Stock Market Today: Market Pendulum Swings Hard, And Into the Green

Apple and IBM helped the Dow stage a big bounce on Tuesday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Global COVID concerns ran just as hot today as they did 24 hours ago, but investors shrugged them off Tuesday to send the major indexes considerably higher in an across-the-board rebound from yesterday's plunge.

"Today's rally seems to be mostly driven by a buy-the-dip wave, along with oversold conditions in some sectors, as economic data and earnings commentary continue to drive market reaction for the time being," says Stefanos Bazinas, execution strategist at the New York Stock Exchange.

Chief among the data likely driving the action were housing starts, which rose 6.3% month-over-month in June to 1.64 million, easily beating expectations.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

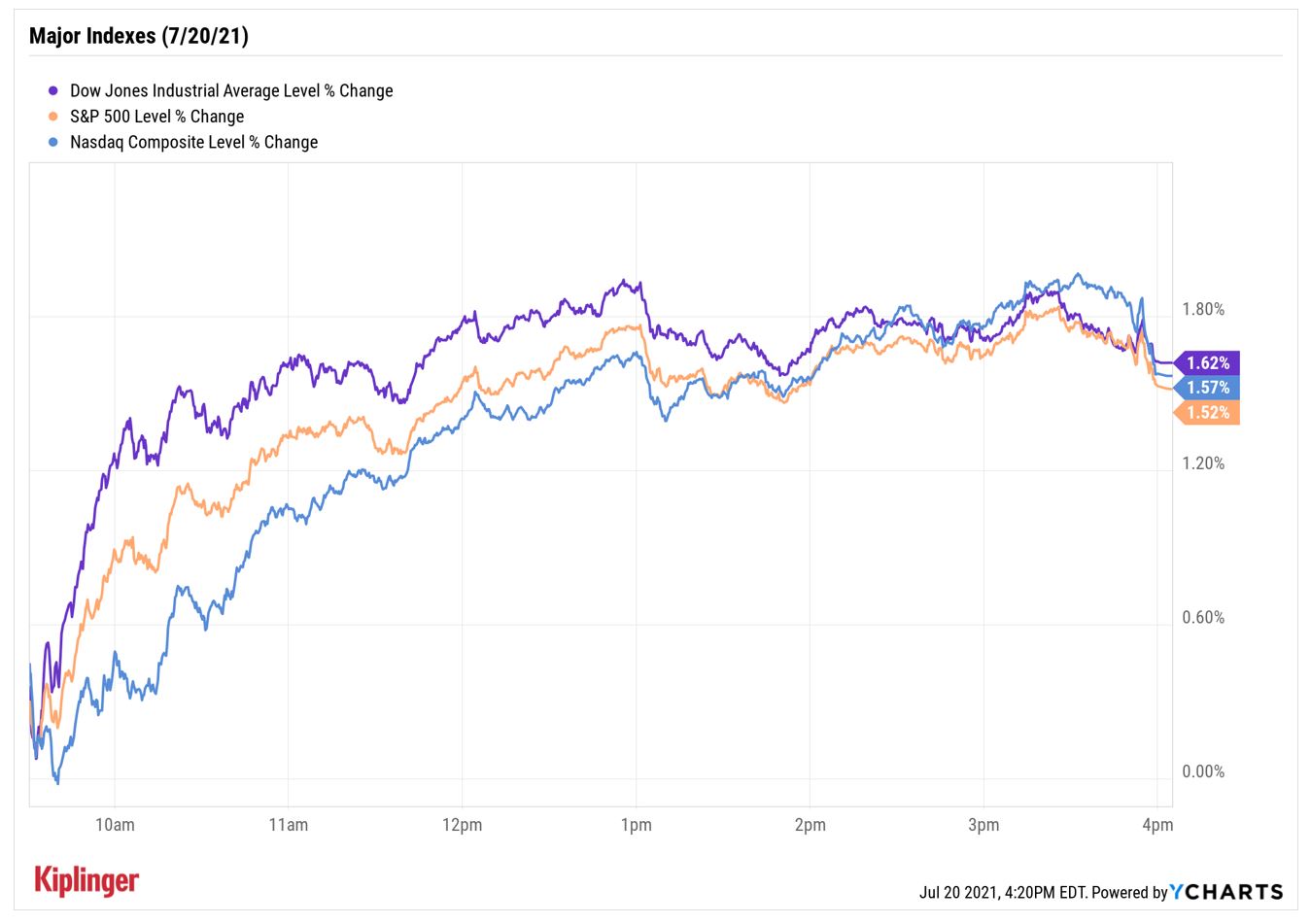

The Dow Jones Industrial Average (+1.6% to 34,511), S&P 500 Index (+1.5% to 4,323) and Nasdaq Composite (+1.6% to 14,498) finished mostly in lockstep.

Notable gainers included Apple (AAPL, +2.6%), which popped after UBS raised its 12-month price target to $166 per share from $155, and International Business Machines (IBM, +1.5%), which rose after it reported 3% revenue growth in Q2 – its briskest quarterly top-line pace in three years.

Other action in the stock market today:

- The small-cap Russell 2000 roared ahead 3% to 2,194.

- AMC Entertainment Holdings (AMC) was a big mover, surging after the movie theater chain said it was reopening two theaters in Los Angeles. The meme stock closed up 24.5% at $43.09, but remains well below its June close at $59.02.

- In earnings news, tobacco firm Philip Morris International (PM) reported higher-than-anticipated second-quarter adjusted earnings of $1.57 per share, but the $7.59 billion in revenues it took in fell short of the consensus estimate. Quarterly results from The Travelers Companies (TRV) were also in focus, with the insurance giant reporting Q2 profit of $3.45 per share on $8.6 billion in revenues. Both figures were higher than what Wall Street was expecting. PM finished the day down 3.1%, while TRV slipped 0.1%.

- U.S. crude oil futures bounced 1.3% to end at $67.20 per barrel.

- Gold futures managed a marginal gain to settle at $1,811.40 an ounce.

- The CBOE Volatility Index (VIX) slumped 11.9% to 19.83.

- Bitcoin continued to decline, falling 3.1% to $29,793.38. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

All's Well That Ends Well, Right?

We jest, of course – Tuesday's bounce-back, while welcome, is unlikely to mark the end of the market's near-term tantrums.

Lauren Goodwin, economist and portfolio strategist at New York Life Investments, notes that we could see pauses in the "reflation trade" this summer thanks in part to concerns that COVID could slow some countries' reopening measures. Also, "investors are wondering whether, despite substantial policy support, post-pandemic trend growth may not be different than the 'lower for longer' environment we experienced before," she says.

If you feel compelled to add a little defense in the short-term, even if just to smooth out returns, you can do well with stocks that boast both high underlying quality and high dividend yields.

Sometimes, however, your best moves might be portfolio subtractions and omissions rather than additions. While it's important to keep an eye out for new investment ideas, it's also vital to watch for stocks that have become overpriced or are running out of upside – and keep them out of your portfolio.

Here, we've compiled a short list of high-profile stocks that carry an unusually high number of Sell calls from Wall Street analysts -- and explain why the pros are so bearish on these names.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Look Out for These Gold Bar Scams as Prices Surge

Look Out for These Gold Bar Scams as Prices SurgeFraudsters impersonating government agents are convincing victims to convert savings into gold — and handing it over in courier scams costing Americans millions.

-

How to Turn Your 401(k) Into A Real Estate Empire

How to Turn Your 401(k) Into A Real Estate EmpireTapping your 401(k) to purchase investment properties is risky, but it could deliver valuable rental income in your golden years.

-

My First $1 Million: Retired Nuclear Plant Supervisor, 68

My First $1 Million: Retired Nuclear Plant Supervisor, 68Ever wonder how someone who's made a million dollars or more did it? Kiplinger's My First $1 Million series uncovers the answers.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.