Stock Market Today: High Consumer Confidence Fails to Stir Stocks

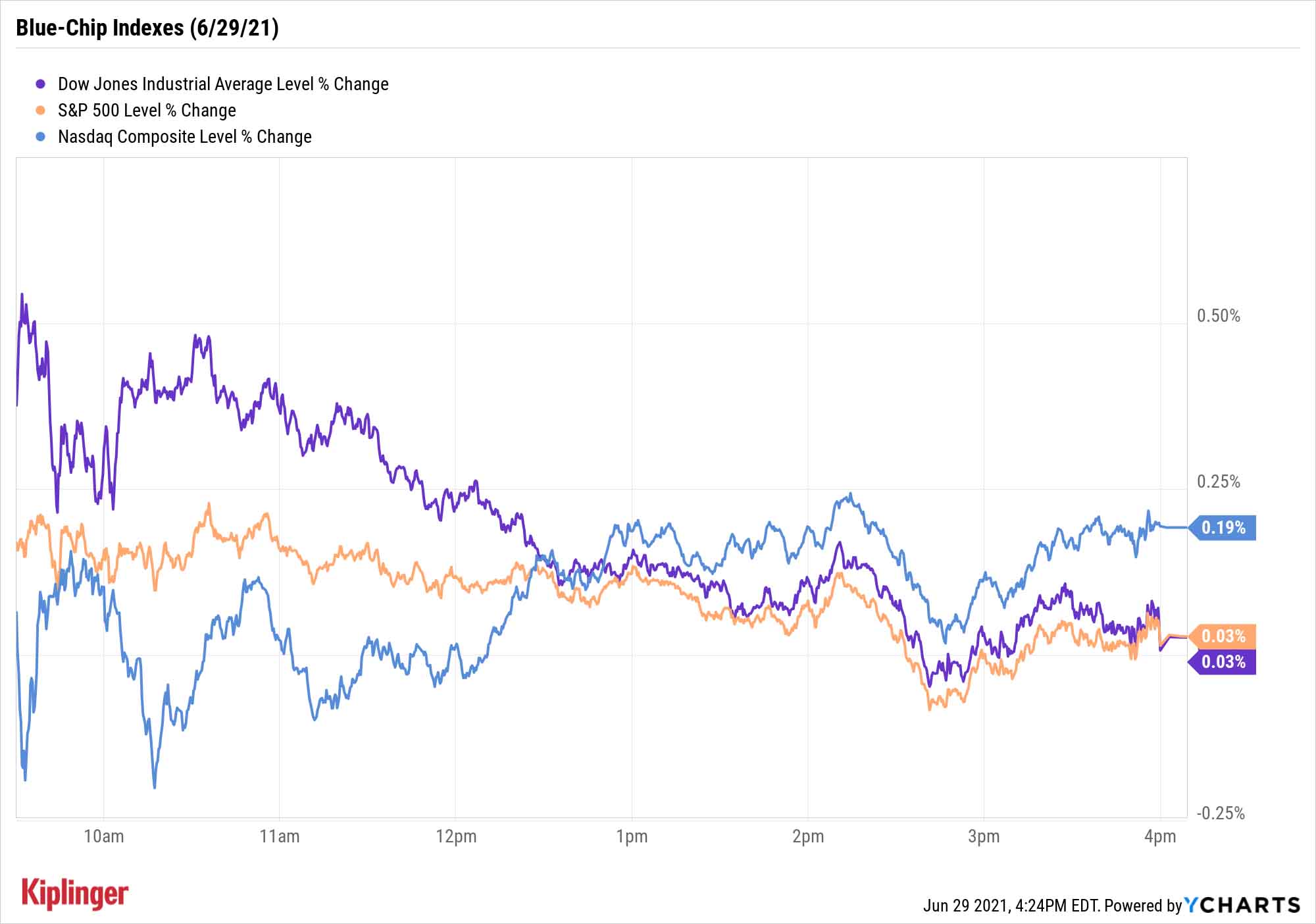

Tuesday's market action was mostly mixed, but the S&P 500 and Nasdaq gained enough to set new highs.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stocks didn't move much Tuesday, nor did they move in the same direction. But investors provided just enough buying action to keep the major indexes in the green – and to keep the Nasdaq Composite and S&P 500 aloft in record territory.

Most notable among Tuesday's upbeat news was a surge in the Conference Board's index of consumer confidence, which jumped to 127.3 in June from 120.0 in May, marking its highest reading since February of last year.

"Consumers' assessments of both the present situation and short-term outlook improved, likely aided by re-opening measures, low case counts and expectations of a return of activity to pre-pandemic levels," says Barclays economist Pooja Sriram.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Financial stocks were a mixed bunch amid a slew of dividend increases.

Investment banks in particular enjoyed share-price gains after hiking their payouts. Morgan Stanley (MS, +3.4%) doubled its dividend to 70 cents per share, while Goldman Sachs (GS, +1.1%) announced a 60% hike to $2 per share. Mega-banks, however, saw their stocks decline, even after giving generous raises of their own. Wells Fargo (WFC, -2.2%) doubled its dividend to 20 cents per share, and Bank of America (BAC, -1.6%) authorized a 16.7% raise to 21 cents per share. Citigroup (C, -2.6%), meanwhile, left its payout untouched.

The Nasdaq closed 0.2% higher to a record 14,528. The S&P 500 finished up marginally, by a mere point, but it was enough for a new high of 4,291. The Dow Jones Industrial Average also finished with a minimal gain to 34,292.

Other action in the stock market today:

- The small-cap Russell 2000 declined by 0.6% to 2,308.

- Skyworks Solutions (SWKS) jumped 4.5% today after Citi (Neutral) put the semiconductor name on "positive catalyst watch." The research firm cited its supply chain checks which show higher-than-expected next-gen iPhone builds. SWKS makes 5G-enabled components for smartphones and other devices. Citi maintained a $182 price target; SWKS closed Wednesday at $190.95.

- Several homebuilder stocks gained ground after the latest S&P CoreLogic Case-Shiller Index showed home prices spiked 14.6% year-over-year in April. Among those finishing in the green today were Lennar (LEN, +0.8%), D.R. Horton (DHI, +1.0%) and PulteGroup (PHM, +2.0%).

- U.S. crude oil futures eked out a marginal gain to settle at $72.98 per barrel.

- Gold futures slipped 1% to end at $1,763.60 an ounce – their lowest finish since April.

- The CBOE Volatility Index (VIX) improved by 1.8% to $16.05.

- Bitcoin prices jumped 5.6% to $36.399.70. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.

What's Ahead in This Bull Market's Next Stage?

The Wells Fargo Investment Institute reminds us that we're not just at the midpoint of the year – we're also in year two of a new bull market. And their forward-looking sector strategy could be easily summed up as "second verse, same as the first."

Says WFII: "In the first year of this new equity bull market, our sector guidance shifted to include favorable ratings on economically sensitive sectors, such as Financials, Industrials, and Materials, and we have upgraded the energy sector to favorable. … Cyclical sectors historically have maintained leadership in the second year of bull markets, and we expect similar relative outperformance early in this cycle."

We've recently outlined potential second-half winners in several of these sectors – this short list of industrial stocks, for instance, or this group of 10 energy picks that could thrive amid continued high oil prices.

You also can find plenty of potential in a number of plays highlighted at the very beginning of the year. Our 21 best stocks for 2021 are looking good so far, outperforming the market by roughly 2 percentage points at a recent check. And they still look good, as many of the same catalysts that made them attractive initially – global vaccination against COVID, reheating economies and a resurgence of corporate earnings – are still in play.

Check out the full list by clicking the link above, and see how each is faring as we hit 2021's midpoint.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Small Caps Can Only Lead Stocks So High: Stock Market Today

Small Caps Can Only Lead Stocks So High: Stock Market TodayThe main U.S. equity indexes were down for the week, but small-cap stocks look as healthy as they ever have.

-

Dow Adds 292 Points as Goldman, Nvidia Soar: Stock Market Today

Dow Adds 292 Points as Goldman, Nvidia Soar: Stock Market TodayTaiwan Semiconductor's strong earnings sparked a rally in tech stocks on Thursday, while Goldman Sachs' earnings boosted financials.

-

Stocks See First Back-to-Back Losses of 2026: Stock Market Today

Stocks See First Back-to-Back Losses of 2026: Stock Market TodayRising geopolitical worries and a continued sell off in financial stocks kept pressure on the main indexes on Wednesday.

-

Nasdaq Takes a Hit as the Tech Trade Falters: Stock Market Today

Nasdaq Takes a Hit as the Tech Trade Falters: Stock Market TodayThe Dow Jones Industrial Average outperformed on strength in cyclical stocks.