Netflix (NFLX) Earnings: Will Subscriber Adds Stall Again?

Our preview of the upcoming week's earnings reports includes Netflix (NFLX), Johnson & Johnson (JNJ) and American Express (AXP).

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

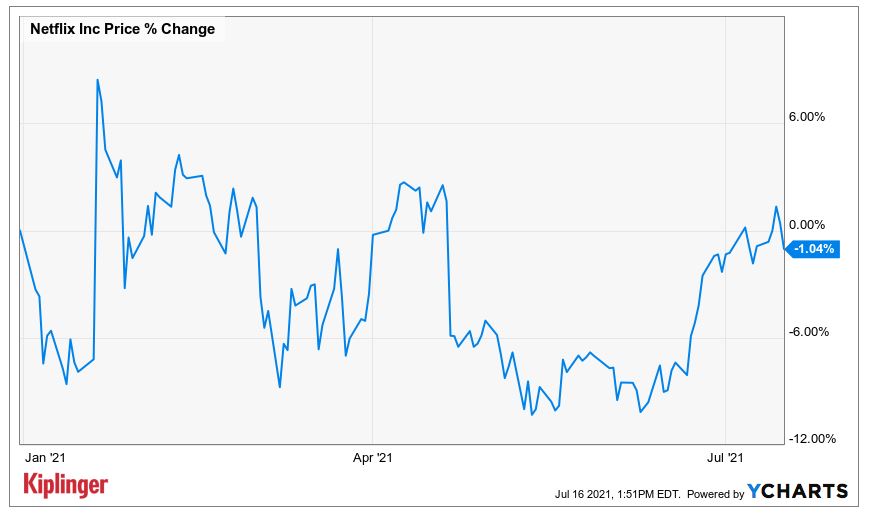

Will Netflix (NFLX, $532.22) post another quarter of disappointing global subscriber additions?

Netflix is scheduled to unveil its second-quarter results after the market closes next Tuesday, July 20. Thus, the streaming giant will be the first of the FAANG stocks to report quarterly earnings this season. Analysts, on average, are looking for revenues of $7.3 billion (+20.3% year-over-year) and earnings per share (EPS) of $3.15, nearly double what NFLX brought in one year ago.

Investors will also be watching global paid subscriber additions. In its first-quarter report, Netflix missed this metric by a wide margin – adding just shy of 4.0 net new subscribers over the three-month period, compared to expectations for 6.2 million – which sent the shares tumbling 7.4% in the subsequent session.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Wedbush analysts rate NFLX at Underperform (the equivalent of a Sell) with a 12-month price target of $342, representing a steep discount to its current per-share price. As far as subscriber adds go, the research firm sees "compelling" opportunities overseas, but believes it may be approaching "market saturation" in the U.S. and Canada.

"While there may be some room for Netflix to add some new high-ARPU (average revenue per unit) subscribers, competition is at its most fierce in the region, and with over half of all households already penetrated, the 'low hanging fruit' (above median income households) has already been harvested," the analysts say. Wedbush is projecting 1 million net additions for NFLX in the second quarter.

Not everyone is bearish on NFLX.

Baird analysts William Power and Charles Erlikh carry an Outperform (Buy) rating on the stock with a $650 price target, implying 21.1% upside over the next 12 months or so. "Both current and upcoming content should reinvigorate subscriber growth for NFLX," the analysts say.

Johnson & Johnson Looks to Turn Around 2021 Underperformance

Johnson & Johnson (JNJ, $168.68) has been in the news lately as the pharmaceutical giant's COVID-19 vaccine has been linked to roughly 100 cases of Guillain-Barré syndrome – a rare neurological disorder. The company also recalled five of its aerosol sunscreen products due to the detection of benzene, a carcinogenic chemical compound.

These headlines have the stock headed for a modest weekly loss; overall, it's up about 7% for the year to date to easily underperform the major indexes. JNJ shareholders are looking for the stock to add to those gains when the company reports second-quarter earnings ahead of the open this Wednesday, July 21.

The pros are upbeat heading into the report. On average, they're looking for a 26% year-over-year pop in revenues to $22.2 billion, with earnings expected to rise 36% to $2.27 per share.

CFRA analyst Sel Hardy (Buy) recently lifted her full-year 2021, 2022 and 2023 adjusted EPS forecasts for JNJ "to reflect the improved outlook for the company's top- and bottom-line performance. In line with the broader reopening in the U.S., JNJ's largest market, we anticipate an improved momentum particularly for the company's key Pharma and Medical Devices segments."

This bullish bias toward the Dow stock is seen among the majority of analysts covering the shares that are tracked by S&P Global Market Intelligence. Currently, nine maintain a Strong Buy opinion, four say Buy, five call JNJ a Hold and just one deems it a Sell.

Can American Express Add to Its Gains?

American Express (AXP, $170.35) caps off a busy week of corporate earnings reports when it reveals its second-quarter results ahead of the July 23 open.

The stock has put in a tremendous showing in 2021, up 41% for the year to date – and trading not far from its July 1 record high of $173.60.

Piper Sandler analyst Christopher Donat thinks there's more to come for the credit card concern and recently raised his price target on AXP to $190 from $170, representing expected upside of 11.4% over the next 12 months or so. He maintains an Overweight rating on the shares, which is the equivalent of a Buy.

"American Express reported another excellent month for credit quality [in June]," Donat says, with both net write-offs and delinquency rates falling to the lowest level since Piper Sandler first started tracking the data in 2012.

"Meanwhile, card loan growth continued, with AXP the only large credit card issuer to post year-over-year loan growth in June. We think AXP's loan growth likely reflects higher spending on Amex cards, which should have positive implications for 2Q21 discount revenue."

On average, analysts are expecting American Express revenues to arrive at $9.5 billion (+17% from the year-ago period) in its second quarter. As for earnings, they're forecast to spike 445% on a year-over-year basis to $1.58 per share.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Stocks Climb Wall of Worry to Hit New Highs: Stock Market Today

Stocks Climb Wall of Worry to Hit New Highs: Stock Market TodayThe Trump administration's threats to Fed independence and bank profitability did little to stop the bulls on Monday.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

Nasdaq Sinks 418 Points as Tech Chills: Stock Market Today

Nasdaq Sinks 418 Points as Tech Chills: Stock Market TodayInvestors, traders and speculators are growing cooler to the AI revolution as winter approaches.