Stock Market Today: Stocks Tread Water Ahead of June Fed Meeting

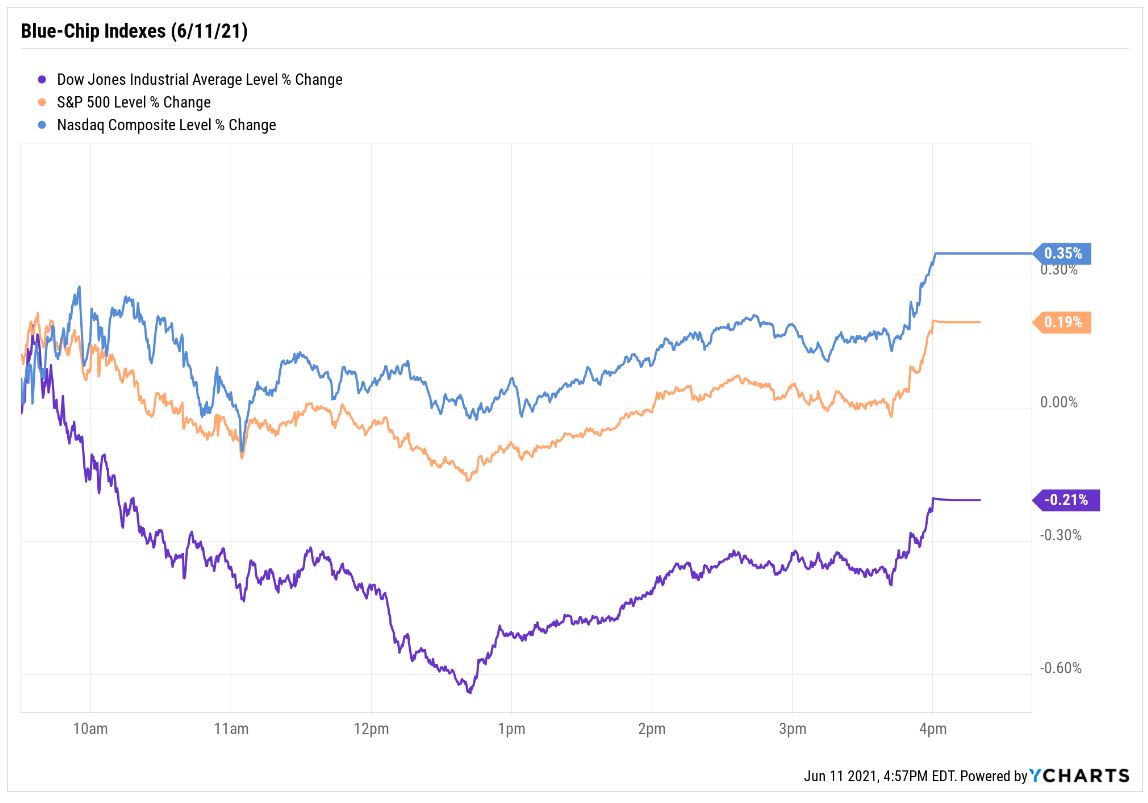

The S&P 500 managed to eke out a new record high, while the Dow muscled its way into the green at the close.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stocks started Friday with gains but lost steam as the day wore on, even as the latest consumer sentiment data came in better than expected.

After yesterday's consumer price index release, which showed inflation is indeed on the rise, today's economic numbers revealed that consumers have "unfavorable perceptions" of market prices for homes and automobiles.

Complicating matters for market participants, these two latest examples of anxiety over rising prices come ahead of next week's Federal Open Market Committee meeting, which investors will be closely watching for any signs of "taper talk" and other interest-rate policy hints.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

That said, the latest inflation data "likely does little to change the Fed's timetable for tapering asset purchases," says Ryan Detrick, chief market strategist at LPL Financial.

"The coming months will be telling, though, as we are now entering the 'show me' phase of the inflation debate where market participants will be increasingly anxious for the Fed to prove its assertion that higher inflation will be transitory."

At the close, though, the Nasdaq Composite was up 0.4% at 14,069, the S&P 500 Index gained 0.2% to 4,247 – enough for a new record high – and the Dow Jones Industrial Average ended marginally higher at 34,479.

Other action in the stock market today:

- The small-cap Russell 2000 gained 1.1% to 2,335.

- Chewy (CHWY, -5.8%) fell after its latest quarterly update. While the online pet supplies retailer reported a surprise per-share profit in its first quarter, it warned of labor shortages and "supply-chain challenges."

- Vertex Pharmaceuticals (VRTX, -11.0%) was another notable decliner today. The biotech said it would halt development of its alpha-1 antitrypsin deficiency (AATD) drug after VRTX said it likely wouldn't have real clinical benefits for those suffering from the rare genetic disease.

- U.S. crude oil futures rose 0.9% to end at $70.91 per barrel.

- Gold futures slipped 0.9% to settle at $1,879.60 an ounce.

- The CBOE Volatility Index (VIX) retreated 2.8% to 15.65.

- Bitcoin rose 1.6% to $37,282.31. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Is Growth the New "Pain Trade"?

That's a question Michael Reinking, senior market strategist for the New York Stock Exchange, is pondering.

"There is an old adage that markets move in ways that inflict the maximum amount of pain to the most participants. We see this time and again and it has occurred multiple times within the most recent market rebound," he says.

"Over the last few months the overly simplified group think has evolved to: given the re-opening and the economic rebound, interest rates will move higher and cyclicals/value stocks will outperform. Short positions in the Treasury markets hit record highs in May at the same time hedge fund positioning in growth-oriented sectors were hitting lows. So what is the pain trade? Yields move lower, cyclicals underperform and growth re-emerges."

Some investors, however, are chasing "growth" of a different sort -- quick pops in stocks that a large number of other investors have bet against, such as these 25 stocks with high short interest.

But for most buy-and-holders, it makes sense to seek out longer-term growth trends. You can find them in individual picks such as machine-learning stocks, cybersecurity names, and these 5G plays, or you can spread your risk across this batch of 13 growth ETFs. These funds allow any investor to harness the power of numerous high-growth trends without having to live or die by any one or two companies' ups and downs.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.

-

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have TodayBank of America stock has been a massive buy-and-hold bust.