Stock Market Today: Dow Hits 35K as Rally Spurs Fresh Index Records

Twitter and Snap had strong showings in the earnings confessional.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

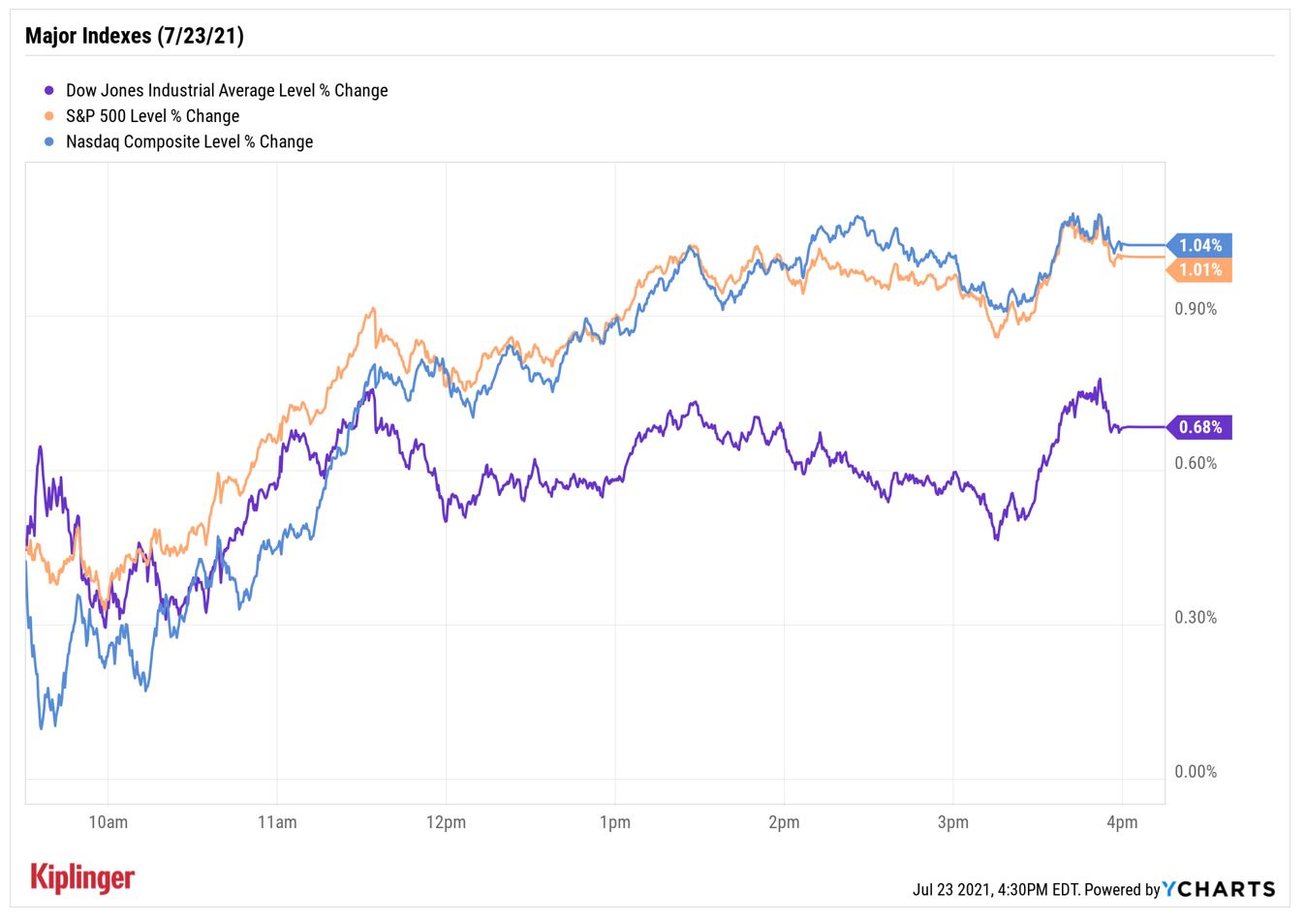

In a mirror image to last week, the major market indexes continued to rebound from Monday's sharp selloff to close Friday at new record highs across the board.

Today's gains came on the back of mixed economic data. On the plus side, IHS Markit's flash purchasing managers index (PMI) hit a record high of 63.1 in July, with growth supported by an uptick in new orders across the manufacturing sector.

On the negative side, the flash services PMI edged down to 59.8 from its June reading of 64.6, indicating the rate of expansion in the services industry (which includes restaurants and hotels) slowed amid "hikes in supplier prices and a greater need to hire additional workers."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Corporate earnings were also in focus, with stronger-than-expected results from social media names Twitter (TWTR, +3.1%) and Snap (SNAP, +23.8%) lifting the collective mood on Wall Street.

The Dow Jones Industrial Average ended up 0.7% at 35,061 – its first-ever close above the 35K mark. "Although there is nothing necessarily special about milestone numbers, 35,000 is yet another reminder of how far we've come," says Ryan Detrick, chief market strategist for LPL Financial. "This bull market is alive and well thanks to a very strong economy and record earnings, justifying current levels and likely higher prices in the future."

The S&P 500 Index and Nasdaq Composite settled at new record highs, too, gaining 1.0% to 4,411 and 1.0% to 14,836, respectively.

Other action in the stock market today:

- The small-cap Russell 2000 rose 0.2% to 2,209.

- Intel (INTC) was the worst Dow stock today, shedding 5.3%. While the chipmaker reported higher-than-anticipated adjusted earnings and revenues for its second quarter, INTC issued a cautious guidance for the current quarter amid continued supply constraints.

- Boston Beer (SAM) was another earnings loser today, slumping 26.0% in the wake of its results. In the second quarter, the maker of Sam Adams beer fell short on both the top and bottom line and lowered its full-year forecast. "The hard seltzer category and overall beer industry were softer than we had anticipated," noted Jim Koch, founder and chairman of SAM.

- U.S. crude oil futures edged up 0.2% to $72.07 per barrel.

- Gold futures slipped 0.2% to settle at $1,801.80 an ounce.

- The CBOE Volatility Index (VIX) fell 2.8% to 17.20.

- Bitcoin eased back 0.3% to $32,304.53. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Time to Work On That Core

This week was discombobulating for investors, to say the least, as Monday's deep selloff on COVID concerns was quickly shrugged off over the ensuing days.

"Monday's tempest passed quickly, but the key point is that the market focus has shifted from an inflation scare to a (brief) growth scare," says Douglas Porter, chief economist for BMO Capital Markets. "At least some concern on the growth front is certainly warranted by the unnerving jump in virus cases in many regions, even if the market has apparently brushed off such concerns."

In other words: New record highs, while appreciated, don't necessarily dash the potential for additional summer volatility. With so many aspects of the recovery remaining uncertain, investors might consider tending to their portfolio core.

These low-cost Vanguard exchange-traded funds (ETFs) and mutual funds, and our Kiplinger ETF 20, can be of help. All of these funds are among the cheapest in their class and offer a variety of strategies across a number of market areas.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.