Stock Market Today: Stocks Maintain Altitude With Q2 Earnings on Deck

Optimism over what should be a blowout Q2 earnings season helped lift the major indexes to new highs on an otherwise low-news Monday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

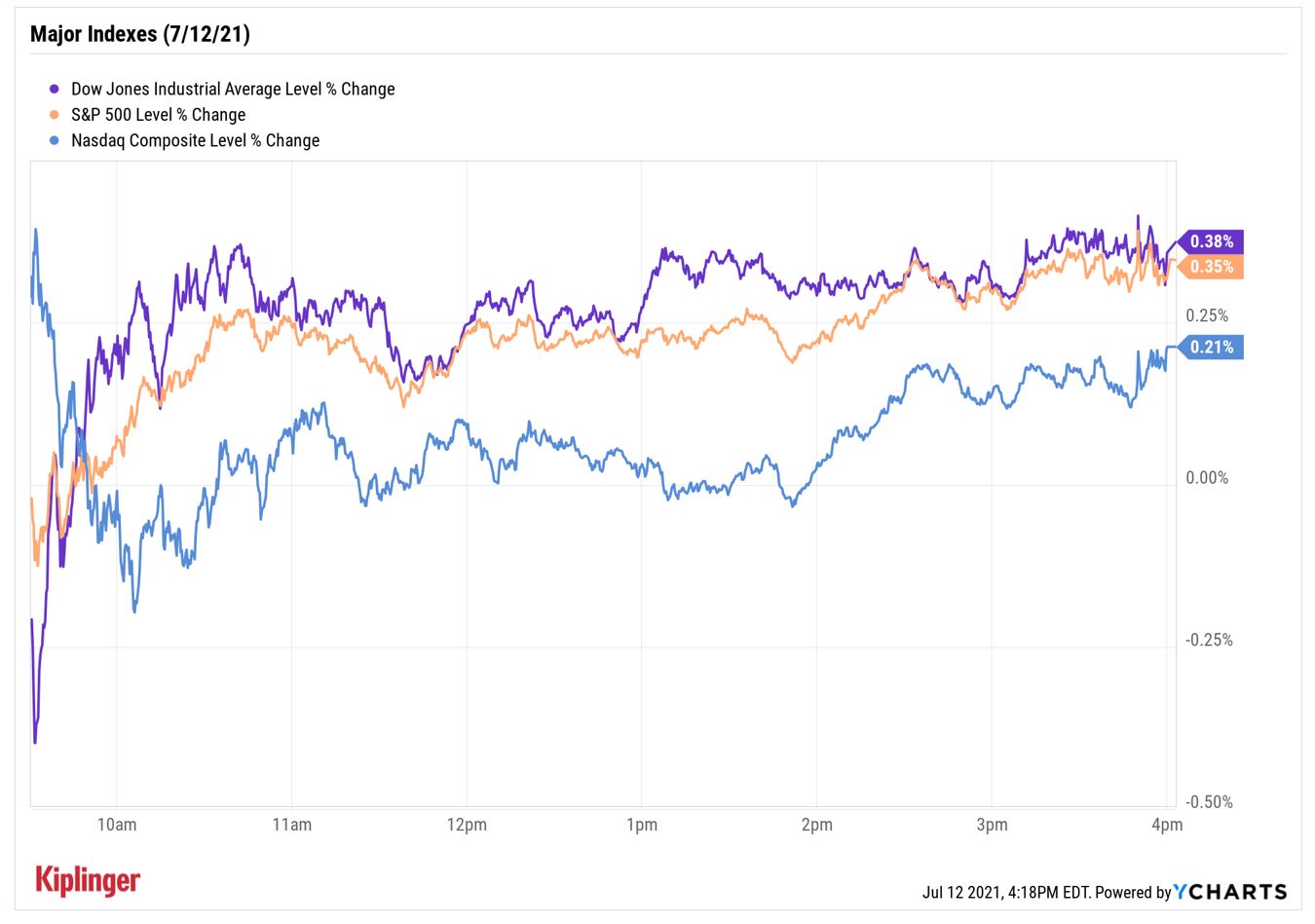

The major indexes largely kicked off the new week the same way they exited the last: chalking up more gains from all-time-high perches.

On a slow-news day, much of the market's optimism was likely tied to what's to come – namely, the start of a second-quarter earnings season that many believe will be chock full of explosive year-over-year growth.

"As of today, the S&P 500 is expected to report (year-over-year) earnings growth of 64.0% for the second quarter," says John Butters, senior earnings analyst at FactSet. "If 64.0% is the actual growth rate for the quarter, it will mark the highest earnings growth rate reported by the index since Q4 2009 (109.1%)."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

A few individual names stood out in today's trade. Tesla (TSLA, +4.4%) jumped after UBS analysts said the company should benefit from Germany's extension of a 9,000-euro subsidy for electric-vehicle purchases. And Disney (DIS, +4.2%) gained after its latest Marvel movie, Black Widow, garnered $80 million at the box office and another $60 million-plus from its Disney+ streaming service.

The major indexes didn't move much, but they continued to reset the record books. The Dow Jones Industrial Average (+0.4% to 34,996), S&P 500 Index (+0.4% to 4,384) and Nasdaq Composite (+0.2% to 14,733) all finished with fresh closing highs.

Other action in the stock market today:

- The small-cap Russell 2000 ended 0.08% higher at 2,281.

- L Brands (LB) jumped 4.2% after the retailer said its board of directors approved the spin-off of its Victoria's Secret brand into its own publicly traded company. The new firm will be named Victoria's Secret & Co. and will likely begin trading on Tuesday, Aug. 3, under the ticker "VSCO." L Brands, meanwhile, will change its name to Bath & Body Works, Inc., and is expected to begin trading under its new symbol, "BBWI," on Aug. 3, as well.

- It was another volatile session for Virgin Galactic (SPCE), which tumbled 17.3% after the company launched a test spaceflight this weekend that had founder Richard Branson onboard. Weighing on SPCE today, though, was news of its filing with the Securities and Exchange Commission (SEC) to sell $500 million in common stock. Even with today's drop, the stock remains up 71.5% for the year to date.

- U.S. crude oil futures fell 0.6% to end at $74.10 per barrel.

- Gold futures slipped 0.3% to settle at $1,805.90 an ounce.

- The CBOE Volatility Index (VIX) fell 0.06% to 16.17.

- Bitcoin gave back 1.8% to $32,844.97. "After a 50% correction across the Crypto markets we are in a consolidation mode which is healthy for the next bull run," says Charlie Silver, CEO of Permission.io. "If [Bitcoin] holds support at 30k through the summer, I think we are poised for a great Q4 rally." (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.

Where to Find Above-Average Yield

It's hard to find much fault with a stock market that has regularly posted records for weeks. But one cohort of investors might have a minor gripe: It is awfully difficult to find high-quality sources of sufficient yield.

The S&P 500's yield has dropped to 1.34% from 1.91% a year ago, according to data from the Nasdaq's Quandl platform – its lowest yield since 2001.

Fortunately, there are always a few corners of the market that typically are good for above-average yield.

Master limited partnerships (MLPs), for instance, might be fewer in number than they were years ago, but mid-single-digit yields are commonplace among them. Many monthly dividend stocks and funds also tend to deliver ample income.

But if you value a variety of choices when assembling your income portfolio, we have a collection of stocks for you to start with. These 10 high-quality stocks each boast a yield of at least 4%, or three times the S&P 500 average, and each gets a collective favorable nod from the analysts that cover them.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

Stocks Extend Losing Streak After Fed Minutes: Stock Market Today

Stocks Extend Losing Streak After Fed Minutes: Stock Market TodayThe Santa Claus Rally is officially at risk after the S&P 500's third straight loss.