Stock Market Today: S&P Sets Another New High to Kick Off Q3

The broad-market index carved out its 35th record of 2021.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stocks got off on the right foot for the second half of 2021, rising Thursday after another encouraging unemployment-filings report.

First-time jobless claims for the week ended June 26 fell by 51,000 filings to 364,000 – that's lower than estimates for 388,000 claims, and a fresh low since COVID was declared a pandemic.

"This morning's beat on jobless claims is a real bright spot," says Cliff Hodge, chief investment officer at wealth management advisor Cornerstone Wealth. "Not only did we print the lowest number since the pandemic began, but it also reverses the trend on misses that we've seen the past few weeks. Staying below that big-round-number 400k level could bolster confidence in risk taking during the dog days of summer."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

But the day's gains were far from balanced – energy stocks such as ConocoPhillips (COP, +3.2%) and EOG Resources (EOG, +3.2%) led the way on the back of a 2.4% rise in U.S. crude oil futures to $75.23 per barrel.

Technology (+0.1%) was flattish, however, and consumer staples (-0.3%) actually posted a small decline.

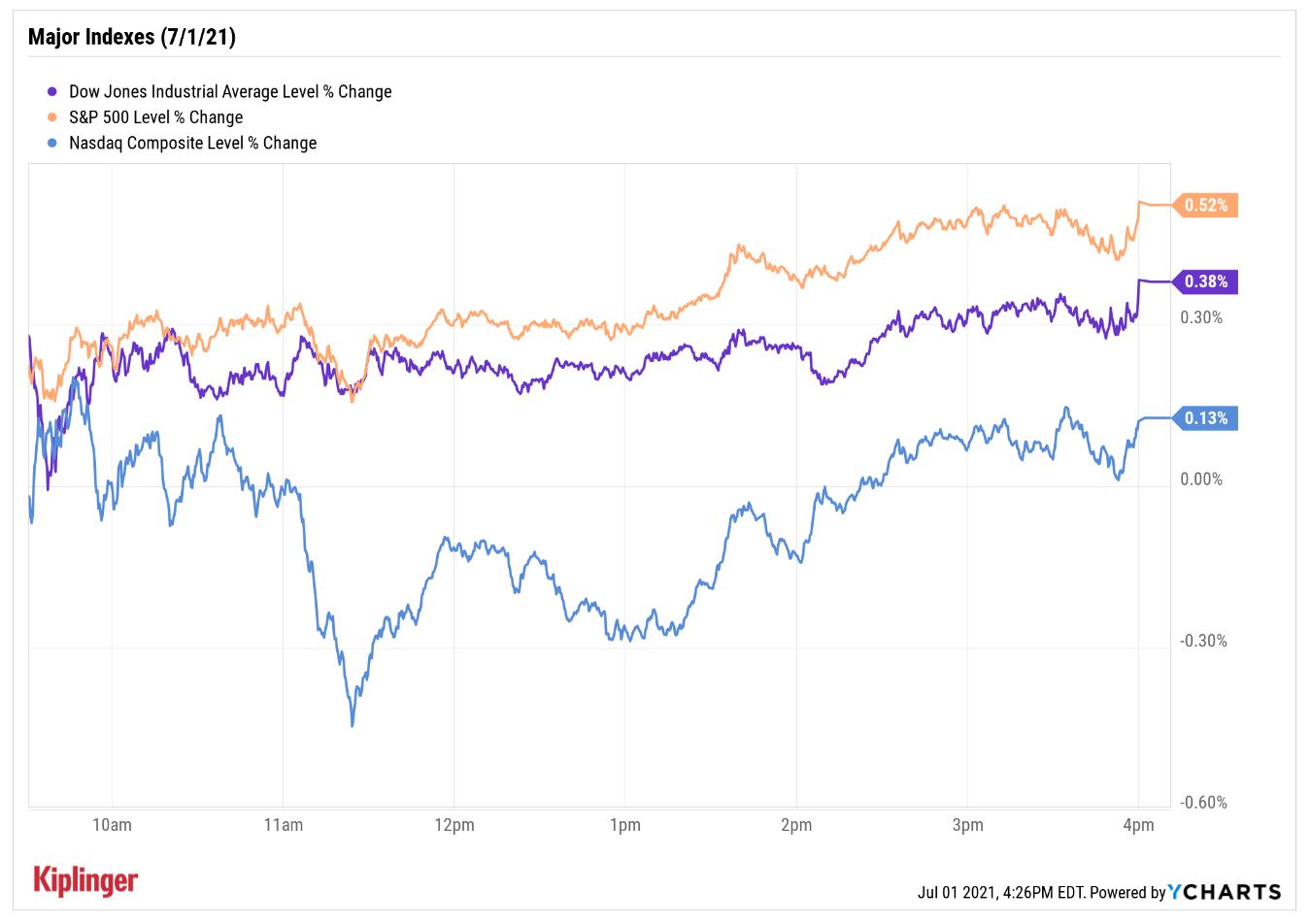

The end result for the major indexes, though, was a fresh high for the S&P 500 Index (+0.5% to 4,319), and gains for both the Dow Jones Industrial Average (+0.4% to 34,633) and Nasdaq Composite (+0.1% to 14,522).

Other action in the stock market today:

- The small-cap Russell 2000 rose 0.8% to 2,329.

- Krispy Kreme (DNUT) had a disappointing start in its return to the public market, opening at $16.30 per share – lower than its initial public offering (IPO) price of $17, which was marked well below the planned range of $21 to $24 per share. The doughnut maker gained some traction during the session, though, settling right at $21.00. In other IPO news, trading app Robinhood today filed its paperwork to go public. While no date was indicated for its debut, the company will trade on the Nasdaq under the ticker "HOOD."

- Walgreens Boots Alliance (WBA) was the worst Dow stock today, sliding 7.4% after earnings. The drugstore chain reported better-than-expected adjusted profit and revenues in its fiscal third quarter and boosted its full-year guidance, due in part to increased traffic from those getting COVID-19 vaccines. Concern that slowing vaccination rates could negatively impact revenue was being cited by some as a reason for today's selloff.

- Gold futures tacked on 0.3% to settle at $1,776.80 an ounce.

- The CBOE Volatility Index (VIX) retreated 2.2% to 15.48.

- Bitcoin prices fell 4.9% to $33,095.95. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.

What Can We Expect in Q3?

Well … the past sends mixed signals.

"Historically, stocks are weak during the third quarter, something to be aware of as we turn the calendar to July. The S&P 500 Index has gained only 0.7% on average during the third quarter, the worst of the calendar year," says independent broker-dealer LPL Financial.

"It has closed green 62% of the time, though, in line with Q1 and Q2. The big reason why the average is worse is some spectacular crashes have taken place during this quarter. Here's the catch … stocks have gained 8 of the past 9 third quarters."

Investors don't need to resign themselves to flattish returns, however.

Fund investors might want to take a gander at these five mutual funds that have earned a five-star rating from research firm CFRA – a grade that suggests a high likelihood of outperforming their broader asset category over the next 12 months.

You could also leave your stock-picking choices to the machines. Since the start of the year, we've been keeping an eye on stocks picked by Danel Capital's artificial intelligence platform, and it continues to build an impressive market-beating track record. The system doesn't make buy-and-hold calls, however – instead, it spies stocks it thinks can outperform over the course of a few months, making it most appropriate for those who like to mix a few small, tactical trades into their portfolios.

Read on if you're curious about which stocks Danel's AI platform has its eye on for the rest of the summer.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

The Cost of Leaving Your Money in a Low-Rate Account

The Cost of Leaving Your Money in a Low-Rate AccountWhy parking your cash in low-yield accounts could be costing you, and smarter alternatives that preserve liquidity while boosting returns.

-

I want to sell our beach house to retire now, but my wife wants to keep it.

I want to sell our beach house to retire now, but my wife wants to keep it.I want to sell the $610K vacation home and retire now, but my wife envisions a beach retirement in 8 years. We asked financial advisers to weigh in.

-

How to Add a Pet Trust to Your Estate Plan

How to Add a Pet Trust to Your Estate PlanAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

These Unloved Energy Stocks Are a Bargain

These Unloved Energy Stocks Are a BargainCleaned-up balance sheets and generous dividends make these dirt-cheap energy shares worth a look.

-

Dow, S&P 500 Rise to New Closing Highs: Stock Market Today

Dow, S&P 500 Rise to New Closing Highs: Stock Market TodayWill President Donald Trump match his Monroe Doctrine gambit with a new Marshall Plan for Venezuela?

-

'Donroe Doctrine' Pumps Dow 594 Points: Stock Market Today

'Donroe Doctrine' Pumps Dow 594 Points: Stock Market TodayThe S&P 500 rallied but failed to turn the "Santa Claus Rally" indicator positive for 2026.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.