Stock Market Today: Amazon Lifts Nasdaq to Another Record Close

Weak services data clipped win streaks in the Dow and S&P 500, but a big move by Amazon.com (AMZN) kept the Nasdaq in the green.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

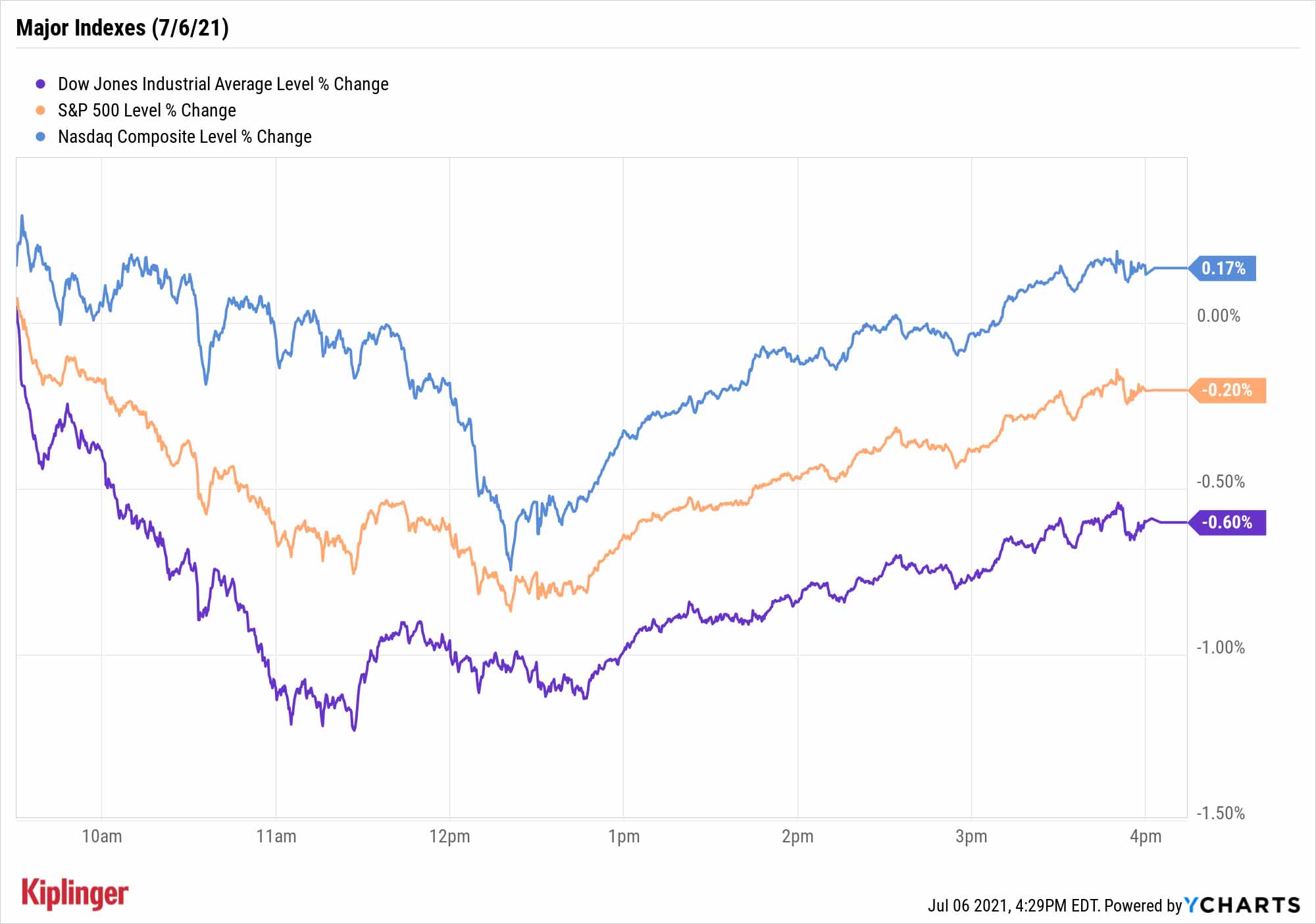

Stocks returned from the holiday weekend somewhat sluggishly. Slight declines on Tuesday snapped win streaks for a couple major indexes, though the Nasdaq managed to claw out another new high.

What weighed on investors' optimism?

The Institute for Supply Management's services reading fell 3.9 points to 60.1 in June; anything over 50 signals expansion, so services are still improving, just at a slower rate than in May.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"June's headline was a fair bit softer than anticipated (Barclays 64.0; consensus 63.4)," says Barclays economist Jonathan Millar. "Today's report suggests that supply bottlenecks remain acute amid very strong demand, slowing the transition of activity from goods to services."

Meanwhile, over the weekend, OPEC and its allies failed to agree on production increases, postponing talks indefinitely. While that initially drove U.S. crude oil prices to six-year highs, they finished soundly negative, declining 2.4% to $73.37 per barrel.

The Dow Jones Industrial Average (-0.6% to 34,577) ended a four-day win streak, while the S&P 500 (-0.2% to 4,343) failed to secure its eighth consecutive advance.

But the Nasdaq (+0.2% to 14,633) managed to score a record close, helped by Amazon.com (AMZN, +4.7%), which leaped to a fresh all-time high following Monday's passing of the torch from founder Jeff Bezos to new CEO Andy Jassy. Tugging in the other direction was Tesla (TSLA, -2.9%); the electric vehicle maker struggled after CEO Elon Musk's weekend comments that he didn't expect that developing self-driving technologies would be "so hard."

Other action in the stock market today:

- The small-cap Russell 2000 took a deep 1.4% cut to 2,274.

- DiDi Global (DIDI) was a notable decliner on Wall Street on Tuesday, just days after the Chinese ride-sharing firm went public. DIDI stock shed 18.9% after China said new users were banned from downloading the company's app until regulators concluded a cybersecurity review. Yesterday, the Wall Street Journal reported that officials in China suggested DIDI delay its initial public offering (IPO) in the U.S. until after the review. Regardless, the company opened for trading on the New York Stock Exchange last Wednesday.

- AMC Entertainment (AMC) fell 3.9% after the company withdrew plans to issue up to 25 million more shares, according to a Securities and Exchange Commission filing. In a tweet, the movie chain's CEO Adam Aron said, "It's no secret I think shareholders should authorize 25 million more AMC shares. But what YOU think is important to us. Many yes, many no. AMC does not want to proceed with such a split." The meme stock is still up roughly 2,260% for the year to date.

- Gold futures gained 0.6% to end at $1,794.20 an ounce.

- The CBOE Volatility Index (VIX) jumped 8.0% to 16.28.

- Bitcoin prices ebbed and flowed across the weekend, but finished Tuesday afternoon at $33,948.73, up 2.2% from the same time on Friday. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.

Grow, Growth! Grow!

Growth is evening the score in 2021. While value still maintains a performance edge across the year, the growth style has flipped the script over the past couple months – and the fun might just be starting.

"We feel this rotation has created an unusual buying opportunity for secular growth stocks, as they are generally 30%-50% off their 52-week highs," say James L. Callinan and Bryan Wong, Osterweis Capital Management's chief investment officer of emerging growth and vice president, respectively. "When combined with their underlying growth rates, which have remained robust despite their tepid share performance, valuations look reasonable, especially on five-year projected earnings."

These growth-at-a-reasonable price (GARP) stocks are a perfect example of that, offering up substantial future earnings prospects while trading at true-blue values.

If you're not as concerned about price but still want to harness secular growth trends, you have your pick of the litter. Booming technologies such as semiconductors and artificial intelligence come to mind, but industries such as marijuana are trying to prove breakneck growth doesn't have to come from tech.

If you prefer a little variety, however, consider these 11 great growth stocks – dealing in everything from electrical products to credit cards to Big Macs – that appear to have runway through at least the end of 2021 … if not much longer.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Dow Dives 870 Points on Overseas Affairs: Stock Market Today

Dow Dives 870 Points on Overseas Affairs: Stock Market TodayFiscal policy in the Far East and foreign policy in the near west send markets all over the world into a selling frenzy.