Stock Market Today: Stocks End Record-Setting Week in the Red

While retail sales came in higher than expected, consumer sentiment data missed the mark.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

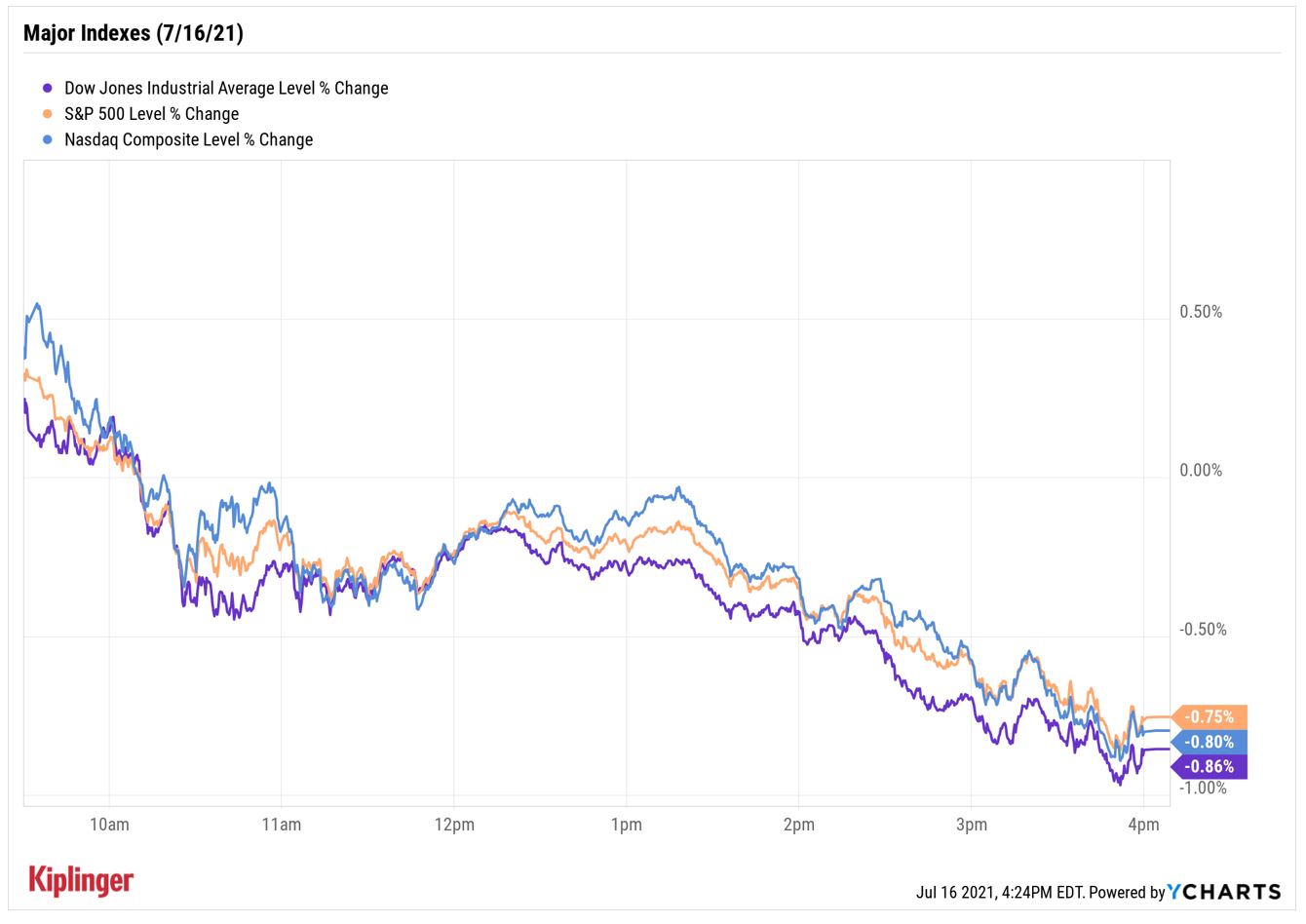

Stocks ended the week far from where they started it, with the major market indexes partaking in a broad selloff today.

The declines came amid a mixed batch of economic data. On one hand, the preliminary July estimate for the University of Michigan's (UofM) consumer sentiment survey fell well below economists' estimates to 80.8 from the final June reading of 85.5, with participants citing "an accelerating inflation rate" as a top concern.

On the other hand, data from the Census Bureau showed retail sales rose 0.4% month-over-month vs. estimates for a modest decline. "Increases were reasonably broad-based across categories, pointing to strong demand," says Barclays economist Pooja Sriram.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

After closing at record highs to start the week, the Dow Jones Industrial Average finished Friday down 0.9% at 34,687, while the S&P 500 Index shed 0.8% to 4,327 and the Nasdaq Composite gave back 0.8% to land at 14,427.

Other action in the stock market today:

- The small-cap Russell 2000 plunged 1.2% to 2,163.

- One name that didn't drop today: COVID-19 vaccine maker Moderna (MRNA). Its shares surged 10.3% on news it will replace Alexion Pharmaceuticals (ALXN, -0.3%) on the S&P 500, effective ahead of the market open on Wednesday, July 21.

- Charles Schwab (SCHW) rounded out a big week of bank earnings. The financial firm reported revenues of $4.5 billion in its second quarter – beating the consensus estimate – but earnings of 70 cents per share fell short. SCHW ended the session down 2.4%.

- U.S. crude oil futures closed the day up 0.2% at $71.81 per barrel, but finished the week down 3.7% – their biggest weekly decline since late March.

- Gold futures fell for the first time in four days, settling down 0.8% at $1,815 an ounce. The malleable metal posted its fourth straight weekly gain, up 0.2% from last Friday's close.

- The CBOE Volatility Index (VIX) spiked 8.5% to 18.45.

- Bitcoin shed 2.4% to $31,930.92. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

- Second-quarter earnings season starts picking up speed next week, with Netflix (NFLX), Johnson & Johnson (JNJ) and American Express (AXP) among the notable names to watch. You can check out the full earnings calendar here.

Inflation Risks Remain High

That's an outlook held not only by the majority of consumers surveyed by UofM, but also by Sal Guatieri, senior economist at BMO Capital Markets.

One such source of risk is the labor market, as staffing shortages limit production. Another is the "giddy mood among consumers." This, says Guatieri, could encourage businesses to continue raising prices in the near term. "And consumer purchasing power will get a boost from the expanded child tax credit that started this month," he adds.

So what's an investor to do?

One potential way to guard a portfolio against inflation risk is with real estate investment trusts (REITs) or healthcare stocks, both of which tend to hold up well during periods of higher prices. Another is to consider consumer staples stocks. In addition to these being defensive, dividend-paying plays, the sector also has some tailwinds on the horizon – including those direct child tax credit payments and back-to-school shopping.

Read on as we look at some of the more attractive ideas among consumer staples stocks for the remainder of the year.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Stocks Climb Wall of Worry to Hit New Highs: Stock Market Today

Stocks Climb Wall of Worry to Hit New Highs: Stock Market TodayThe Trump administration's threats to Fed independence and bank profitability did little to stop the bulls on Monday.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

Nasdaq Leads as Tech Stages Late-Week Comeback: Stock Market Today

Nasdaq Leads as Tech Stages Late-Week Comeback: Stock Market TodayOracle stock boosted the tech sector on Friday after the company became co-owner of TikTok's U.S. operations.