Stock Market Today: Stocks Notch Best Week in Months

Nike was a big winner on Wall Street after the company's blowout earnings report.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

It was a solid end to a strong week for stocks.

In addition to riding momentum from the bipartisan infrastructure proposal announced Thursday, Wall Street digested a not-so-bad reading on inflation. Specifically, the personal consumption and expenditures (PCE) index rose 0.4% month-over-month, while core PCE, which excludes volatile food and energy prices – increased 0.5% from April, both figures lower than economists were projecting.

"Today's inflation data should calm some nerves about runaway inflation," says Ryan Detrick, chief market strategist at LPL Financial. "Remember, the PCE is the Fed's favorite measure of inflation, and it very well could be near a peak in inflation, which should help the Fed keep its dovish policy stance."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

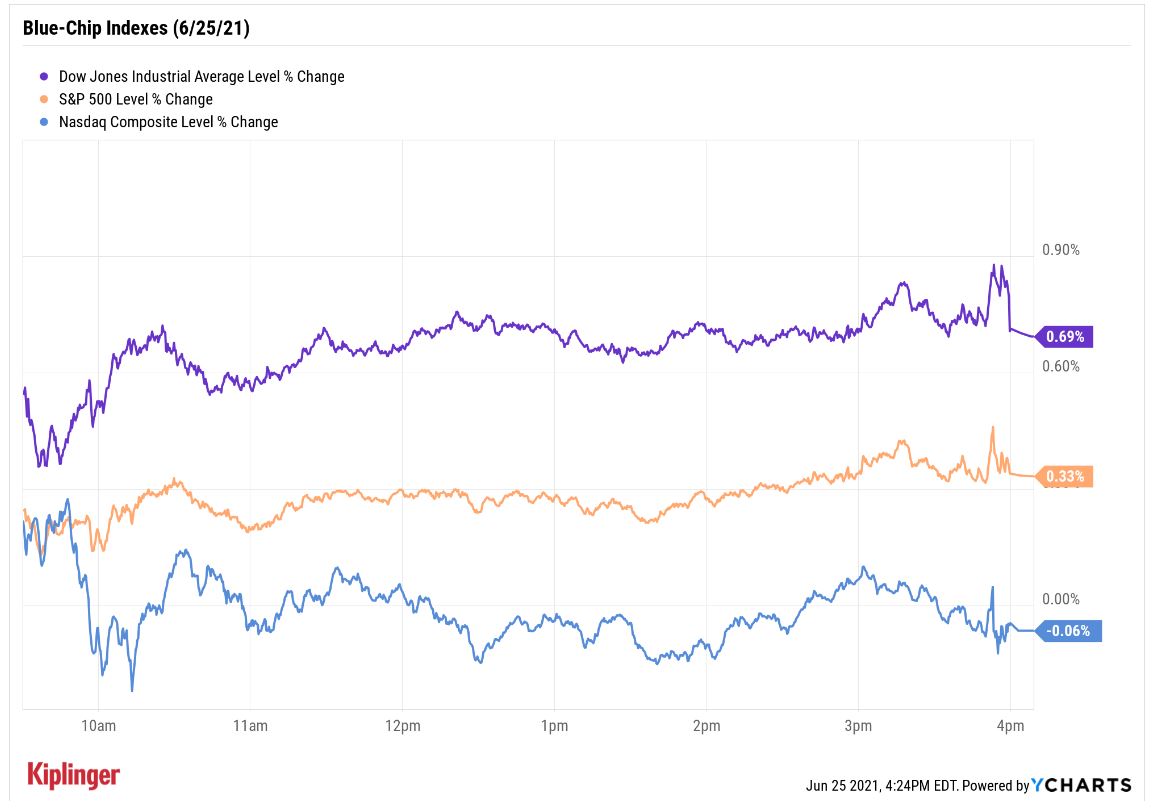

The S&P 500 Index finished Friday up 0.3% at 4,280 – a new record high, and its best weekly showing (+2.7%) since early February – as bank stocks soared on positive results to the Fed's stress tests (which will allow financial institutions to boost buybacks and dividends).

The Dow Jones Industrial Average added 0.7% to 34,433 – its strongest week (+3.4%) since mid-March – as Nike (NKE) surged 15.5% on a big fiscal fourth-quarter beat. The athletic apparel retailer also said it expects fiscal 2022 sales to top $50 billion.

And, after a choppy start, the Nasdaq Composite eased back 0.1% at 14,360, though still its best week (+2.4%) since early April.

Other action in the stock market today:

- The small-cap Russell 2000 eked out a fractional gain to finish at 2,334.

- Virgin Galactic Holdings (SPCE) soared 38.9% today after the Federal Aviation Administration (FAA) gave the go-ahead for the company to fly commercial passengers on future spaceflights.

- CarMax (KMX) spiked 6.7% after the online used vehicle retailer reported fiscal first-quarter earnings of $2.63 per share on revenues of $7.7 billion – well above what analysts were expecting. The company is guiding for $33 billion on revenues and 2 million vehicles sold by fiscal 2026.

- U.S. crude oil futures gained 1% to end at $74.05 per barrel, with black gold surging 3% on a week-over-week basis.

- Gold futures ended with a marginal gain at $1,777.80 an ounce.

- The CBOE Volatility Index (VIX) fell 2.2% to 15.62.

- Next week's earnings calendar features some notable names, including Bed Bath & Beyond (BBBY), Micron (MU) and Walgreens (WBA).

Bitcoin Closes Out Tough Week With Another Loss

One area of weakness in the market today: cryptocurrencies.

Bitcoin prices plunged 7.1% to finish at $32,309, and ended the week down 8.8% (Bitcoin markets don't close; price taken at 4 p.m. ET).

Why?

"China's four biggest banks this week refused to help their customers trade Bitcoin and other cryptocurrencies", says Louis Navellier, founder and chief investment officer of Navellier & Associates, Inc.

But volatility in the cryptocurrency is nothing new. In mid-April, Bitcoin topped out at a record high above $64,000 before sinking all the way down to $30,000 just weeks later and then bouncing back up to $40,000.

Bitcoin and other digital assets remain highly speculative and aren't for the faint of heart, but for the crypto-curious, here's our primer answering common questions asked about Bitcoin.

And for investors who are considering dipping their toes into crypto space, but would like a less-risky option, consider focusing on larger, established companies that are profiting from this technology. Read on as we highlight a list of seven cryptocurrency stocks (and one fund) that have embraced this phenomenon.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

Stocks End Volatile Year on a Down Note: Stock Market Today

Stocks End Volatile Year on a Down Note: Stock Market TodayAfter nearing bear-market territory in the spring, the main market indexes closed out the year with impressive gains.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

The Santa Claus Rally Officially Begins: Stock Market Today

The Santa Claus Rally Officially Begins: Stock Market TodayThe Santa Claus Rally is officially on as of Wednesday's closing bell, and initial returns are positive.

-

Nasdaq Leads as Tech Stages Late-Week Comeback: Stock Market Today

Nasdaq Leads as Tech Stages Late-Week Comeback: Stock Market TodayOracle stock boosted the tech sector on Friday after the company became co-owner of TikTok's U.S. operations.

-

Dow Rises 497 Points on December Rate Cut: Stock Market Today

Dow Rises 497 Points on December Rate Cut: Stock Market TodayThe basic questions for market participants and policymakers remain the same after a widely expected Fed rate cut.