Stock Market Today: Nasdaq Hits New High as FAANGs Bare Teeth

The market continued to move higher, led by a rally in Big Tech.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

It was a slow start for the major market indexes following Monday's red-hot session, but stocks gained momentum as the day wore on.

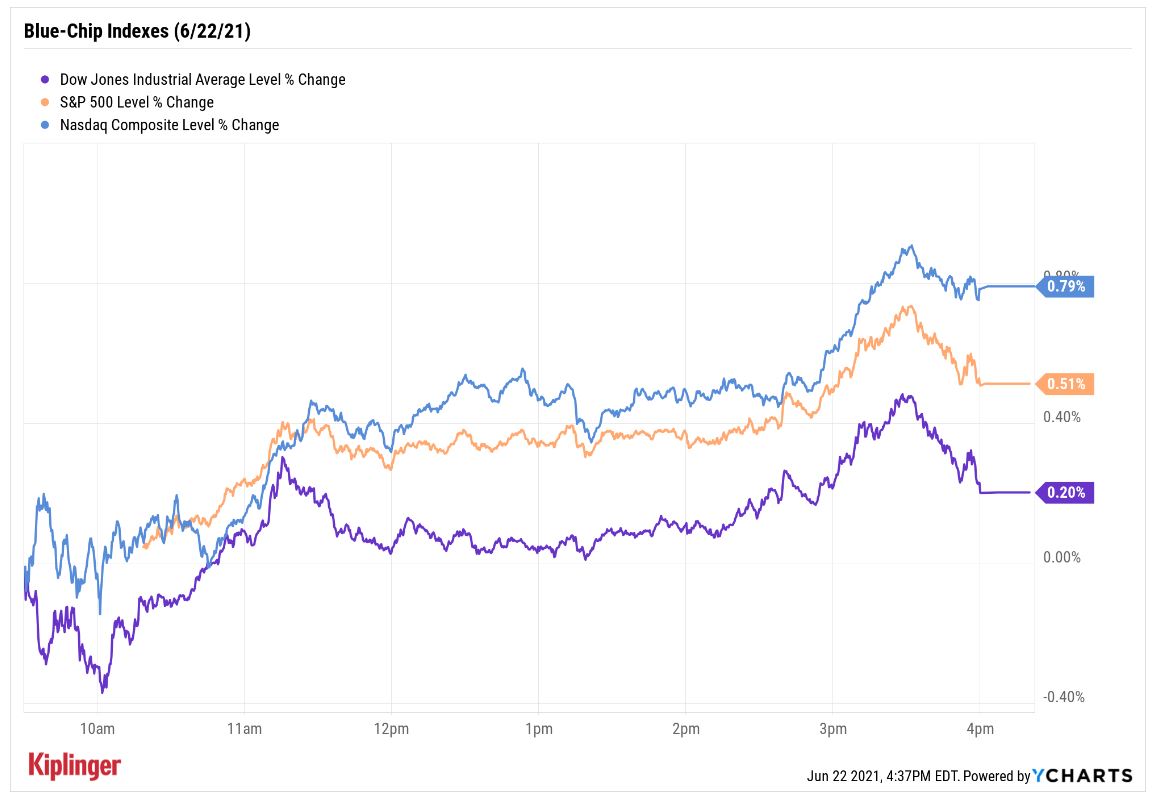

The Nasdaq Composite (+0.8% at 14,253) outpaced its peers – and hit a record high – thanks to strong gains in FAANG stocks Apple (AAPL, +1.3%), Amazon.com (AMZN, +1.5%) and Netflix (NFLX, +2.4%). But the S&P 500 Index and Dow Jones Industrial Average weren't far behind, adding 0.5% to 4,246, and 0.2% to 33,945, respectively.

As the markets crept higher, Wall Street got a look at the latest housing data, which showed home prices continued to surge in May, rising 23.6% year-over-year, with the median home price hitting a record high of $350,300. This increase in prices likely kept some potential homebuyers sidelined, as existing home sales declined 0.9% sequentially last month to a seasonally adjusted annualized rate of 5.8 million units.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"The momentum in home sales has slowed since Q3 of last year, markedly in this quarter, likely weighed down by high demand, strong home price appreciation and limited inventories," says Barclays economist Pooja Sriram.

Investors also heard from Fed Chair Jerome Powell, with today's congressional testimony marking his first appearance since the central bank last week projected higher interest rates in 2023.

Other action in the stock market today:

- The small-cap Russell 2000 gained 0.4% to 2,295.

- 3D printing company 3D Systems (DDD) jumped 27.7% after announcing a parternship with Israeli regenerative medicine firm CollPlant Biotechnologies (CLGN, +12.6%) "for a 3D bioprinted regenerative soft tissue matrix for use in breast reconstruction procedures in combination with an implant." The potential for 3D printing to take on healthcare applications also juiced shares of rivals including Stratasys (SSYS, +11.7%) and ExOne (XONE, +8.2%).

- Plug Power (PLUG), one of a handful of noteworthy earnings reports as the Q1 reporting season comes to a close, shot 14.0% higher despite a disappointing quarterly earnings report. The maker of hydrogen fuel cell systems reported a 12-cent-per-share loss , which was wider than expectations for an 8-cent loss. However, its $72 million in sales were better than the consensus analyst estimate. And the act of simply reporting its earnings were viewed as a step in the right direction; Plug's Q1 report was delayed by accounting issues that were disclosed back in March.

- U.S. crude oil futures receded after yesterday's boom, trickling 0.8% lower to $73.06 per barrel. Prices were hampered by reports that OPEC+ might relax production curbs starting in August.

- Gold futures slipped by 0.3% to settle at $1,777.40 per ounce.

- The CBOE Volatility Index (VIX) sank 6.9% to 16.66.

- Bitcoin experienced quite the volatile Tuesday. Prices plunged by as much as 12% to around $28,800 – the cryptocurrency's first trip below $30,000 since late January. However, prices rebounded 13% from those lows to $32,562.71, good for a modest 0.2% fall since Monday. "Bitcoin has a history of precipitous drops followed by setting new all-time highs," says Bankrate.com analyst James Royal. "While there's no guarantee that Bitcoin will recover this time, those who believe in its long-term future may well see this decline as an opportunity to invest more." (Cryptocurrencies trade 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Gain an Edge in a "Tricky" Trading Environment

Inflation has risen "notably" over the past few months, Powell wrote in prepared remarks to the House Select Subcommittee on the Coronavirus Crisis. He chalked this up to several factors – supply bottlenecks and increased demand as the economy reopens among them – but said high inflation should be "transitory" and will likely abate as these factors expire.

"This back-and-forth of the inflation debate perhaps presents a view of things to come – and we would caution investors that over the short-run, the trading landscape is likely to remain tricky," says Dan Wantrobski, technical strategist at Janney Montgomery Scott.

So, how do investors gain an edge in a "tricky" environment?

One way is to delve into the tireless research of the analyst set. Large clusters of bullish pros can help you identify some of the best opportunities for at least the next 12 months – say, these 10 beloved energy stocks, or these top picks within the growth-minded Nasdaq.

We also like to keep up with hedge-fund managers. These institutional investors don’t just have deep research resources – unlike analysts, they also must put their money where their mouths are. These 25 blue-chip stocks are particularly popular among Wall Street's largest investors, but naturally the question is: why? We explain what draws hedge funds to blue chips in general, and explore the bull cases for each individual pick.

Karee Venema was long AAPL as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.

-

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have TodayBank of America stock has been a massive buy-and-hold bust.