Stock Market Today: Treasury-Rate Tumult Trips Up Stocks

The rate on 10-year T-notes plumbed to their lowest point since February, pulling the major indexes back from their recent highs.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Another dip in Treasury rates, as well as a surprisingly weak report on the employment front, rattled equity markets on Thursday.

The 10-year Treasury yield dropped below 1.25% today – marking its lowest point since February – before settling down 3 basis points to 1.29%, still well below where it started July (1.44%).

"The sharp drop in yields reflects the market’s concern that the Fed will begin tapering soon, and that the removal of liquidity from the system will create volatility and a rush out of risk assets (like equities) and toward safe havens (like government bonds)," says Chris Zaccarelli, chief investment officer for registered investment advisor Independent Advisor Alliance.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Also weighing on sentiment were unemployment-benefit filings for the week of July 3, which rose slightly to 373,000 from 371,000 the week prior and easily outstripped consensus estimates for 350,000 claims.

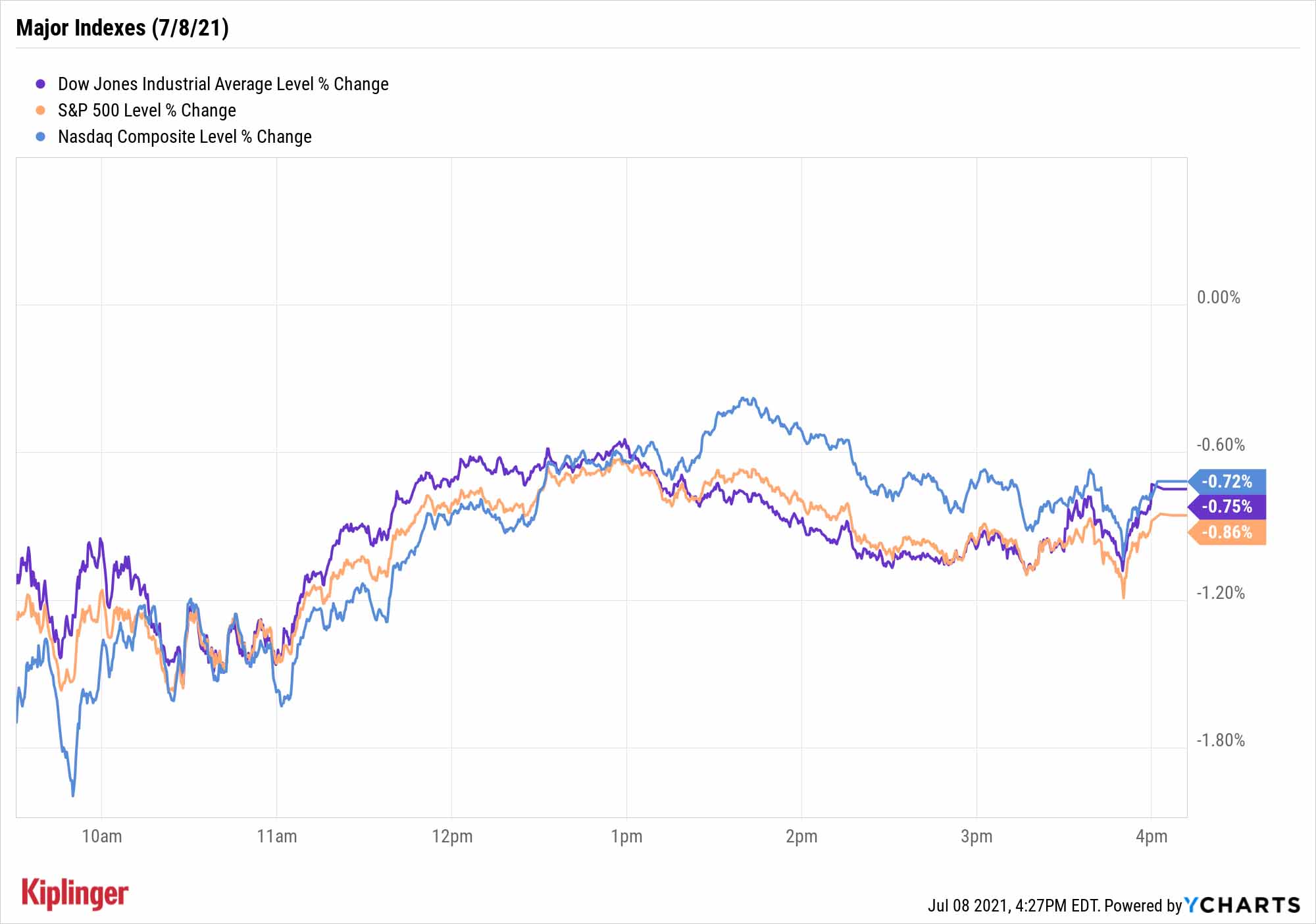

But while the major indexes opened on pace for their worst daily performance in months, they managed to regain some composure by the close. The Dow Jones Industrial Average fell by more than 1.5% at its nadir, but ended the day with a slimmer 0.8% decline to 34,421. The S&P 500 (-0.9% to 4,320) and Nasdaq Composite (-0.7% to 14,559) also finished off their lows.

"A market moment, not a trend setter," says George Ball, chairman of Houston-based investment firm Sanders Morris Harris. He described Thursday's yield decline as mostly technical in nature, chalking it up to repositioning by portfolio managers who expected 10-year rates to rise and held short positions in bonds.

"With the Federal Reserve reiterating its patient stance on tapering in Wednesday's minutes report, many portfolio managers changed course and covered their short positions in bonds, which drove up bond prices and pushed yields down," Ball says.

Other action in the stock market today:

- The small-cap Russell 2000 declined 0.9% to 2,231.

- Railroad stocks were notable decliners in today's trading. This comes after the Biden administration issued an executive order asking the Federal Maritime Commission and the Surface Transportation Board to address consolidation and what it believes to be aggressive pricing in the shipping and railroad industries, according to the Wall Street Journal. Kansas City Southern (KSU, -7.9%), CSX (CSX, -6.2%) and Union Pacific (UNP, -4.4%) were among those that closed lower.

- The semiconductor sector also struggled today, dragged down on concerns the pace of the global economic recovery might be slowing. Advanced Micro Devices (AMD, -0.9%), Intel (INTC, -1.0%) and Micron (MU, -1.4%) were among the chip stocks that lost ground today.

- U.S. crude oil futures gained 1.0% to settle at $72.94 per barrel.

- Gold futures slipped 0.1% to finish at $1,800.20 an ounce, snapping their five-day winning streak.

- The CBOE Volatility Index (VIX) enjoyed a sharp 16.2% jump to 18.82.

- Bitcoin suffered alongside equities, falling 4.6% to $33,007.18. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.

Should You Sweat Declining Rates? Not Yet.

Other market experts weren't racing to sound the alarm, either.

"The economy is in transition, and while transitions may be bumpy they need not spell turmoil in my view," says George K. Mateyo, chief investment officer of KeyBank. "More specifically, the economic surge is transitioning to a slower yet more stable trajectory as the pandemic moves further into the rearview mirror … although it hasn't completely disappeared, for sure."

"We're maintaining our existing overweight position in stocks," adds Richard Saperstein, chief investment officer of New York City-based wealth advisor Treasury Partners. "It's not just because there is no alternative – rather, companies are seizing the post-COVID opportunity and putting up impressive earnings growth."

Still, if you're looking to tamp down on risk a skosh while still remaining nimble, you might consider exchange-traded funds (ETFs).

The primary benefits of ETFs remain the same as they've always been: easy diversification across dozens, hundreds or even thousands of issues, and (typically) low fees. That helps make picks like our Kip ETF 20 perfect for investors building a core portfolio.

But the ETF world offers a wider variety of products compared to mutual funds, allowing you to be tactical, too.

On the one hand, investors looking to cover their behinds will appreciate funds such as buffered ETFs, which are designed to limit losses. On the other, those that see today's stumble as a mere blip and still want to hit the gas can make fairly aggressive plays, such as buying the biotech space.

Biotech funds offer a tempting blend of safety and potential, holding scores of names that could be one trial announcement away from popping … without the risk of a single stock torpedoing your portfolio. And these nine biotech ETFs in particular provide a variety of ways to play the latest breakthroughs in healthcare.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Soars 588 Points as Trump Retreats: Stock Market Today

Dow Soars 588 Points as Trump Retreats: Stock Market TodayAnother up and down day ends on high notes for investors, traders, speculators and Greenland.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Small Caps Can Only Lead Stocks So High: Stock Market Today

Small Caps Can Only Lead Stocks So High: Stock Market TodayThe main U.S. equity indexes were down for the week, but small-cap stocks look as healthy as they ever have.

-

Dow Adds 292 Points as Goldman, Nvidia Soar: Stock Market Today

Dow Adds 292 Points as Goldman, Nvidia Soar: Stock Market TodayTaiwan Semiconductor's strong earnings sparked a rally in tech stocks on Thursday, while Goldman Sachs' earnings boosted financials.

-

Visa Stamps the Dow's 398-Point Slide: Stock Market Today

Visa Stamps the Dow's 398-Point Slide: Stock Market TodayIt's as clear as ever that President Donald Trump and his administration can't (or won't) keep their hands off financial markets.

-

Dow Hits a Record High After December Jobs Report: Stock Market Today

Dow Hits a Record High After December Jobs Report: Stock Market TodayThe S&P 500 also closed the week at its highest level on record, thanks to strong gains for Intel and Vistra.