Stock Market Today: Dow Drops 725 Points on Resurgent COVID Fears

The Dow suffered its biggest one-day drop since late October.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

COVID-19 and its increasingly problematic variants rose from a dull background hum to the center of attention Monday, as a cascade of market declines across the globe eventually made their way to the U.S., sending the Dow to its worst drop in months.

"The global economy is barely surviving on life support, and another wave of infections may spur lockdowns that could signal the death knell for the tenuous recovery," says Peter Essele, head of investment management for Commonwealth Financial Network, who highlighted the drop in 10-year Treasury yields to their lowest levels since early 2021.

"Fear of stagflation will be a major concern for investors if a resurgence in COVID infections causes economies to slow while consumer prices continue an upward trajectory."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Perhaps unsurprisingly, the worst sectors of the day were energy (-3.6%) and financials (-2.8%) – two areas of the economy that would feel the brunt of a COVID economic backslide the most.

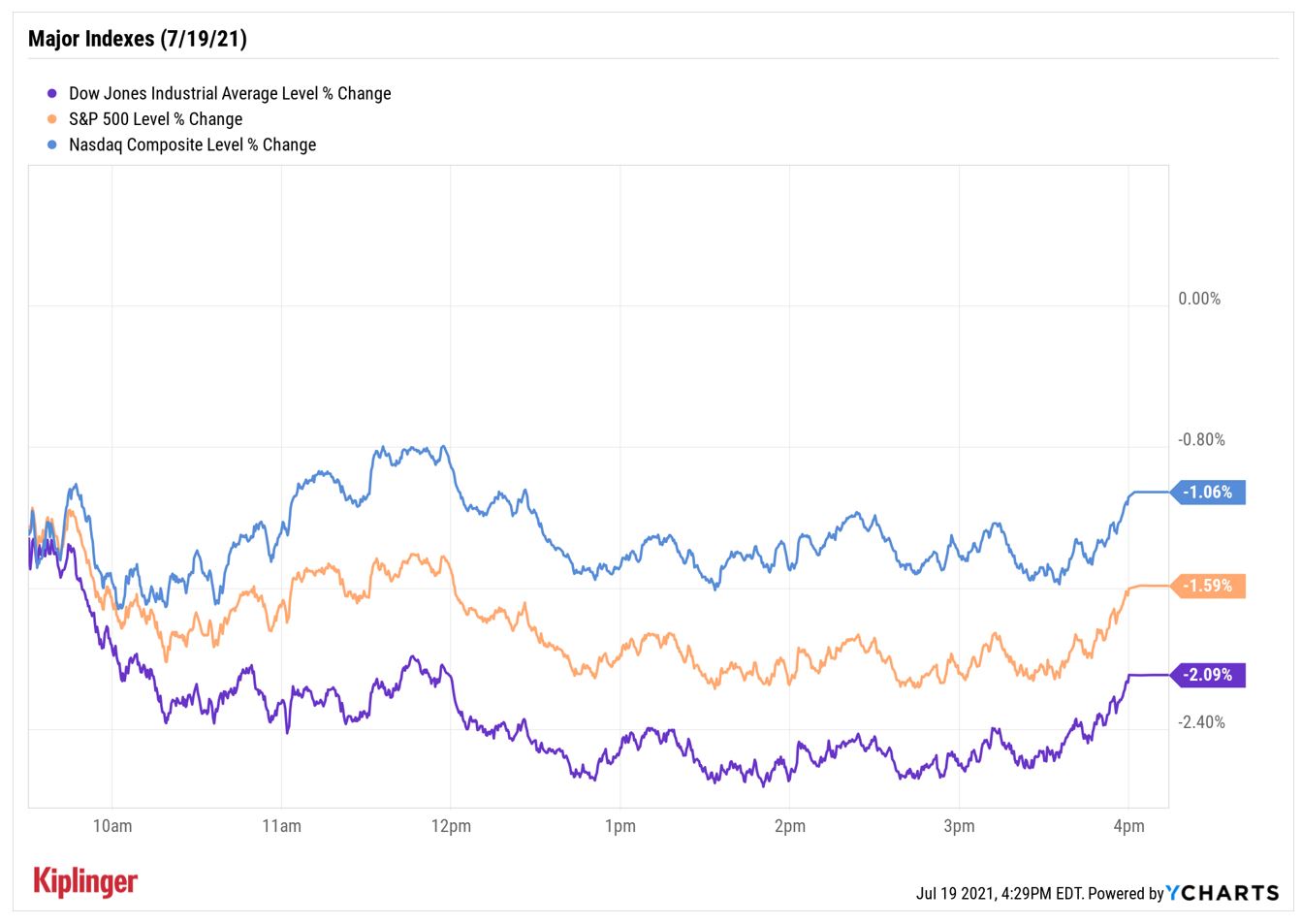

The major indexes all finished lower Monday, but the Dow Jones Industrial Average (-2.1% to 33,962) took the worst of it, suffering its biggest single-day decline since Oct. 28, when the index plunged 3.4%.

The S&P 500 Index shed 1.6% to end at 4,258. "Broad-based selling this morning easily pushed the S&P 500 through our initial level of 4,285 – watch for bounces that close above this level, as the index is now getting oversold on a short-term basis," says Dan Wantrobski, technical strategist at Janney Montgomery Scott. "Declines thus far have been halted at the 50-day moving average, which is currently near 4,240."

Other action in the stock market today:

- The Nasdaq Composite gave back 1.1% to end at 14,274.

- The small-cap Russell 2000 dropped 1.5% to 2,130.

- Zoom Video Communications (ZM) was in focus today thanks to some M&A news. The videoteleconference name said it is buying cloud call center firm Five9 (FIVN) for $14.7 billion in stock. This marks one of the biggest U.S. tech deals of 2021, coming in just behind Microsoft's (MSFT) $16-billion bid for Nuance Communications (NUAN), per FactSet. ZM ended the day down 2.2%, while FIVN jumped 5.9%.

- Not everyone finished the day in the red. Several stay-at-home stocks – those that did well when everyone was stuck inside when the economy shutdown – got a lift as COVID-19 fears ramped up. Among those that got a lift today were online pet supplier Chewy (CHWY, +6.8%), meal kit specialist Blue Apron (APRN, +8.7%) and food delivery name DoorDash (DASH, +4.9%).

- U.S. crude oil futures plummeted 7.5% to end at $66.42 per barrel, marking their biggest one-day slump since Sept. 8. Black gold was hit by rising COVID-19 concerns and news the Organization of the Petroleum Exporting Countries (OPEC) and its allies agreed to raise global crude output to pre-pandemic levels.

- Gold futures slipped 0.3% to $1,809.20 an ounce.

- The CBOE Volatility Index (VIX) spiked 22% to 22.50 – its highest point since May.

- Bitcoin shed 3.7% to $30,757.94. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

- Second-quarter earnings season starts picking up speed tomorrow, with Netflix (NFLX) set to report. You can check out the full earnings calendar here.

What to Do Next

An unwelcome move? Certainly. But today's action is likely not a shock to regular readers of Closing Bell.

Experts have been issuing warnings about the potential for summer market volatility for months – and they don't necessarily think we've seen the last of it. "The S&P 500 hasn't had a 5% correction since October," says LPL Financial chief financial strategist Ryan Detrick, "so you could say we are more than due for some turbulence."

A natural reaction might be to pull some risk out of your portfolio. You might even want to raise cash for buying purposes should this dip get even deeper. Either way, take the time to get refreshed on how to go to cash. That said, we can't overstress the financial and psychological importance of simply buying and holding, while occasionally making small, tactical tweaks along the way.

Today's pockets of relative strength – technology and healthcare stocks, for example – hint that some sectors could hold up better than most if COVID variants put a pause in global reopenings.

That goes for consumer staples, as well, which suffered the least of any sector Monday and traditonally provide both lower volatility and dividends to investors looking for defense.

Of course, these tweaks should be made around a solid core portfolio, which you can easily build with diversified, low-cost funds. Not sure where to start? (Or just looking for a few ideas to round out your current holdings?) We suggest you catch up with the Kip 25 – Kiplinger's favorite actively managed no-load funds.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.