak today.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

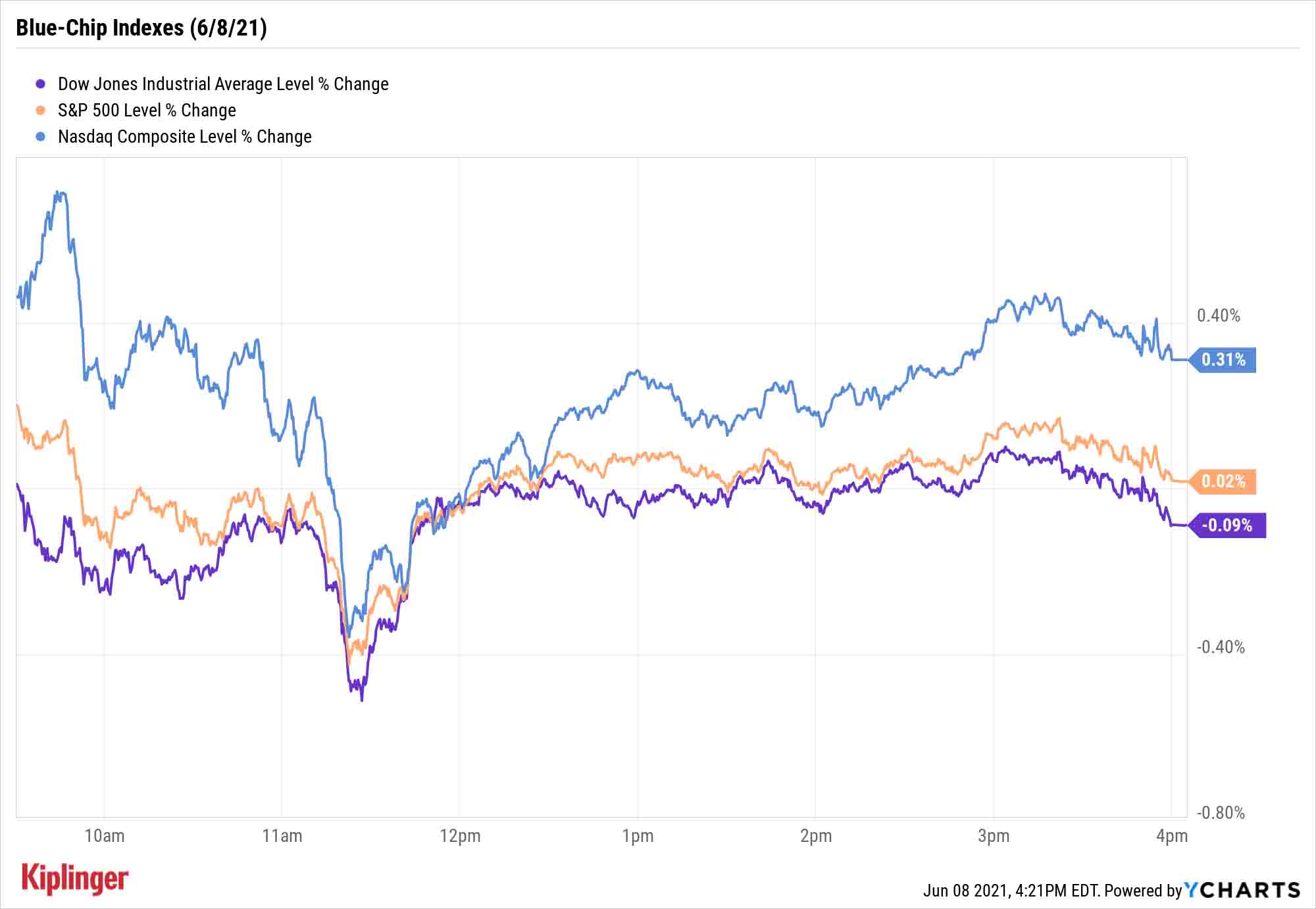

While small caps and meme stocks made big moves, it was another muted session for the blue-chip indexes, with the Dow Jones Industrial Average declining marginally to 34,599 and the S&P 500 gaining less than a point to 4,227.

"The S&P has been relatively quiet thus far [this week], trading in a tight range ahead of [Thursday's consumer price index inflation update] that may shed light on future Fed positioning," says Dan Wantrobski, technical strategist at Janney Montgomery Scott. "But the macro landscape remains ripe with potential headline risk – any of which could trigger bigger moves ahead and break the index out of its current range."

Other action in the stock market today:

- The Nasdaq Composite gained 0.3% to 13,924.

- SFIX wasn't the only earnings mover today, with Marvell Technology (MRVL, +5.1%) higher in the wake of its quarterly report. The chipmaker reported revenues and earnings per share above what analysts were expecting, and gave an upbeat forecast for the current quarter.

- Generac Holdings (GNRC, +6.3%) got a lift today after KeyBanc upgraded the power generator producer to Overweight from Sector Weight (equivalents of Buy and Neutral, respectively). Analysts said GNRC is likely to benefit from grid-stability issues, and that a recent pullback creates an attractive valuation for the large-cap stock.

- U.S. crude oil futures jumped 1.2% to end at $70.05 per barrel after the Energy Information Administration raised its 2021 West Texas Intermediate oil price forecast by 5% to $61.85 per barrel. This was the first close above the $70-per-barrel mark for crude oil futures since October 2018.

- Gold futures slipped 0.2% to finish at $1,894.40 an ounce.

- The CBOE Volatility Index (VIX) moved 4% higher to 17.08.

- Bitcoin's slide continued, with the digital currency declining 7.7% to $32,968.05. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Housing Keeps Delivering the Heat

The housing sector (+0.6%) was also a pocket of strength on a mixed day. This outperformance from homebuilders is just more of the same in 2021 amid a red-hot housing market.

"Demand for housing climbed higher in the months following the onset of the pandemic," say economists at BofA Global Research. "This has left builders to scramble to respond. The result: home prices and building costs have surged higher."

It's not only home prices that have soared (+13% year-over-year in May); valuations for housing stocks have jumped, too. And with the housing shortfall in the U.S. now at nearly 4 million homes, according to mortgage-finance firm Freddie Mac, homebuilders and housing-related stocks could have more room to run.

We've compiled a list of housing stocks that could see more tailwinds from the extreme imbalance in supply and demand. This group features several traditional homebuilders, as well as other companies providing products and services within the housing space.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.

-

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have TodayBank of America stock has been a massive buy-and-hold bust.